Printable Gift Deed Template

Gift Deed - Customized for State

Misconceptions

There are several misconceptions about the Gift Deed form that can lead to confusion. Here are four common misunderstandings:

-

Gift Deeds are only for real estate transactions.

This is not true. While Gift Deeds are often associated with real estate, they can also be used for transferring personal property, such as vehicles, jewelry, or other valuable items.

-

A Gift Deed does not require any legal documentation.

This misconception can lead to problems. A Gift Deed should be documented properly to ensure that the transfer is legally recognized. Without proper documentation, disputes may arise in the future.

-

Gift Deeds are irrevocable.

Many believe that once a Gift Deed is executed, it cannot be undone. However, under certain circumstances, it may be possible to revoke a Gift Deed, especially if the donor retains some control over the property.

-

All gifts are tax-free.

This is a common misunderstanding. While many gifts may not incur taxes, there are limits on the value of gifts that can be given without tax implications. It's important to understand the tax laws to avoid unexpected liabilities.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document used to transfer ownership of property without any exchange of money. |

| Consideration | No monetary consideration is required for a Gift Deed, making it distinct from other property transfer methods. |

| Governing Laws | Each state has specific laws governing Gift Deeds. For example, in California, the relevant laws are found in the California Civil Code. |

| Requirements | A valid Gift Deed must be in writing, signed by the donor, and typically notarized to be legally enforceable. |

| Revocation | A Gift Deed can be revoked before the transfer is complete, but once executed, it generally cannot be undone. |

| Tax Implications | Gift taxes may apply depending on the value of the property and the relationship between the donor and recipient. |

| Recording | To protect the recipient's rights, it's advisable to record the Gift Deed with the local county recorder's office. |

| Eligibility | Both the donor and recipient must be legally competent to enter into a Gift Deed. |

| Types of Property | A Gift Deed can be used for various types of property, including real estate, vehicles, and personal items. |

Key takeaways

When filling out and using a Gift Deed form, it is essential to understand the following key points:

- Ensure that the donor and recipient information is accurate and complete.

- Clearly describe the property being gifted, including its legal description.

- Both parties should sign the document in the presence of a notary public.

- Consider any potential tax implications for both the donor and the recipient.

- Verify local laws regarding gift deeds, as requirements can vary by state.

- Keep a copy of the completed Gift Deed for your records.

- File the Gift Deed with the appropriate local government office if required.

- Understand that a Gift Deed is irrevocable once executed.

- Consult with a legal professional if there are questions or concerns about the process.

- Communicate openly with the recipient about the intentions and conditions of the gift.

Dos and Don'ts

When filling out a Gift Deed form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do: Provide accurate information about the donor and the recipient.

- Do: Clearly describe the property being gifted.

- Don't: Leave any sections of the form blank.

- Don't: Use vague language that could lead to confusion.

Common mistakes

-

Incomplete Information: One common mistake is leaving out essential details. The names of both the donor and the recipient must be clearly stated. Additionally, the property description should be specific and complete. Omitting any of this information can lead to confusion or disputes later on.

-

Improper Signatures: All parties involved must sign the Gift Deed. Often, individuals forget to have the document signed by witnesses or a notary public, which can invalidate the deed. Ensuring that all necessary signatures are obtained is crucial for the document’s legality.

-

Failure to Understand Tax Implications: Some people overlook the potential tax consequences of gifting property. It is important to consider whether the gift exceeds the annual exclusion limit set by the IRS. Not doing so can lead to unexpected tax liabilities for both the donor and the recipient.

-

Not Recording the Deed: After completing the Gift Deed, many individuals neglect to record it with the appropriate local government office. This step is vital for ensuring that the transfer of ownership is recognized legally. Failing to record the deed can result in complications if the property is later sold or transferred again.

What You Should Know About This Form

-

What is a Gift Deed?

A Gift Deed is a legal document used to transfer ownership of property or assets from one individual to another without any exchange of money. The giver, known as the donor, voluntarily gives the property to the recipient, known as the donee. This transfer is typically irrevocable and is often used for family members or friends.

-

What types of property can be transferred using a Gift Deed?

A Gift Deed can be used to transfer various types of property, including real estate, vehicles, personal belongings, and financial assets. It is important to specify the property being gifted clearly in the document to avoid any confusion.

-

Are there any tax implications associated with a Gift Deed?

Yes, there may be tax implications for both the donor and the donee. The donor may be subject to gift tax if the value of the gift exceeds a certain threshold set by the IRS. The donee may also need to consider the tax basis of the property for future capital gains tax purposes. It is advisable to consult a tax professional for guidance.

-

Is it necessary to have witnesses for a Gift Deed?

While not always required, having witnesses can add validity to a Gift Deed. Many states recommend or require the presence of one or two witnesses during the signing of the document. This can help prevent disputes regarding the authenticity of the gift in the future.

-

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it is generally considered irrevocable. However, if the donor has not yet transferred possession or if certain conditions are met, it may be possible to revoke the deed. Legal advice should be sought in such cases to understand the specific circumstances.

-

How do I create a Gift Deed?

To create a Gift Deed, you will need to gather relevant information about the property, the donor, and the donee. The document should include a clear description of the property, the intent to gift, and the signatures of both parties, along with any required witnesses. It is often beneficial to use a template or consult with a legal professional to ensure compliance with state laws.

