Download Goodwill donation receipt Template

Misconceptions

When it comes to donating items to Goodwill, many people have misconceptions about the donation receipt form. Here are five common misunderstandings:

- Misconception 1: The receipt is only for tax purposes.

- Misconception 2: You must have a detailed list of items to receive a receipt.

- Misconception 3: The value of donated items is determined by Goodwill.

- Misconception 4: You can only get a receipt for large donations.

- Misconception 5: The receipt must be filled out at the time of donation.

While the receipt can be used for tax deductions, it also serves as proof of your charitable contribution. It can be helpful for personal record-keeping and tracking your donations over time.

Goodwill does not require you to list every item in detail on the receipt. A general description of the donated items is usually sufficient. This makes the process easier for donors.

Donors are responsible for estimating the value of their donated items. Goodwill provides guidelines, but ultimately, it is up to the donor to assign a fair market value.

Goodwill issues receipts for all donations, regardless of size. Whether you donate a single item or several boxes of clothing, you can receive a receipt.

While it’s common to receive a receipt immediately, donors can also request a receipt later if they forget to ask at the time of donation. Goodwill keeps records of donations, making it easier to obtain a receipt later.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Goodwill donation receipt form serves as proof of donation for tax purposes. |

| Tax Deduction | Donors can claim a tax deduction for their donations, provided they keep the receipt. |

| Item Valuation | Donors are responsible for estimating the value of their donated items. |

| State-Specific Forms | Some states may have specific requirements for donation receipts under local tax laws. |

| Record Keeping | It is advisable to keep the receipt for at least three years after filing your tax return. |

| Nonprofit Status | Goodwill is a registered nonprofit organization, which allows donations to be tax-deductible. |

| Governing Laws | IRS regulations govern the tax deductibility of charitable donations across the U.S. |

Key takeaways

When filling out and using the Goodwill donation receipt form, keep these key takeaways in mind:

- Keep a copy for your records. Always retain a copy of the receipt for your personal records and tax purposes.

- Fill out the form completely. Provide all necessary information, including your name, address, and the date of the donation.

- List donated items. Clearly describe the items you are donating, including their condition and estimated value.

- Understand the tax implications. Donations may be tax-deductible, so familiarize yourself with the IRS guidelines regarding charitable contributions.

- Get a signature. If possible, have a Goodwill representative sign the receipt to validate your donation.

- Use fair market value. When estimating the value of your items, use fair market value rather than original purchase price.

- Check for updates. Goodwill may update their receipt forms or policies, so ensure you have the latest version.

- Consider item limits. Be aware of any limits on the number of items you can donate at once, as this can vary by location.

Dos and Don'ts

When filling out the Goodwill donation receipt form, it’s important to ensure accuracy and clarity. Here’s a helpful list of things you should and shouldn’t do:

- Do provide your name and contact information clearly.

- Do list all items donated, including their condition.

- Do estimate the value of your donated items honestly.

- Do keep a copy of the receipt for your records.

- Don’t leave any sections blank on the form.

- Don’t overestimate the value of your items.

- Don’t forget to sign and date the receipt.

By following these guidelines, you can ensure that your donation process is smooth and beneficial for both you and Goodwill. Remember, accurate records can make a difference when it comes time for tax deductions or verifying your contributions.

Common mistakes

-

Failing to provide a complete description of the donated items. It is important to list each item clearly, including its condition, to ensure accurate record-keeping.

-

Not assigning a fair market value to the items. Donors should estimate the value of each item based on similar items sold in thrift stores or online marketplaces.

-

Overlooking the date of the donation. This date is crucial for tax purposes and should be filled out correctly to avoid complications later.

-

Missing the signature of the donor. The receipt should be signed to validate the donation and confirm that the donor agrees with the stated information.

-

Not keeping a copy of the receipt. It is essential to retain a copy for personal records and potential tax deductions, as this serves as proof of the donation.

What You Should Know About This Form

-

What is a Goodwill donation receipt form?

A Goodwill donation receipt form is a document provided to donors when they make a contribution of goods to Goodwill Industries. This form serves as proof of the donation for tax purposes and includes details about the items donated.

-

Why do I need a receipt for my donation?

The receipt is important for tax deductions. When you donate to a qualified nonprofit like Goodwill, you can claim a deduction on your income tax return. The receipt helps substantiate your donation in case of an audit.

-

What information is included on the receipt?

The receipt typically includes:

- The name and address of Goodwill Industries

- The date of the donation

- A description of the items donated

- A statement indicating whether you received any goods or services in return for your donation

-

How do I obtain a Goodwill donation receipt?

You can obtain a receipt at the time of your donation. When you drop off your items at a Goodwill location, staff will provide you with a receipt. If you forget to ask for one, you can usually request a duplicate by contacting the specific Goodwill location.

-

Can I estimate the value of my donated items?

Yes, you can estimate the value of your donated items, but it’s important to be reasonable. The IRS allows you to claim a deduction based on the fair market value of the items. Goodwill often provides guidelines on how to assess the value of common items.

-

What if I lose my receipt?

If you lose your receipt, it can be challenging to prove your donation for tax purposes. However, you can try to retrieve a copy by contacting the Goodwill location where you made the donation. Keep in mind that maintaining good records is essential for your financial documentation.

-

Is there a limit to how much I can deduct for my donations?

There is no specific limit on the total amount you can deduct for charitable donations, but your deduction may be limited based on your income and the type of property donated. It's advisable to consult a tax professional to understand how these rules apply to your situation.

