Printable Last Will and Testament Template

Last Will and Testament - Customized for State

Last Will and Testament Subtypes

Misconceptions

Understanding the Last Will and Testament is crucial for anyone considering their estate planning. However, several misconceptions often arise regarding this important document. Below are some common misunderstandings:

- A will only takes effect after death. Many people believe that a will has no legal standing until the individual passes away. While it is true that the will is executed after death, the decisions made within it can influence estate planning and asset management even before that time.

- Only wealthy individuals need a will. There is a misconception that wills are only necessary for those with significant assets. In reality, anyone can benefit from having a will. It ensures that personal wishes are honored regarding asset distribution, guardianship of children, and other important matters.

- A handwritten will is always valid. Some individuals think that simply writing a will by hand guarantees its validity. However, for a will to be legally binding, it must meet specific requirements, including proper witnessing and signing, depending on state laws.

- Once a will is created, it cannot be changed. Many believe that a will is a fixed document that cannot be altered. In fact, individuals can revise or revoke their wills at any time, as long as they follow the legal procedures. This flexibility allows for adjustments as life circumstances change.

By addressing these misconceptions, individuals can better navigate the complexities of estate planning and ensure their wishes are clearly communicated and legally recognized.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Last Will and Testament is a legal document that outlines how a person's assets will be distributed after their death. |

| Testator | The person creating the will is known as the testator. They must be of sound mind and at least 18 years old in most states. |

| State-Specific Laws | Each state has its own laws governing wills, including requirements for signing and witnessing. For example, California's Probate Code Section 6100 governs wills. |

| Revocation | A will can be revoked at any time by the testator, often by creating a new will or destroying the old one. |

| Executor | The executor is the person appointed to carry out the terms of the will. They have a legal duty to manage the estate responsibly. |

| Beneficiaries | Beneficiaries are individuals or organizations designated to receive assets from the estate. They can be family members, friends, or charities. |

| Witness Requirements | Most states require at least two witnesses to sign the will, affirming that the testator was of sound mind and not under duress. |

| Probate Process | After death, the will typically goes through probate, a legal process to validate the will and oversee the distribution of assets. |

Key takeaways

Creating a Last Will and Testament is an essential step in planning for the future. Here are some key takeaways to keep in mind when filling out and using this important document:

- Clearly Identify Your Assets: Make sure to list all your assets, including property, bank accounts, and personal belongings. This clarity helps ensure that your wishes are followed.

- Choose an Executor: Select a trustworthy person to manage your estate. This individual will be responsible for ensuring your will is executed according to your wishes.

- Be Specific with Beneficiaries: Clearly name the individuals or organizations that will inherit your assets. This reduces confusion and potential disputes among family members.

- Review and Update Regularly: Life changes, such as marriage, divorce, or the birth of a child, may require updates to your will. Regular reviews ensure your document reflects your current wishes.

By keeping these takeaways in mind, you can create a Last Will and Testament that accurately reflects your intentions and provides peace of mind for you and your loved ones.

Dos and Don'ts

When filling out a Last Will and Testament form, it's essential to follow certain guidelines to ensure your wishes are clearly expressed and legally valid. Here are eight things to consider:

- Do: Clearly state your full name and address at the beginning of the document.

- Do: Specify that the document is your Last Will and Testament.

- Do: List your beneficiaries and what they will receive in clear terms.

- Do: Appoint an executor who will carry out your wishes after your passing.

- Don't: Use vague language that could lead to confusion about your intentions.

- Don't: Forget to sign and date the document in the presence of witnesses.

- Don't: Leave out necessary details about your debts and expenses.

- Don't: Ignore state laws regarding the witnessing and notarization of the will.

Following these guidelines will help ensure your Last Will and Testament is effective and respected.

Common mistakes

-

Not clearly identifying beneficiaries. It is crucial to specify who will receive your assets. Vague descriptions can lead to disputes among family members.

-

Failing to update the will. Life changes, such as marriage, divorce, or the birth of a child, necessitate updates to the will to reflect your current wishes.

-

Not signing the document properly. A will must be signed in accordance with state laws. Missing signatures can render the will invalid.

