Printable Lady Bird Deed Template

Lady Bird Deed - Customized for State

Misconceptions

- Misconception 1: A Lady Bird Deed is only for elderly individuals.

- Misconception 2: A Lady Bird Deed avoids all taxes.

- Misconception 3: You lose control of your property once you sign a Lady Bird Deed.

- Misconception 4: A Lady Bird Deed is the same as a traditional life estate.

- Misconception 5: A Lady Bird Deed can only be used for residential property.

- Misconception 6: Once a Lady Bird Deed is executed, it cannot be changed.

- Misconception 7: A Lady Bird Deed eliminates the need for a will.

- Misconception 8: A Lady Bird Deed is only beneficial in certain states.

This is not true. While many people who use Lady Bird Deeds are older, anyone who owns property can utilize this form of deed to transfer property upon their death.

While this deed can help avoid probate, it does not eliminate tax obligations. Property taxes will still apply, and there may be capital gains taxes for the beneficiaries.

This is incorrect. The grantor retains full control over the property during their lifetime, including the right to sell or mortgage it.

These two are different. A traditional life estate can restrict the owner's rights, while a Lady Bird Deed allows for greater flexibility and control.

This misconception is false. Lady Bird Deeds can apply to various types of real estate, including commercial properties.

This is misleading. The grantor can revoke or modify the deed at any time before their death, as long as they are mentally competent.

This is not accurate. While a Lady Bird Deed helps with property transfer, a will is still necessary for other assets and to address any additional wishes.

This is a common misunderstanding. While the specifics of Lady Bird Deeds may vary by state, many states recognize and allow this type of deed.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer real estate to beneficiaries while retaining control during their lifetime. |

| Governing Law | In the United States, Lady Bird Deeds are primarily governed by state law, particularly in states like Florida and Texas. |

| Retained Control | The property owner retains the right to sell, mortgage, or change the beneficiaries without their consent. |

| Tax Benefits | This type of deed can help avoid probate and may provide certain tax advantages to the beneficiaries. |

| Medicaid Protection | In some states, a Lady Bird Deed can protect the property from being counted as an asset for Medicaid eligibility. |

| Revocability | The deed can be revoked or amended at any time by the property owner before their death. |

| Beneficiaries | Beneficiaries named in the deed receive the property automatically upon the owner's death without going through probate. |

| State Variations | While Florida and Texas commonly use Lady Bird Deeds, other states may have different forms or requirements. |

Key takeaways

When considering a Lady Bird Deed, there are several important points to keep in mind. This type of deed can provide significant benefits for property owners. Below are key takeaways about filling out and using the Lady Bird Deed form:

- Retain Control: The property owner maintains control over the property during their lifetime. This means they can sell, mortgage, or change the deed as they see fit.

- Avoid Probate: Upon the owner's death, the property transfers directly to the designated beneficiaries without going through probate, which can save time and costs.

- Tax Benefits: The Lady Bird Deed can help in managing capital gains taxes. The property receives a step-up in basis, which can reduce tax liability for heirs.

- Medicaid Planning: This deed can be a useful tool in Medicaid planning, as it may help protect the property from being counted as an asset for Medicaid eligibility.

Dos and Don'ts

When filling out the Lady Bird Deed form, consider the following guidelines:

- Do ensure that all names are spelled correctly.

- Do include the correct legal description of the property.

- Do verify that the grantor and grantee information is accurate.

- Do sign the document in the presence of a notary public.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank unless instructed.

- Don't use outdated forms; always use the latest version.

- Don't rush through the process; take your time to review.

- Don't forget to check local laws for any specific requirements.

Common mistakes

-

Not including the full legal names of all parties involved can lead to confusion or disputes later. Ensure that the names match those on official identification documents.

-

Forgetting to specify the property accurately can create issues. It’s essential to include the complete address and legal description of the property to avoid ambiguity.

-

Neglecting to check state-specific requirements may result in an invalid deed. Each state has its own rules regarding the execution and recording of a Lady Bird Deed.

