Download Independent Contractor Pay Stub Template

Misconceptions

When it comes to understanding the Independent Contractor Pay Stub form, several misconceptions can cloud the reality of its purpose and use. Here are eight common misunderstandings:

- Independent contractors do not need pay stubs. Many believe that since independent contractors are not employees, they do not require pay stubs. However, pay stubs can provide essential documentation for tax purposes and income verification.

- All pay stubs look the same. It's a common belief that pay stubs for independent contractors follow a standard format. In reality, the design and details can vary significantly depending on the company or individual issuing them.

- Pay stubs are only for employees. Some think that pay stubs are exclusive to traditional employees. In fact, independent contractors can also receive pay stubs to track their earnings and deductions.

- Independent contractors do not have deductions. A misconception exists that independent contractors take home their full pay without deductions. In truth, they may have taxes withheld or other deductions, which should be reflected on their pay stubs.

- Pay stubs are not necessary for tax filing. Some independent contractors might believe that they can file taxes without pay stubs. However, these documents are crucial for accurately reporting income and claiming deductions.

- Pay stubs are optional. Many think that issuing a pay stub is optional for independent contractors. While not legally required, providing a pay stub can help maintain clear records and enhance professionalism.

- Independent contractors can’t dispute charges on their pay stubs. There’s a belief that independent contractors have no recourse if they find discrepancies on their pay stubs. In fact, they can and should address any errors with the issuer.

- Pay stubs are only important for the contractor. Some assume that only the independent contractor benefits from pay stubs. However, clients and companies also gain from providing these documents, as they help maintain clear financial records.

Understanding these misconceptions can help independent contractors navigate their financial documentation more effectively. Clarity around the purpose and importance of pay stubs can lead to better financial management and compliance with tax obligations.

File Details

| Fact Name | Description |

|---|---|

| Definition | An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. |

| Purpose | This form serves to provide transparency regarding payments made to independent contractors, detailing gross pay, deductions, and net pay. |

| Legal Requirement | While not universally mandated, many states require pay stubs to ensure compliance with wage laws and to provide clear documentation for tax purposes. |

| State-Specific Forms | Some states, such as California, have specific requirements for pay stubs under the California Labor Code, which mandates detailed itemization of earnings. |

| Information Included | Typically, a pay stub will include the contractor's name, payment period, total hours worked, hourly rate, gross pay, deductions, and net pay. |

| Tax Implications | Independent contractors are responsible for their own tax payments, including self-employment taxes, which should be reflected in the deductions on the pay stub. |

| Record Keeping | Contractors should keep their pay stubs for at least three years for tax purposes and to verify income when applying for loans or other financial services. |

| Format | Pay stubs can be provided in various formats, including paper and electronic, but must be accessible and easy to understand. |

| Dispute Resolution | In case of discrepancies, having a pay stub can be crucial for resolving payment disputes between the contractor and the hiring entity. |

Key takeaways

Filling out and using the Independent Contractor Pay Stub form is an important task for both contractors and businesses. Here are some key takeaways to keep in mind:

- The form should include the contractor's name, address, and Social Security number or Tax Identification Number.

- Clearly state the pay period for which the payment is being made.

- List the total amount earned during the pay period, including any bonuses or commissions.

- Include a breakdown of deductions, if applicable, such as taxes or insurance contributions.

- Make sure to provide the net pay amount after all deductions have been accounted for.

- Keep a copy of the pay stub for your records and for tax purposes.

- Using the form can help maintain transparency between contractors and businesses.

- Ensure that the form is filled out accurately to avoid discrepancies later.

- Consider providing the pay stub in a timely manner to help contractors manage their finances.

- Regular use of the pay stub can assist in establishing a clear payment history.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it's important to be thorough and accurate. Here are some key dos and don'ts to keep in mind:

- Do double-check all personal information for accuracy.

- Do clearly list the services provided during the pay period.

- Do specify the payment rate for each service rendered.

- Do include the total hours worked to ensure proper compensation.

- Do keep a copy of the completed pay stub for your records.

- Don't leave any sections blank; fill out every required field.

- Don't use vague descriptions for your services; be specific.

