Printable Investment Letter of Intent Template

Misconceptions

Many people have misunderstandings about the Investment Letter of Intent (LOI) form. These misconceptions can lead to confusion and missteps in the investment process. Here are nine common misconceptions explained:

- It's a binding contract. Many believe that signing an LOI creates a legally binding agreement. In reality, most LOIs are non-binding, meaning they outline intentions but do not obligate the parties to finalize the deal.

- All terms are set in stone. Some think that once an LOI is signed, all terms are final. However, an LOI serves as a starting point for negotiations. Terms can still be discussed and modified before a final agreement is reached.

- Only large investors use LOIs. This is not true. Both large and small investors can benefit from using an LOI to clarify intentions and streamline the negotiation process.

- LOIs are only for real estate investments. While common in real estate, LOIs are also used in various types of investments, including business acquisitions and partnerships.

- They are unnecessary. Some individuals believe that LOIs complicate the process. In fact, they can provide clarity and help prevent misunderstandings between parties.

- LOIs are only for the seller's benefit. This is a misconception. An LOI protects the interests of both parties by outlining expectations and intentions.

- They do not require legal review. Some think that an LOI is simple enough to skip legal review. However, having a legal professional review the document can help ensure that it accurately reflects the intentions of all parties involved.

- LOIs are the same as term sheets. While similar, they serve different purposes. A term sheet typically outlines key terms of a deal, while an LOI expresses the intent to negotiate those terms.

- Once signed, the LOI cannot be changed. This is a common belief, but LOIs can be amended or renegotiated if all parties agree to the changes.

Understanding these misconceptions can help individuals navigate the investment landscape more effectively. Clear communication and careful consideration of the LOI can lead to smoother transactions.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent (LOI) outlines the preliminary terms and conditions of a potential investment agreement between parties. |

| Non-Binding Nature | Typically, the terms in an LOI are non-binding, meaning that they do not create a legal obligation to proceed with the investment. |

| Governing Law | The LOI may specify which state's laws will govern the agreement, such as Delaware or California, depending on where the parties are located. |

| Confidentiality Clause | Many LOIs include a confidentiality clause to protect sensitive information shared during negotiations. |

| Expiration Date | LOIs often have an expiration date, after which the terms may no longer be valid unless extended by mutual agreement. |

| Key Terms | Commonly included key terms are the investment amount, equity stake, and any conditions that must be met before finalizing the investment. |

Key takeaways

When filling out and using the Investment Letter of Intent form, keep these key takeaways in mind:

- Understand the Purpose: The Investment Letter of Intent serves as a preliminary agreement outlining the terms of a potential investment. It expresses your intention to invest and sets the stage for further negotiations.

- Be Clear and Concise: Fill out the form with clarity. Avoid vague language and ensure that your intentions and terms are explicitly stated. This clarity helps prevent misunderstandings later.

- Include Essential Details: Make sure to provide all necessary information, such as the amount of investment, the type of investment, and the timeline for the proposed transaction. Missing details can lead to confusion.

- Consult with Professionals: Before finalizing the form, consider seeking advice from a legal or financial expert. Their insights can help you avoid pitfalls and ensure that your interests are protected.

- Keep a Copy: Always retain a copy of the completed Investment Letter of Intent for your records. This document may be crucial for future reference or in case of disputes.

- Follow Up: After submitting the form, follow up with the other party. This demonstrates your commitment and helps keep the lines of communication open as you move toward a formal agreement.

Dos and Don'ts

When filling out an Investment Letter of Intent form, it’s crucial to approach the task with care and attention. This document often sets the stage for significant financial decisions, so being thorough is key. Here are some important dos and don’ts to consider:

- Do read the entire form carefully before starting. Understanding each section will help you provide the correct information.

- Do provide accurate and complete information. Double-check facts such as names, addresses, and financial figures.

- Do consult with a financial advisor or legal expert if you have any questions. Their insights can clarify complex terms.

- Do keep a copy of the completed form for your records. This will be useful for future reference.

- Don't rush through the form. Taking your time can prevent errors that might delay the process.

- Don't leave any required fields blank. Missing information can lead to complications down the line.

- Don't hesitate to ask for help if you’re unsure about any part of the form. Clarifying your doubts is always better than guessing.