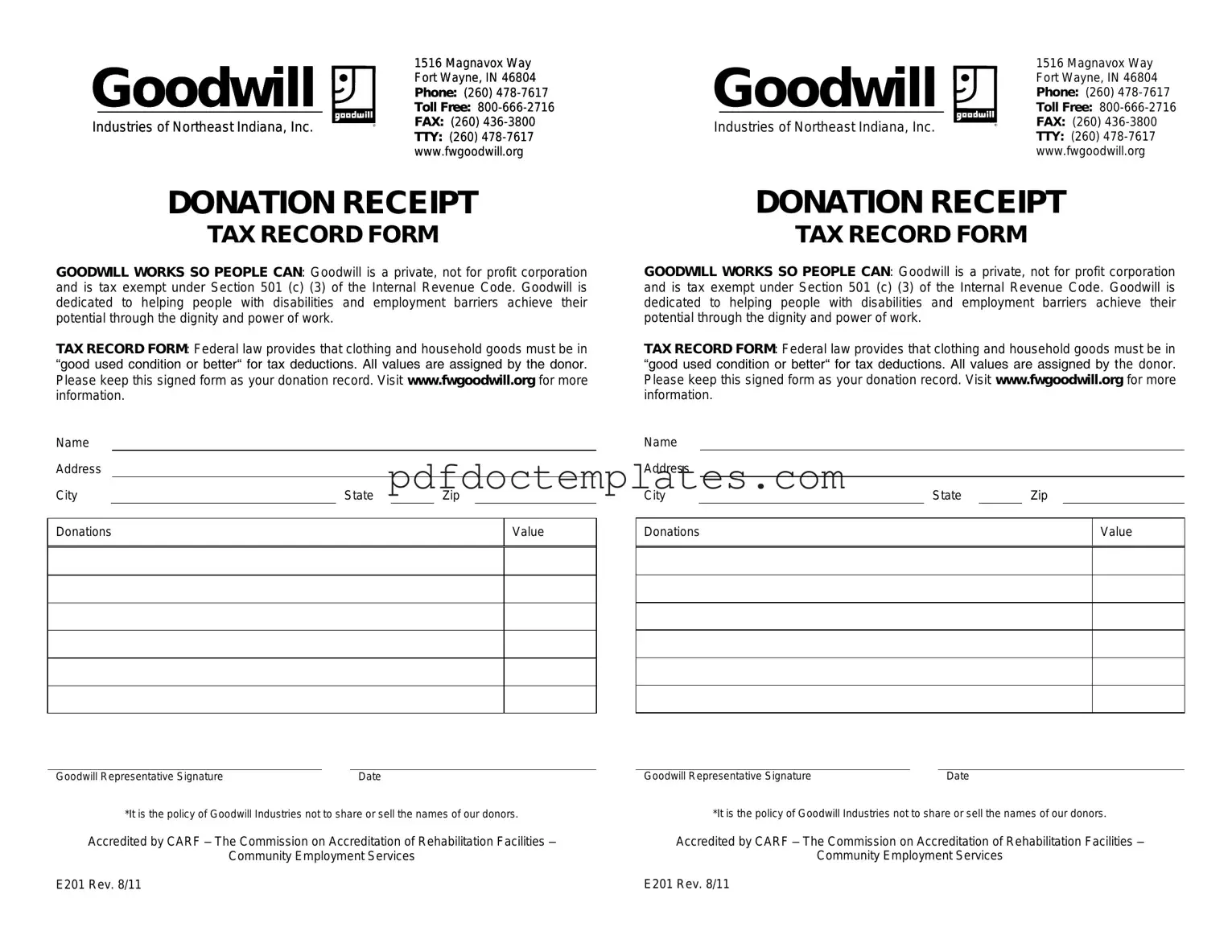

Goodwill donation receipt Example

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Goodwill |

1516 Magnavox Way |

|

Toll Free: |

||

|

Fort Wayne, IN 46804 |

|

|

Phone: (260) |

|

Industries of Northeast Indiana, Inc. |

FAX: (260) |

|

TTY: (260) |

||

|

||

|

www.fwgoodwill.org |

DONATION RECEIPT

TAX RECORD FORM

GOODWILL WORKS SO PEOPLE CAN: Goodwill is a private, not for profit corporation and is tax exempt under Section 501 (c) (3) of the Internal Revenue Code. Goodwill is dedicated to helping people with disabilities and employment barriers achieve their potential through the dignity and power of work.

TAX RECORD FORM: Federal law provides that clothing and household goods must be in “good used condition or better“ for tax deductions. All values are assigned by the donor. Please keep this signed form as your donation record. Visit www.fwgoodwill.org for more information.

Name

Address

City |

|

State |

|

Zip |

|

|

|

|

|

|

|

|

|

Donations |

|

|

|

|

Value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Goodwill Representative Signature |

|

Date |

*It is the policy of Goodwill Industries not to share or sell the names of our donors.

Accredited by CARF – The Commission on Accreditation of Rehabilitation Facilities –

Community Employment Services

E201 Rev. 8/11

Consider More Forms

I9 Documents - Used when applying for government assistance programs.

When dealing with the transfer of trailer ownership in Florida, it is essential to complete the appropriate documentation to ensure a smooth transaction. The Florida Trailer Bill of Sale not only serves as proof of the sale but also protects both the seller and the buyer. For those looking for a reliable source to obtain this form, All Florida Forms offers the necessary templates to facilitate the process effectively.

Osha Privacy Case - Make sure to include a description of the employee's injuries.

Test Drive Agreement - Your next adventure starts with a simple test drive agreement.