- Don't forget to sign the form before submitting it.

- Don't submit the form without reviewing it for errors.

Common mistakes

-

Failing to include accurate personal information. Ensure that your name, address, and Social Security number are correct. Mistakes here can lead to tax issues.

-

Not specifying the correct payment period. Clearly indicate the start and end dates for the work performed. This helps avoid confusion and ensures proper payment.

-

Omitting hours worked. Always document the total hours you worked during the pay period. This is crucial for accurate compensation.

-

Incorrectly calculating the pay rate. Double-check your hourly rate or project fee. Errors can result in underpayment or overpayment.

-

Neglecting to itemize deductions. If applicable, list any deductions taken from your pay. This transparency is important for both you and the payer.

-

Not keeping a copy of the pay stub. Always retain a copy for your records. This can be useful for tax purposes or future reference.

-

Using outdated forms. Ensure you are using the latest version of the Independent Contractor Pay Stub form. Outdated forms may not comply with current regulations.

-

Failing to sign the form. Your signature is often required to validate the document. Without it, the form may be considered incomplete.

-

Not providing sufficient detail about the work performed. Include a brief description of the services rendered. This helps clarify the nature of the work for both parties.

-

Ignoring state-specific requirements. Different states may have additional rules regarding pay stubs. Research your state’s regulations to ensure compliance.

What You Should Know About This Form

-

What is an Independent Contractor Pay Stub?

An Independent Contractor Pay Stub is a document that outlines the earnings and deductions for an independent contractor during a specific pay period. It serves as a record of payment and can be used for tax purposes. The pay stub typically includes details such as the contractor's name, the amount earned, any deductions taken, and the net amount paid.

-

Who needs an Independent Contractor Pay Stub?

Independent contractors who provide services to clients or businesses may need a pay stub to track their income. This document is particularly important for contractors who need to report their earnings for tax purposes. Clients or businesses that hire independent contractors may also provide pay stubs as a way to document payments made.

-

What information is included on the pay stub?

A typical Independent Contractor Pay Stub includes the following information:

- Contractor's name and contact information

- Pay period dates

- Total earnings for the period

- Deductions (if applicable), such as taxes or fees

- Net pay amount

This information helps both the contractor and the hiring entity maintain accurate records.

-

How can I obtain an Independent Contractor Pay Stub?

Independent contractors can create their own pay stubs using various online templates or software designed for this purpose. Alternatively, clients or businesses that hire contractors may provide pay stubs as part of their payment process. It is essential to ensure that the pay stub is accurate and reflects the agreed-upon payment terms.

-

Is an Independent Contractor Pay Stub required by law?

While there is no federal law specifically requiring independent contractors to receive pay stubs, having one can be beneficial for record-keeping and tax reporting. Some states may have regulations regarding payment documentation, so it is advisable to check local laws to ensure compliance.

-

Can I use the pay stub for tax purposes?

Yes, an Independent Contractor Pay Stub can be used for tax purposes. It provides a clear record of income earned and any deductions taken. Contractors should keep these pay stubs organized, as they may be needed when filing taxes to report income accurately and claim any allowable deductions.

