Download Gift Letter Template

Misconceptions

-

Misconception 1: A gift letter is only needed for large sums of money.

Many believe that a gift letter is only necessary for significant financial contributions. However, any amount given as a gift for a home purchase may require documentation to clarify the source of funds.

-

Misconception 2: The donor must be a family member.

While family members often provide gifts for home purchases, anyone can be a donor. Friends or other acquaintances may also give financial gifts, and a letter is still essential.

-

Misconception 3: A gift letter is not legally binding.

Some think that a gift letter holds no legal weight. In reality, it serves as a formal declaration of the gift, which can be important for lenders and tax purposes.

-

Misconception 4: The gift letter does not need to be notarized.

While notarization is not always required, it can add an extra layer of authenticity. Some lenders may request a notarized letter to ensure the legitimacy of the gift.

-

Misconception 5: You can use a generic template for the gift letter.

Using a generic template may not suffice. Each lender may have specific requirements regarding the content and format of the gift letter, so it is crucial to follow their guidelines.

-

Misconception 6: The donor does not need to provide personal information.

Some individuals believe that personal information is unnecessary. In fact, the donor's name, address, and relationship to the recipient are typically required for the letter.

-

Misconception 7: A gift letter can be submitted after closing.

It is a common misunderstanding that the gift letter can be submitted at any time. Most lenders require the letter to be provided before closing to ensure compliance with financing rules.

File Details

| Fact Name | Description |

|---|---|

| Purpose | A Gift Letter form is used to document a financial gift given to a borrower, often to help with a home purchase. |

| Requirements | Typically, the form must include the donor's name, address, relationship to the borrower, and the amount of the gift. |

| State-Specific Laws | In some states, such as California, the governing law may require specific disclosures regarding the source of funds. |

| Tax Implications | Gift amounts over a certain threshold may have tax implications for the donor, which is governed by federal tax law. |

Key takeaways

When filling out and using a Gift Letter form, it is important to understand several key points. These letters are often required in real estate transactions, especially when a buyer receives financial assistance from a family member or friend. Here are some essential takeaways:

- Purpose: A Gift Letter confirms that money given to a buyer is a gift, not a loan. This distinction is crucial for lenders.

- Donor Information: Include the full name, address, and relationship of the person giving the gift. This information helps establish the legitimacy of the gift.

- Amount of the Gift: Clearly state the exact amount being gifted. This ensures transparency and clarity for all parties involved.

- Declaration: The donor must declare that the funds do not need to be repaid. This statement reassures lenders that the buyer will not incur additional debt.

- Signature: The donor should sign and date the letter. A signature adds authenticity and validity to the document.

- Timing: Submit the Gift Letter to the lender as soon as possible. Early submission can prevent delays in the mortgage approval process.

- Documentation: Keep a copy of the Gift Letter for personal records. It may be useful for future reference or if questions arise.

- Consultation: Consider seeking advice from a financial advisor or real estate professional. They can provide guidance tailored to individual circumstances.

Understanding these key points can help ensure a smooth process when using a Gift Letter in real estate transactions. Clarity and honesty are essential in these situations.

Dos and Don'ts

When filling out a Gift Letter form, it is important to follow certain guidelines to ensure the process goes smoothly. Below are four key actions to take and avoid.

- Do: Clearly state the relationship between the giver and the recipient.

- Do: Include the exact amount of the gift.

- Do: Sign and date the letter to validate it.

- Do: Provide any additional information that may be required by the lender.

- Don't: Use vague language or general terms when describing the gift.

- Don't: Forget to mention if the gift is a loan or a true gift.

- Don't: Leave out important details, such as the date of the gift.

- Don't: Submit the form without reviewing it for accuracy.

Common mistakes

-

Not including all required information: People often forget to provide essential details like the donor's name, address, and relationship to the recipient.

-

Inaccurate dollar amount: Some individuals misstate the amount of the gift, which can lead to confusion or complications later.

-

Failure to sign the letter: A common mistake is neglecting to sign the gift letter, rendering it invalid.

-

Omitting the date: Without a date, it can be difficult to establish when the gift was made.