Gift Deed Example

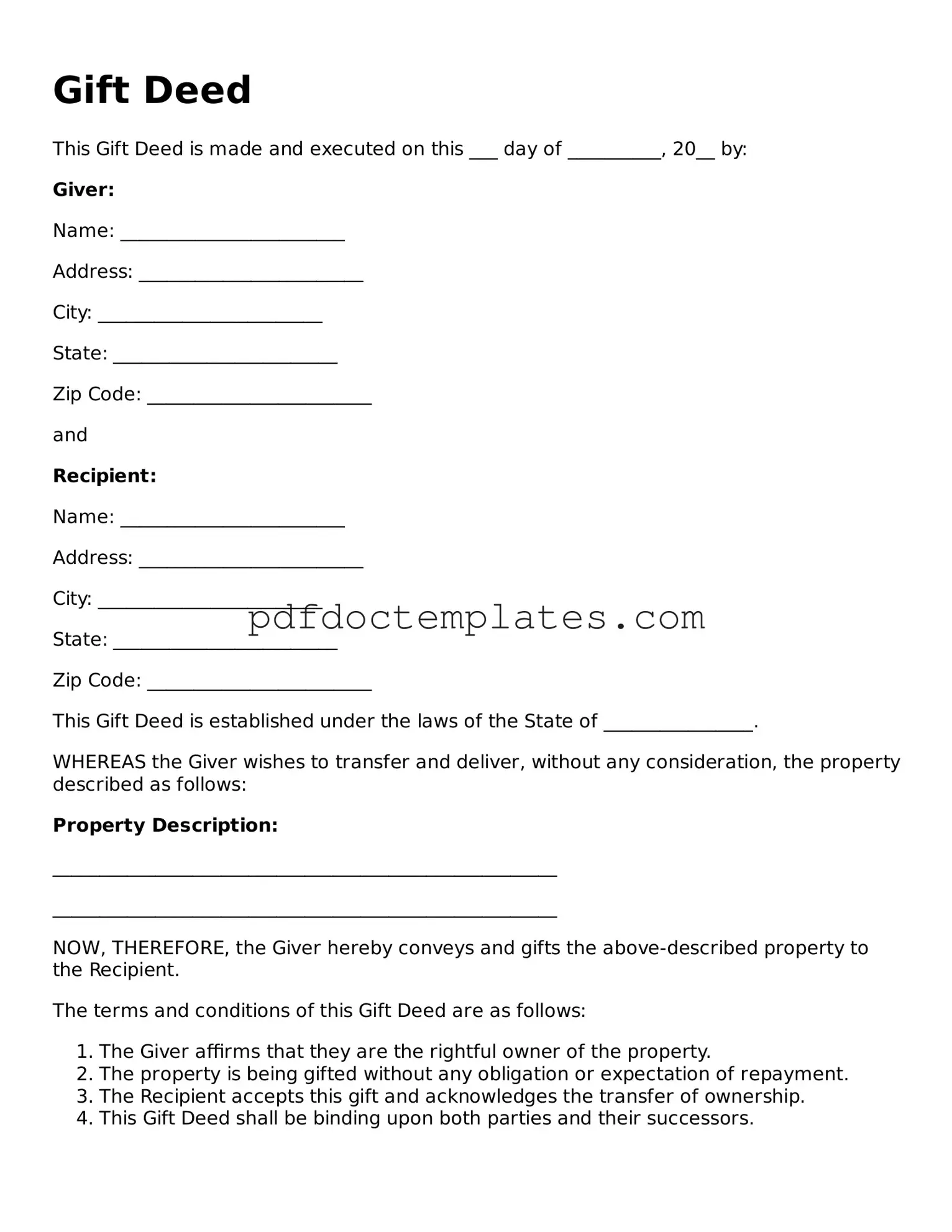

Gift Deed

This Gift Deed is made and executed on this ___ day of __________, 20__ by:

Giver:

Name: ________________________

Address: ________________________

City: ________________________

State: ________________________

Zip Code: ________________________

and

Recipient:

Name: ________________________

Address: ________________________

City: ________________________

State: ________________________

Zip Code: ________________________

This Gift Deed is established under the laws of the State of ________________.

WHEREAS the Giver wishes to transfer and deliver, without any consideration, the property described as follows:

Property Description:

______________________________________________________

______________________________________________________

NOW, THEREFORE, the Giver hereby conveys and gifts the above-described property to the Recipient.

The terms and conditions of this Gift Deed are as follows:

- The Giver affirms that they are the rightful owner of the property.

- The property is being gifted without any obligation or expectation of repayment.

- The Recipient accepts this gift and acknowledges the transfer of ownership.

- This Gift Deed shall be binding upon both parties and their successors.

IN WITNESS WHEREOF, the parties have executed this Gift Deed on the date first above written.

Signature of Giver: ________________________

Signature of Recipient: ________________________

Witness:

Name: ________________________

Address: ________________________

Different Types of Gift Deed Forms:

Ladybug Deed - A Lady Bird Deed can help protect assets from Medicaid claims in certain situations.

For those looking to legally document the transfer of a trailer, the important Trailer Bill of Sale process provides a clear framework to ensure compliance with state requirements, making it easier for both buyers and sellers to navigate this essential transaction.

Where Can I Get a Quit Claim Deed Form - Quitclaim deeds are often seen as a quick and informal way to manage property ownership changes.