Download Intent To Lien Florida Template

Misconceptions

Misconceptions about the Intent To Lien Florida form can lead to confusion for property owners and contractors alike. Here are seven common misunderstandings:

- It’s a lien itself. Many believe that the Intent To Lien is the same as filing a lien. In reality, it is a notice that precedes the actual lien filing.

- It must be sent by certified mail. While certified mail is a common method for sending this notice, it is not the only acceptable method. Hand delivery or other means can also be used.

- It guarantees payment. Sending an Intent To Lien does not guarantee that payment will be received. It is a formal notice that payment is overdue.

- It applies to all property owners. Some think this notice applies to every property owner involved in a project. However, it only applies to those who have not made payment for services rendered.

- It has no time constraints. A common misconception is that there are no deadlines associated with the notice. In fact, it must be sent at least 45 days before filing a lien.

- It can be ignored. Ignoring the Intent To Lien can lead to serious consequences, including the potential for a lien to be filed and subsequent foreclosure actions.

- It is only for contractors. Some believe only contractors can send this notice. In truth, any party providing labor or materials can issue an Intent To Lien.

Understanding these misconceptions can help both property owners and contractors navigate the process more effectively. Clear communication is essential to avoid disputes and ensure that all parties are aware of their rights and responsibilities.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Intent to Lien form notifies property owners of an impending lien due to non-payment for services or materials provided. |

| Governing Law | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien in Florida. |

| Notice Period | Property owners must be notified at least 45 days before a Claim of Lien is recorded, as per Florida Statutes §713.06(2)(a). |

| Response Time | Property owners have 30 days to respond to the notice. Failure to do so may lead to a lien being recorded. |

| Consequences of Non-Payment | If a lien is recorded, the property may be subject to foreclosure, and the owner could incur additional legal costs. |

| Service Methods | The notice can be served via certified mail, registered mail, hand delivery, process server, or publication. |

| Required Information | The form requires details such as the property owner's name, address, and the amount owed for services rendered. |

| Certificate of Service | A certificate of service must be included, verifying that the notice was properly delivered to the property owner. |

| Importance of Timeliness | Timely delivery of the notice is crucial to uphold the rights of the service provider and to avoid potential legal complications. |

Key takeaways

Here are some key takeaways about filling out and using the Intent To Lien Florida form:

- Complete Information: Fill in all required fields accurately, including property owner’s name, address, and a detailed description of the property.

- Timeliness Matters: Send the notice at least 45 days before filing a Claim of Lien to comply with Florida law.

- Payment Details: Clearly state the amount owed for the work performed. This helps establish the basis for the lien.

- Response Timeframe: The property owner has 30 days to respond to the notice. Be aware of this timeline to avoid complications.

- Potential Consequences: Understand that failure to pay can lead to a lien being recorded, which may result in foreclosure and additional costs.

- No Waivers: Ensure that no waivers or releases of lien have been received that could invalidate your claim.

- Contact Information: Provide your contact details clearly. This encourages prompt communication and resolution.

- Service Certificate: Complete the certificate of service section to prove that the notice was delivered to the property owner.

Dos and Don'ts

When filling out the Intent To Lien Florida form, it’s important to pay attention to detail. Here are some dos and don’ts to keep in mind:

- Do ensure that all names are spelled correctly.

- Do provide the full legal names of property owners and contractors.

- Do include the correct property description, including street and legal addresses.

- Do specify the amount owed clearly.

- Do send the notice at least 45 days before filing the lien.

- Don’t forget to sign the form before sending it.

- Don’t leave any required fields blank.

- Don’t ignore the deadline for the property owner to respond.

- Don’t use informal language in the notice.

- Don’t assume that verbal communication is enough; always provide written notice.

Common mistakes

-

Incomplete Property Owner Information: Failing to provide the full legal name and mailing address of the property owner can lead to complications in the lien process.

-

Missing Contractor Details: Not including the general contractor's full name and mailing address, if applicable, can create confusion about who is filing the lien.

-

Inaccurate Property Description: Omitting or incorrectly stating the street address and legal description of the property can invalidate the lien.