By following these guidelines, you can navigate the process more smoothly and ensure that your Investment Letter of Intent is filled out correctly.

Common mistakes

-

Failing to provide complete personal information. It is essential to include your full name, address, and contact details. Incomplete information can lead to delays or issues with processing.

-

Not specifying the investment amount clearly. Make sure to state the exact amount you intend to invest. Ambiguities can create confusion for both parties.

-

Overlooking the investment purpose. Clearly outline why you are making this investment. This helps clarify your intentions and can aid in future communications.

-

Ignoring the deadline for submission. Each investment opportunity may have specific timelines. Missing a deadline could result in losing the chance to invest.

-

Not reviewing the form for errors. Simple mistakes like typos or incorrect figures can undermine the professionalism of your submission. Always double-check your entries.

-

Failing to sign and date the form. A signature is often required to validate your intent. Without it, the form may be considered incomplete.

-

Neglecting to include any required documentation. Some investment letters may require additional documents, such as proof of identity or financial statements. Ensure you attach everything needed.

-

Not keeping a copy of the submitted form. Retaining a copy for your records can be helpful for future reference or in case any issues arise.

-

Providing outdated contact information. Ensure that the contact details you provide are current. This allows for smooth communication regarding your investment.

-

Misunderstanding the terms of the investment. Familiarize yourself with the investment terms before filling out the form. Misinterpretations can lead to unexpected obligations.

What You Should Know About This Form

-

What is an Investment Letter of Intent (LOI)?

An Investment Letter of Intent is a preliminary agreement between parties that outlines the intention to enter into a formal investment transaction. It serves as a roadmap for negotiations and can help clarify the terms and conditions that both parties are considering. While it is not legally binding, it demonstrates a serious commitment to move forward with the investment process.

-

What information is typically included in an Investment LOI?

An Investment LOI generally includes several key components:

- The identities of the parties involved.

- A description of the investment opportunity.

- The proposed terms, such as the amount of investment and valuation.

- Confidentiality provisions.

- Any conditions that must be met before finalizing the investment.

This information helps both parties understand the scope and expectations of the potential investment.

-

Is an Investment LOI legally binding?

Generally, an Investment LOI is not legally binding. However, certain sections, such as confidentiality or exclusivity clauses, may carry legal weight. The primary purpose of the LOI is to outline intentions and facilitate discussions, not to create enforceable obligations. It is crucial for both parties to clearly understand which parts of the LOI are binding and which are not.

-

How does an Investment LOI benefit both parties?

An Investment LOI benefits both parties by providing a clear framework for negotiations. It allows investors to express their interest while also giving the company a sense of commitment. This document can help identify potential deal breakers early in the process, saving time and resources for both sides. Additionally, it establishes a foundation for building trust and ensuring that both parties are aligned in their objectives.

-

What should I do if I receive an Investment LOI?

If you receive an Investment LOI, it is essential to review it carefully. Consider consulting with a legal advisor to understand the implications of the terms outlined in the document. Assess whether the proposed terms align with your goals and values. If everything looks favorable, you can proceed to negotiate further or sign the LOI to formalize your interest.