-

Overlooking witnesses. Many states require witnesses to the signing of a will. Failing to have the appropriate number of witnesses can invalidate the document.

-

Using outdated forms. Laws regarding wills can change. Using an old form may not comply with current legal requirements.

-

Neglecting to include a residuary clause. This clause addresses any assets not specifically mentioned in the will, ensuring they are distributed according to your wishes.

-

Not considering tax implications. Failing to plan for taxes can reduce the inheritance left to beneficiaries. Consulting with a financial advisor can help avoid this mistake.

-

Not storing the will safely. A will should be kept in a secure location where it can be easily accessed after your passing. Losing the document can lead to complications.

What You Should Know About This Form

-

What is a Last Will and Testament?

A Last Will and Testament is a legal document that outlines how a person's assets and affairs should be handled after their death. It allows individuals to specify who will inherit their property, appoint guardians for minor children, and designate an executor to carry out their wishes.

-

Who should create a Last Will and Testament?

Anyone who has assets, children, or specific wishes for their estate should consider creating a Last Will and Testament. This includes homeowners, parents, and individuals with savings or investments. Even if you think your estate is small, having a will can help avoid confusion and disputes among your loved ones.

-

What happens if I die without a will?

If you pass away without a will, your estate will be distributed according to state laws, known as intestacy laws. This often means that your assets may not go to the people you would have chosen. Instead, the state will determine how to divide your property, which can lead to complications and potential family disputes.

-

Can I change my Last Will and Testament?

Yes, you can change your will at any time while you are still alive and mentally competent. This is typically done by creating a new will or adding a codicil, which is an amendment to the existing will. It’s important to ensure that any changes are made following legal requirements to avoid confusion later.

-

Do I need a lawyer to create a Last Will and Testament?

While it is possible to create a will without a lawyer using online templates or forms, consulting with a legal professional can be beneficial. A lawyer can help ensure that your will meets all legal requirements and accurately reflects your wishes, reducing the risk of issues down the line.

-

How do I ensure my Last Will and Testament is valid?

To ensure your will is valid, it typically needs to be signed by you in the presence of witnesses. Most states require at least two witnesses who are not beneficiaries of the will. Additionally, you should check your state’s specific laws regarding wills, as requirements can vary.