-

Not clarifying the purpose of the gift: Some forget to explain that the gift is meant for a specific purpose, such as a home purchase.

-

Using vague language: Ambiguous terms can create misunderstandings about the nature of the gift.

-

Ignoring lender requirements: Different lenders may have specific requirements for gift letters, which some people overlook.

-

Not providing proof of funds: Some fail to include documentation showing that the donor has the funds available for the gift.

-

Neglecting to mention any repayment: If the gift is actually a loan, it should be clearly stated to avoid legal issues.

What You Should Know About This Form

-

What is a Gift Letter form?

A Gift Letter form is a document that outlines a financial gift given to an individual, typically for the purpose of purchasing a home. It serves to clarify that the funds provided are a gift and not a loan, which is important for mortgage lenders.

-

Why do I need a Gift Letter form?

This form is necessary to assure lenders that the funds will not need to be repaid. When applying for a mortgage, lenders require evidence that your financial resources are legitimate and that you can afford the loan. A Gift Letter helps to establish the source of your down payment.

-

Who can provide a Gift Letter?

Typically, family members or close friends provide the gift. The lender may specify who qualifies as a donor, often including parents, siblings, or even grandparents. Some lenders may also accept gifts from other individuals, but this is less common.

-

What information is included in a Gift Letter?

A Gift Letter generally includes the donor's name, address, and relationship to the recipient. It should state the amount of the gift, confirm that it is a gift and not a loan, and include the date the funds were transferred. Some lenders may also require the donor's signature.

-

Are there limits on the amount I can receive as a gift?

While there is no specific limit set by federal law, the IRS does impose a gift tax exclusion. For 2023, this exclusion allows an individual to gift up to $17,000 per recipient without incurring gift tax. However, if the amount exceeds this limit, the donor may need to file a gift tax return.

-

Can I use a Gift Letter for any type of loan?

Gift Letters are most commonly used for mortgage loans, particularly for first-time homebuyers. However, other types of loans may also accept gift funds, but it is essential to check with the specific lender for their policies regarding gift funds.

-

What happens if I do not provide a Gift Letter?

Failing to provide a Gift Letter can lead to complications in the mortgage application process. Lenders may view the funds as a loan, which could affect your debt-to-income ratio and ultimately jeopardize your ability to secure financing. It is crucial to provide this documentation to avoid delays or denials.