Investment Letter of Intent Example

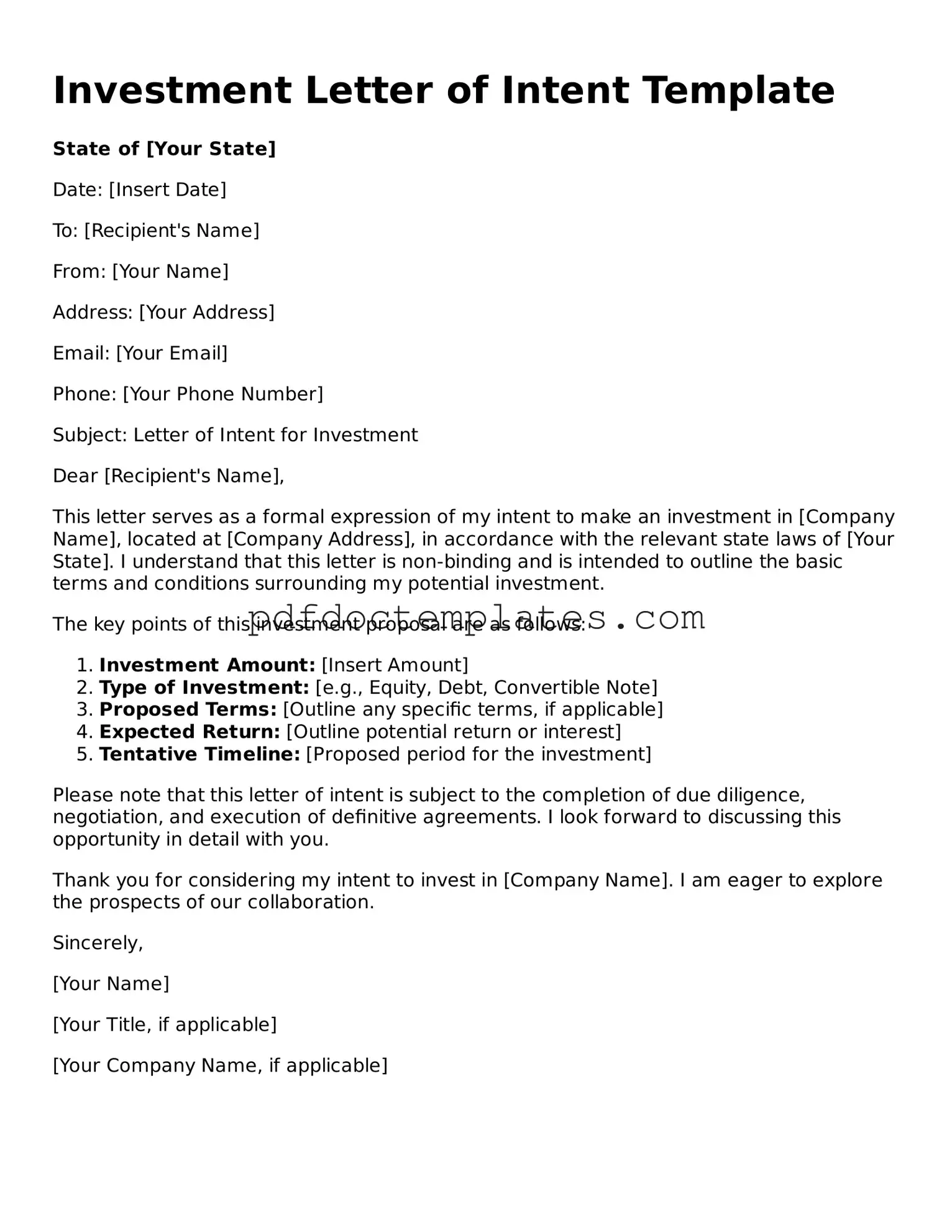

Investment Letter of Intent Template

State of [Your State]

Date: [Insert Date]

To: [Recipient's Name]

From: [Your Name]

Address: [Your Address]

Email: [Your Email]

Phone: [Your Phone Number]

Subject: Letter of Intent for Investment

Dear [Recipient's Name],

This letter serves as a formal expression of my intent to make an investment in [Company Name], located at [Company Address], in accordance with the relevant state laws of [Your State]. I understand that this letter is non-binding and is intended to outline the basic terms and conditions surrounding my potential investment.

The key points of this investment proposal are as follows:

- Investment Amount: [Insert Amount]

- Type of Investment: [e.g., Equity, Debt, Convertible Note]

- Proposed Terms: [Outline any specific terms, if applicable]

- Expected Return: [Outline potential return or interest]

- Tentative Timeline: [Proposed period for the investment]

Please note that this letter of intent is subject to the completion of due diligence, negotiation, and execution of definitive agreements. I look forward to discussing this opportunity in detail with you.

Thank you for considering my intent to invest in [Company Name]. I am eager to explore the prospects of our collaboration.

Sincerely,

[Your Name]

[Your Title, if applicable]

[Your Company Name, if applicable]

Different Types of Investment Letter of Intent Forms:

Letter of Intent for Grant - Helps prioritize projects in line with the funding agency's guidelines.

Rental Letter of Intent - Can serve as a reference point during future discussions regarding the lease.

Intent to Sue Letter Template - Might involve stating the impact of the issue on the sender.