-

Not signing the deed in the presence of a notary can invalidate the document. It’s crucial to have the signatures notarized to ensure legal acceptance.

-

Failing to record the deed with the appropriate county office is a common oversight. Without recording, the deed may not be enforceable against third parties.

-

Using outdated forms can lead to complications. Always ensure you are using the most current version of the Lady Bird Deed form.

-

Not understanding the implications of a Lady Bird Deed can cause issues down the line. It’s important to know how it affects property taxes and Medicaid eligibility.

-

Incorrectly identifying beneficiaries can lead to disputes. Clearly specify who will inherit the property to avoid potential conflicts among heirs.

-

Overlooking the need for witnesses in some states may invalidate the deed. Check local laws to determine if witnesses are required.

-

Assuming the deed is irrevocable can be misleading. While a Lady Bird Deed allows for changes, it’s important to understand the conditions under which it can be revoked.

What You Should Know About This Form

-

What is a Lady Bird Deed?

A Lady Bird Deed is a type of property transfer document that allows a property owner to transfer their property to a beneficiary while retaining control over the property during their lifetime. This deed enables the owner to sell, lease, or change the property without needing the beneficiary's consent. Upon the owner's death, the property automatically transfers to the beneficiary without going through probate.

-

What are the benefits of using a Lady Bird Deed?

There are several advantages to using a Lady Bird Deed:

- Avoids Probate: The property passes directly to the beneficiary upon the owner's death, bypassing the often lengthy and costly probate process.

- Retained Control: The property owner retains full control over the property during their lifetime, allowing them to make decisions without needing to consult the beneficiary.

- Tax Benefits: The property may receive a step-up in basis upon the owner's death, potentially reducing capital gains taxes for the beneficiary when they sell the property.

-

Who can benefit from a Lady Bird Deed?

Anyone who owns real estate and wishes to transfer it to a loved one while maintaining control can benefit from a Lady Bird Deed. This is particularly useful for elderly individuals who want to ensure their property passes to their heirs without complications. It can also be advantageous for those looking to protect their property from potential creditors or Medicaid claims.

-

How do I create a Lady Bird Deed?

Creating a Lady Bird Deed typically involves the following steps:

- Consult with a Professional: It is advisable to consult with a legal expert to ensure that the deed is prepared correctly and complies with state laws.

- Draft the Deed: The deed must clearly state the property details, the name of the current owner, and the name of the beneficiary.

- Sign and Notarize: The property owner must sign the deed in the presence of a notary public to make it legally binding.

- Record the Deed: Finally, the deed should be recorded with the appropriate county office to ensure it is recognized in public records.