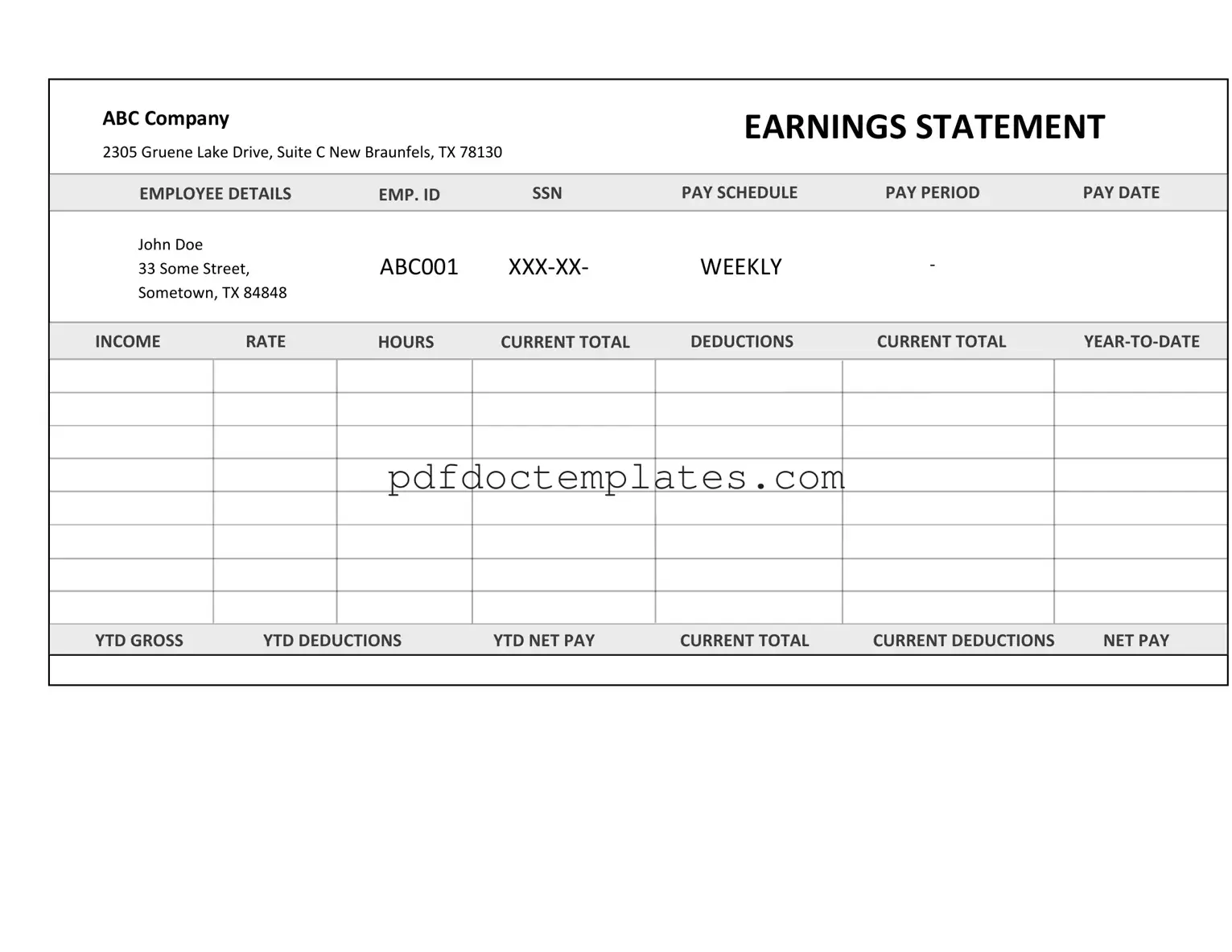

Independent Contractor Pay Stub Example

ABC Company |

|

|

|

EARNINGS STATEMENT |

||

|

|

|

|

|

|

|

2305 Gruene Lake Drive, Suite C New Braunfels, TX 78130 |

|

|

|

|||

EMPLOYEE DETAILS |

EMP. ID |

SSN |

PAY SCHEDULE |

PAY PERIOD |

PAY DATE |

|

John Doe |

|

ABC001 |

WEEKLY |

- |

|

|

33 Some Street, |

|

|||||

Sometown, TX 84848 |

|

|

|

|

|

|

INCOME |

RATE |

HOURS |

CURRENT TOTAL |

DEDUCTIONS |

CURRENT TOTAL |

|

YTD GROSS |

YTD DEDUCTIONS |

YTD NET PAY |

CURRENT TOTAL |

CURRENT DEDUCTIONS |

NET PAY |

Consider More Forms

Dd Form 2870 Download - It leads the way for service members to obtain assistance for their studies.

In establishing a Limited Liability Company (LLC) in New York, creating a solid Operating Agreement is crucial for defining roles and responsibilities among members, as well as outlining procedures for decision-making and profit distribution. For those looking to draft this important document, you can find a useful resource at https://smarttemplates.net/fillable-new-york-operating-agreement, which provides a fillable template tailored to meet the specific requirements of New York-based LLCs.

Cuddy Buddy Application - It's time to embrace someone new.