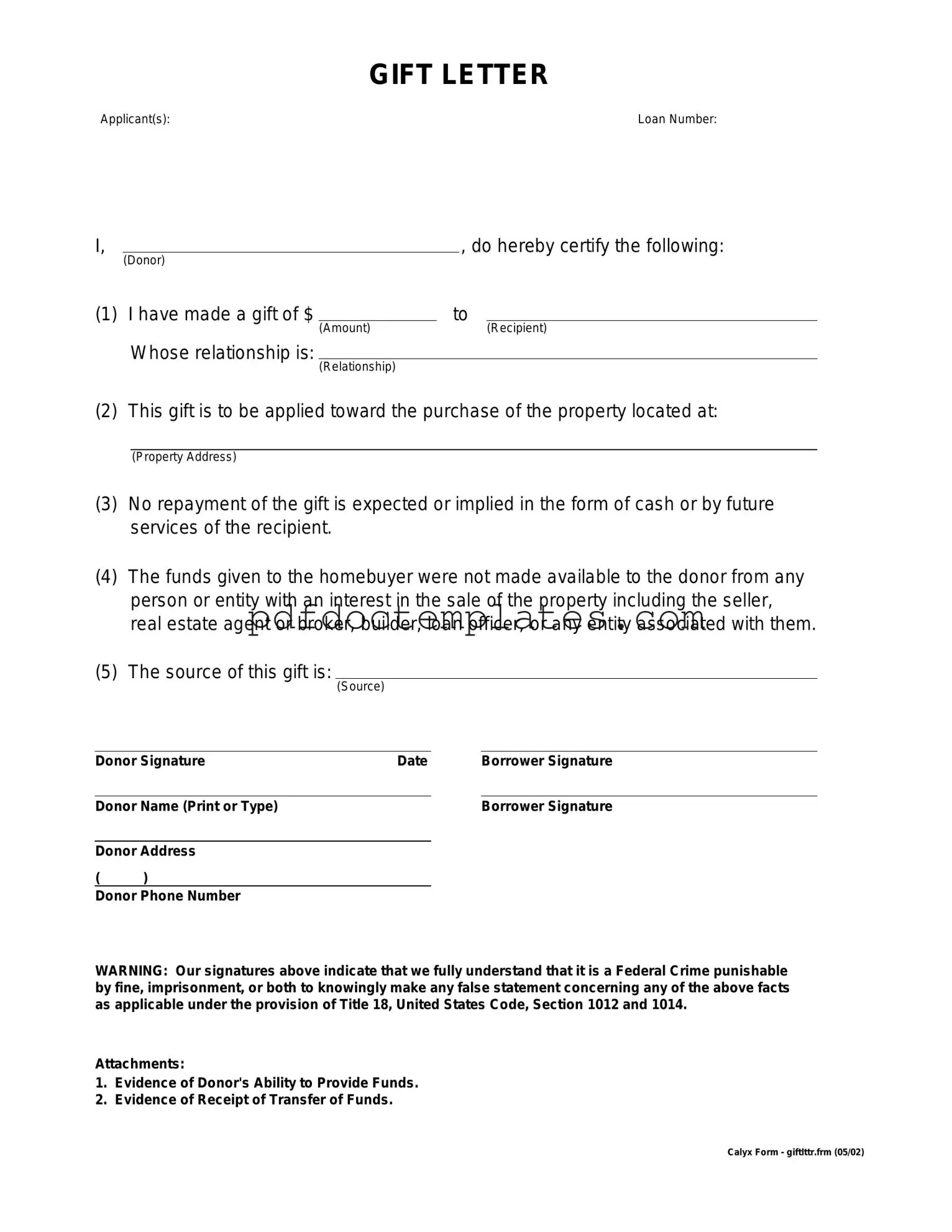

Gift Letter Example

GIFT LETTER

Applicant(s): |

Loan Number: |

I, |

|

|

, do hereby certify the following: |

||

|

(Donor) |

|

|

|

|

(1) I have made a gift of $ |

|

to |

|

||

|

|

(Amount) |

|

|

(Recipient) |

|

Whose relationship is: |

|

|

|

|

|

|

(Relationship) |

|

|

|

(2) This gift is to be applied toward the purchase of the property located at:

(Property Address)

(3)No repayment of the gift is expected or implied in the form of cash or by future services of the recipient.

(4)The funds given to the homebuyer were not made available to the donor from any person or entity with an interest in the sale of the property including the seller, real estate agent or broker, builder, loan officer, or any entity associated with them.

(5)The source of this gift is:

(Source)

Donor Signature |

Date |

Borrower Signature |

||

|

|

|

|

|

Donor Name (Print or Type) |

|

|

Borrower Signature |

|

|

|

|

|

|

Donor Address |

|

|

|

|

( |

) |

|

|

|

Donor Phone Number

WARNING: Our signatures above indicate that we fully understand that it is a Federal Crime punishable by fine, imprisonment, or both to knowingly make any false statement concerning any of the above facts as applicable under the provision of Title 18, United States Code, Section 1012 and 1014.

Attachments:

1.Evidence of Donor's Ability to Provide Funds.

2.Evidence of Receipt of Transfer of Funds.

Calyx Form - giftlttr.frm (05/02)

Consider More Forms

Printable Lyft Inspection Form - Inspect the vehicle for any signs of rust or corrosion.

In the realm of legal documentation, particularly for residents in New York, the importance of a Power of Attorney form cannot be overstated. This form enables individuals to designate someone they trust to handle essential decision-making when they are unable to do so themselves, covering vital areas such as financial and health-related choices. To ensure that your legal rights and preferences are adequately communicated, it is imperative to familiarize yourself with this form, and for additional resources, you can refer to All New York Forms.

262 Form - For detailed rights and responsibilities, refer to the Car Buyer's Bill of Rights online.