-

Failure to Specify Payment Amount: Not clearly stating the amount owed for work performed can weaken your position when pursuing payment.

-

Ignoring the 45-Day Requirement: Sending the notice less than 45 days before filing the lien can result in the lien being deemed invalid.

-

Neglecting the 30-Day Response Window: Not allowing the property owner a full 30 days to respond before filing the lien can lead to legal challenges.

-

Omitting the Certificate of Service: Failing to include a certificate of service can undermine the legality of the notice.

-

Using Inappropriate Delivery Methods: Choosing a delivery method that does not comply with legal requirements can cause issues with the notice's validity.

-

Not Keeping Copies: Failing to retain a copy of the sent notice can create difficulties if disputes arise later regarding the lien.

What You Should Know About This Form

-

What is the purpose of the Intent to Lien Florida form?

The Intent to Lien form serves as a formal notice to property owners that a contractor, subcontractor, or supplier intends to file a lien against their property due to non-payment for services rendered or materials provided. This notice is a prerequisite under Florida law, specifically Florida Statutes §713.06(2)(a), which requires that the notice be sent at least 45 days before filing the lien. The goal is to inform the property owner of the outstanding payment and to encourage resolution before further legal action is taken.

-

Who should receive the Intent to Lien notice?

The notice should be sent to the property owner's full legal name and mailing address. If applicable, the general contractor's name and address should also be included in the notice. This ensures that all parties involved in the project are aware of the potential lien and can take necessary action to resolve the payment issue.

-

What are the consequences of not responding to the Intent to Lien notice?

If the property owner fails to respond to the notice within 30 days, the contractor or supplier may proceed to file a Claim of Lien against the property. This can lead to serious consequences, including the potential for foreclosure proceedings on the property. Additionally, the property owner may incur attorney fees, court costs, and other related expenses as part of the legal process to resolve the lien.

-

How can a property owner avoid a lien being filed against their property?

To avoid a lien, the property owner should address the outstanding payment as indicated in the Intent to Lien notice. This involves contacting the party who sent the notice to discuss the payment issue and arrange for payment. Prompt communication and resolution can prevent the need for further legal action and protect the property from being subject to a lien.