Last Will and Testament Example

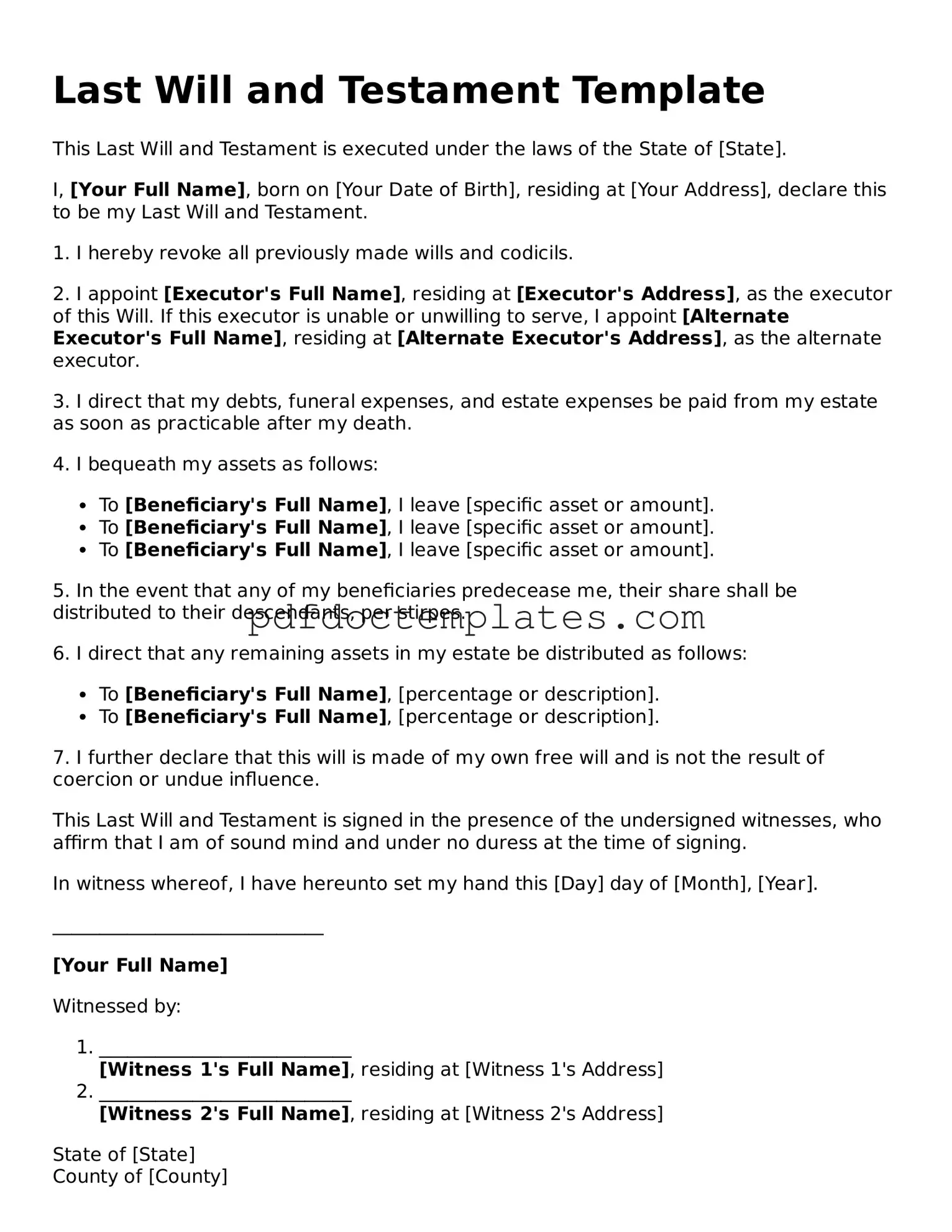

Last Will and Testament Template

This Last Will and Testament is executed under the laws of the State of [State].

I, [Your Full Name], born on [Your Date of Birth], residing at [Your Address], declare this to be my Last Will and Testament.

1. I hereby revoke all previously made wills and codicils.

2. I appoint [Executor's Full Name], residing at [Executor's Address], as the executor of this Will. If this executor is unable or unwilling to serve, I appoint [Alternate Executor's Full Name], residing at [Alternate Executor's Address], as the alternate executor.

3. I direct that my debts, funeral expenses, and estate expenses be paid from my estate as soon as practicable after my death.

4. I bequeath my assets as follows:

- To [Beneficiary's Full Name], I leave [specific asset or amount].

- To [Beneficiary's Full Name], I leave [specific asset or amount].

- To [Beneficiary's Full Name], I leave [specific asset or amount].

5. In the event that any of my beneficiaries predecease me, their share shall be distributed to their descendants, per stirpes.

6. I direct that any remaining assets in my estate be distributed as follows:

- To [Beneficiary's Full Name], [percentage or description].

- To [Beneficiary's Full Name], [percentage or description].

7. I further declare that this will is made of my own free will and is not the result of coercion or undue influence.

This Last Will and Testament is signed in the presence of the undersigned witnesses, who affirm that I am of sound mind and under no duress at the time of signing.

In witness whereof, I have hereunto set my hand this [Day] day of [Month], [Year].

_____________________________

[Your Full Name]

Witnessed by:

- ___________________________

[Witness 1's Full Name], residing at [Witness 1's Address] - ___________________________

[Witness 2's Full Name], residing at [Witness 2's Address]

State of [State]

County of [County]

On this [Day] day of [Month], [Year], before me, a notary public, personally appeared [Your Full Name], to me known to be the person who executed the foregoing instrument and acknowledged that they executed the same as their free act and deed.

_____________________________

Notary Public

Find Other Forms

Deed in Lieu of Foreclosure Sample - The document protects both parties by formalizing the transfer of ownership while addressing any concerns regarding remaining loan balances.

In order to effectively initiate your device protection claim, it is essential to complete the necessary documentation. The process is simplified by utilizing the Fill PDF Forms, which guides users through the required steps and ensures that all information is accurately submitted for processing.

Da Form 638 Pdf - Part IV includes a section for intermediate authorities to review and act on the recommendation.