Lady Bird Deed Example

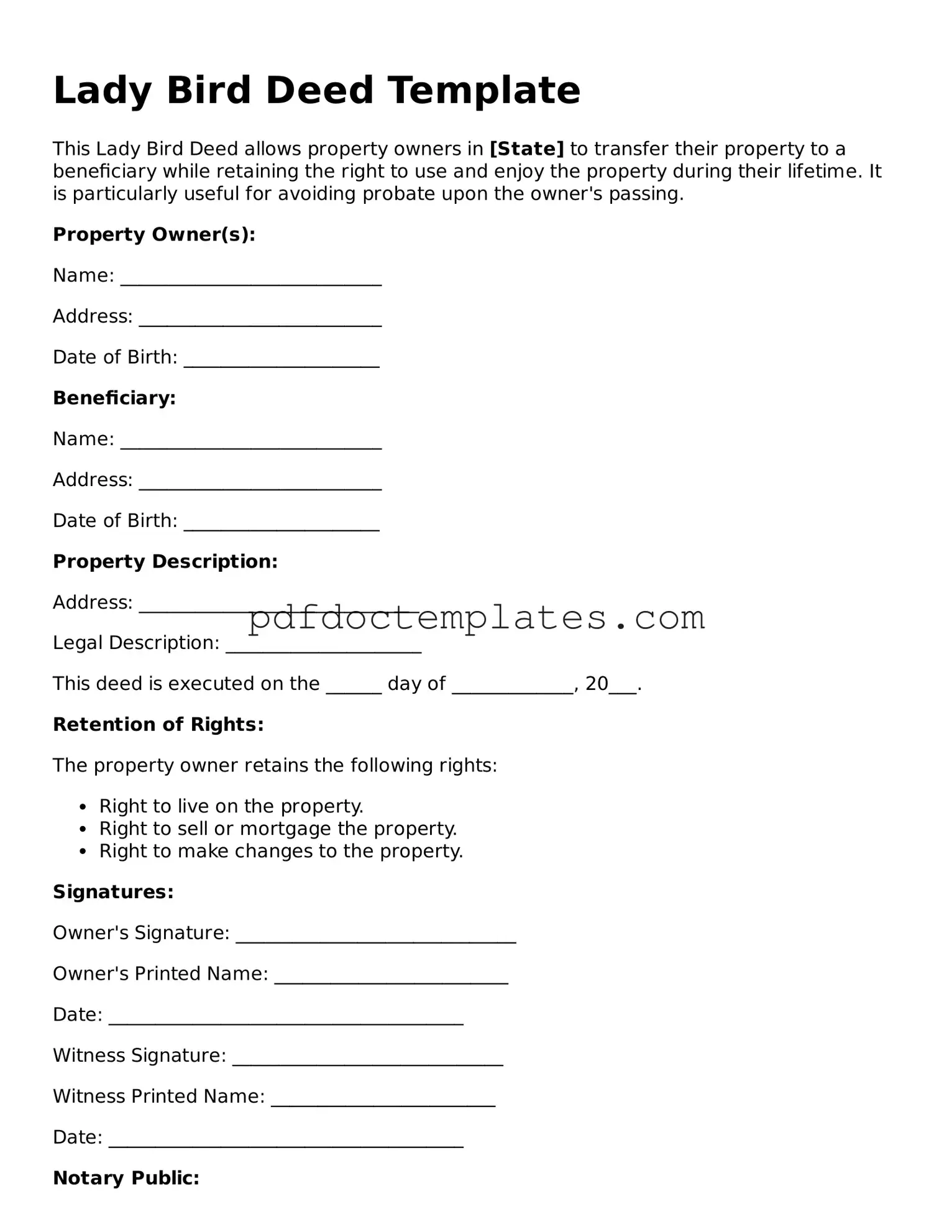

Lady Bird Deed Template

This Lady Bird Deed allows property owners in [State] to transfer their property to a beneficiary while retaining the right to use and enjoy the property during their lifetime. It is particularly useful for avoiding probate upon the owner's passing.

Property Owner(s):

Name: ____________________________

Address: __________________________

Date of Birth: _____________________

Beneficiary:

Name: ____________________________

Address: __________________________

Date of Birth: _____________________

Property Description:

Address: ______________________________

Legal Description: _____________________

This deed is executed on the ______ day of _____________, 20___.

Retention of Rights:

The property owner retains the following rights:

- Right to live on the property.

- Right to sell or mortgage the property.

- Right to make changes to the property.

Signatures:

Owner's Signature: ______________________________

Owner's Printed Name: _________________________

Date: ______________________________________

Witness Signature: _____________________________

Witness Printed Name: ________________________

Date: ______________________________________

Notary Public:

State of ____________

County of ___________

Subscribed and sworn to before me on the ______ day of _______________, 20___.

Notary Public_____________________________

My Commission Expires: __________________

Different Types of Lady Bird Deed Forms:

Does California Have a Transfer on Death Deed - Keep a copy of the recorded deed in a safe place for reference by your beneficiaries.

To facilitate the purchase and sale of trailers in Florida, it is essential to utilize the appropriate documentation, such as the Florida Trailer Bill of Sale. This critical legal document not only formalizes the transfer of ownership but also provides necessary protection for both the buyer and the seller. For those seeking a straightforward way to complete this process, resources like All Florida Forms offer templates that streamline the paperwork and ensure compliance with state regulations.