Intent To Lien Florida Example

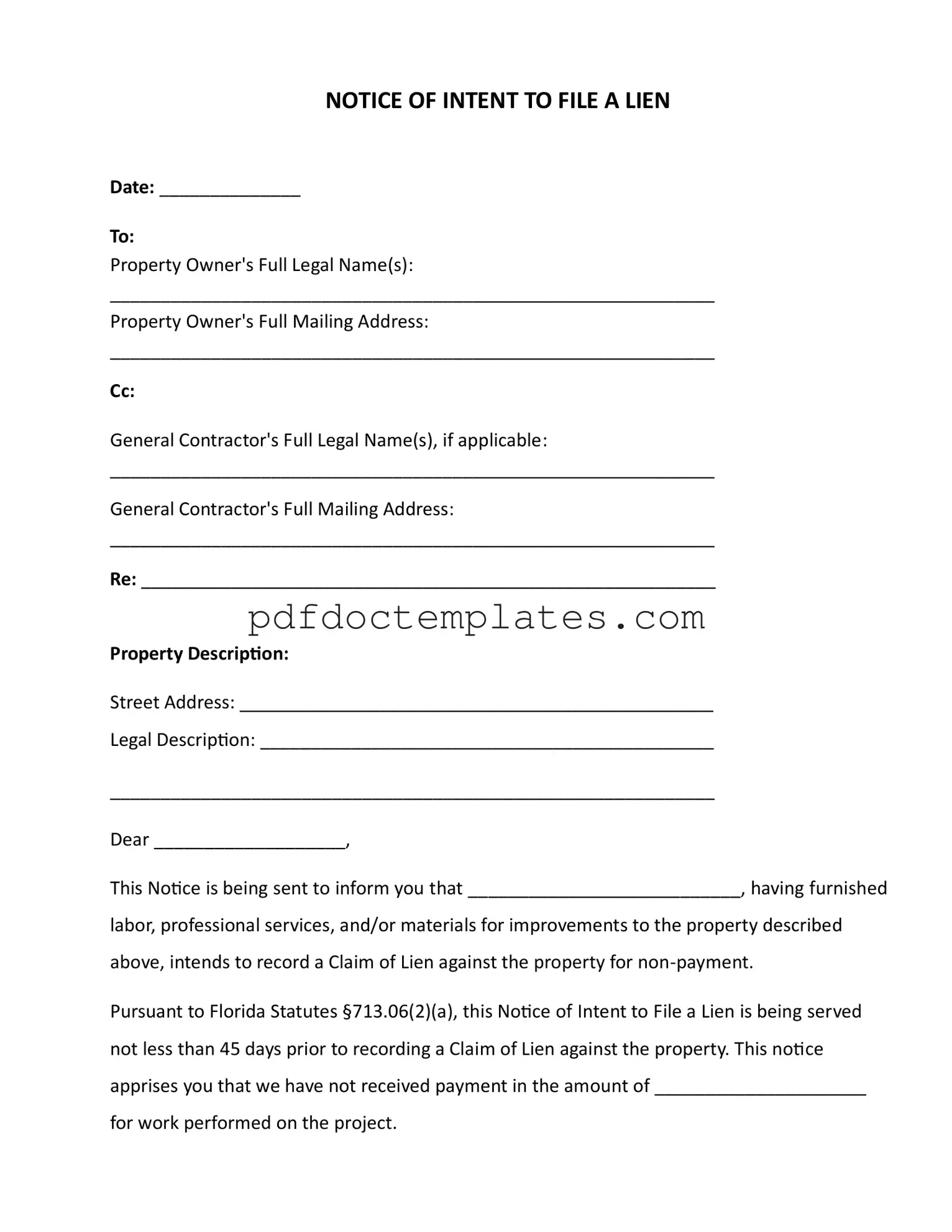

NOTICE OF INTENT TO FILE A LIEN

Date: ______________

To:

Property Owner's Full Legal Name(s):

____________________________________________________________

Property Owner's Full Mailing Address:

____________________________________________________________

Cc:

General Contractor's Full Legal Name(s), if applicable:

____________________________________________________________

General Contractor's Full Mailing Address:

____________________________________________________________

Re: _________________________________________________________

Property Description:

Street Address: _______________________________________________

Legal Description: _____________________________________________

____________________________________________________________

Dear ___________________,

This Notice is being sent to inform you that ___________________________, having furnished

labor, professional services, and/or materials for improvements to the property described above, intends to record a Claim of Lien against the property for

Pursuant to Florida Statutes §713.06(2)(a), this Notice of Intent to File a Lien is being served not less than 45 days prior to recording a Claim of Lien against the property. This notice apprises you that we have not received payment in the amount of _____________________

for work performed on the project.

As per Florida Statutes §713.06(2)(b), failure to make payment in full or provide a satisfactory response within 30 days may result in the recording of a lien on your property. If the lien is recorded, your property could be subject to foreclosure proceedings, and you could be responsible for attorney fees, court costs, and other expenses.

No waivers or releases of lien have been received that would affect the validity of this lien claim.

We would prefer to avoid this action and request your immediate attention to this matter. Please contact us at your earliest convenience to arrange payment and avoid further action.

Thank you for your prompt attention to this matter.

Sincerely,

_________________________ [Your Name]

_________________________ [Your Title]

_________________________ [Your Phone Number]

_________________________ [Your Email Address]

CERTIFICATE OF SERVICE

I certify that a true and correct copy of the Notice of Intent to File a Lien was served on

______________ to ____________________________ at

__________________________________________ by:

□Certified Mail, Return Receipt Requested

□Registered Mail

□Hand Delivery

□Delivery by a Process Server

□Publication

____________________________ |

____________________________ |

Name |

Signature |

Consider More Forms

How to Make a Character Sheet - A stoic knight wearing heavy armor, dedicated to protecting the realm.

For those looking to establish a business entity, understanding the essential details of the Florida Articles of Incorporation requirements is crucial. This form is fundamental in ensuring compliance with state regulations and facilitating the smooth formation of a corporation.

Stem Opt Employer Requirements - Accuracy in the form helps streamline the extension process.