Download Generic Direct Deposit Template

Misconceptions

When it comes to the Generic Direct Deposit form, there are several misconceptions that can lead to confusion. Here are ten common misunderstandings, along with clarifications to help you navigate the process smoothly.

- Direct deposit is only for payroll. Many people believe that direct deposit can only be used for salary payments. In reality, it can also be used for benefits, tax refunds, and other types of payments.

- All banks accept direct deposit. While most financial institutions do accept direct deposit, it's essential to confirm with your bank. Some smaller banks or credit unions may have specific requirements.

- You can use any account number. It's crucial to use the correct account number and routing transit number. Errors in these numbers can lead to delayed or misdirected deposits.

- Only one signature is needed. If the account is a joint account, both account holders must sign the form to authorize the direct deposit.

- Direct deposit is instantaneous. Although direct deposits are generally quick, they may take one to two business days to process, especially for first-time deposits.

- You don’t need to notify your employer. After completing the form, you should submit it to your employer or the relevant department. They need this information to set up the direct deposit.

- Using a deposit slip is the best way to verify account details. It’s advisable not to use a deposit slip for verification. Instead, check directly with your bank to ensure accuracy.

- Changing your account is complicated. Changing your direct deposit account is usually straightforward. Just fill out a new form and submit it to your employer.

- Direct deposit is not secure. Direct deposit is generally considered secure. Banks use encryption and other security measures to protect your information.

- You can skip filling out all boxes if you think they are unnecessary. Every box on the form must be filled out completely. Missing information can lead to processing delays.

Understanding these misconceptions can help you complete your Generic Direct Deposit form accurately and ensure a smooth experience with your financial transactions.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Generic Direct Deposit form allows individuals to authorize their employer or other entities to deposit funds directly into their bank accounts. |

| Account Information | Users must provide their account number, routing transit number, and specify the type of account (savings or checking) to complete the form. |

| Signature Requirement | The form requires the signature of the account holder. If the account is joint or in another person's name, that individual must also sign. |

| State-Specific Laws | In Florida, the governing laws for direct deposits can be found under Florida Statutes, Title XXXIII, Chapter 655. |

Key takeaways

Filling out the Generic Direct Deposit form can seem daunting, but understanding the process can make it easier. Here are some key takeaways to help you through:

- Complete All Sections: Ensure that every box on the form is filled out completely. Missing information can delay your direct deposit.

- Provide Accurate Information: Double-check your Social Security Number, account number, and routing transit number for accuracy.

- Choose the Correct Account Type: Specify whether your account is a checking or savings account. This is crucial for processing your deposit correctly.

- Contact Your Bank: Before submitting, call your financial institution to confirm they accept direct deposits. This can prevent any issues later on.

- Verify Routing and Account Numbers: Use the information provided by your bank to confirm your routing and account numbers. Do not rely on a deposit slip for this verification.

- Sign and Date: Your signature is required to authorize the direct deposit. Make sure to date the form as well.

- Joint Accounts Require Additional Signature: If the account is joint or in someone else's name, that person must also sign the form.

- Keep a Copy: After filling out the form, make a copy for your records. This can be useful for future reference.

- Submit Promptly: Turn in your completed form as soon as possible to ensure timely processing of your direct deposit.

- Understand Your Rights: You have the right to cancel or change your direct deposit at any time. Follow the proper procedures to do so.

By following these steps, you can ensure a smooth experience with your direct deposit setup. Take your time, and don’t hesitate to reach out for help if you need it.

Dos and Don'ts

When filling out the Generic Direct Deposit form, there are important practices to follow. Here’s a list of what you should and shouldn’t do:

- Do fill in all required boxes completely to avoid delays.

- Do double-check your Social Security Number for accuracy.

- Do ensure that the routing transit number has all nine digits.

- Do verify your account number with your financial institution before submission.

- Do sign and date the form to authorize the transactions.

- Don’t use a deposit slip to verify the routing number, as it may lead to errors.

- Don’t forget to have a joint account holder sign if the account is not solely yours.

Following these guidelines will help ensure that your direct deposit setup goes smoothly.

Common mistakes

-

Incomplete Information: Failing to fill in all required fields can lead to processing delays. Each box must be completed, including names, Social Security Number, and account details.

-

Incorrect Account Number: Entering an incorrect account number can result in funds being deposited into the wrong account. It is crucial to verify this number with the financial institution.

-

Routing Transit Number Errors: Providing an inaccurate routing transit number can cause significant issues. All nine digits must be correct, and the first two numbers should be between 01 and 12 or 21 and 32.

-

Omitting Signatures: Not signing the form can invalidate the authorization. Both the account holder and any joint account holders must sign if applicable.

-

Choosing the Wrong Account Type: Selecting the incorrect account type (savings or checking) can lead to failed transactions. Ensure the correct type is marked on the form.

-

Using a Deposit Slip: Relying on a deposit slip to verify the routing number is discouraged. It is recommended to confirm the number directly with the financial institution.

-

Ignoring Effective Date: Not specifying an effective date for the changes can lead to confusion regarding when the direct deposit will commence.

-

Not Verifying with the Financial Institution: Failing to call the financial institution to ensure they accept direct deposits can result in unexpected complications.

-

Incorrectly Indicating Ownership: Misrepresenting the ownership of the account can lead to authorization issues. The form should accurately reflect whether the account is self, joint, or other.

-

Neglecting to Keep a Copy: Not retaining a copy of the completed form for personal records can complicate future inquiries or disputes regarding the direct deposit.

What You Should Know About This Form

-

What is the purpose of the Generic Direct Deposit form?

The Generic Direct Deposit form allows individuals to authorize their employer or another organization to deposit funds directly into their bank account. This can include payroll payments or reimbursements.

-

How do I fill out the form?

To complete the form, fill in all the required boxes, including your name, Social Security number, and account details. Make sure to sign and date the form at the bottom. Ensure that the account number and routing transit number are accurate.

-

What should I do if I have a joint account?

If you have a joint account, both account holders must sign the form to authorize direct deposits. This ensures that all parties agree to the terms of the direct deposit arrangement.

-

What if I want to change or cancel my direct deposit?

You can indicate a change or cancellation by selecting the appropriate option on the form. Make sure to complete the form with updated information and submit it to your employer or the organization managing the deposits.

-

How can I verify my account and routing numbers?

Contact your financial institution directly to confirm your account number and routing transit number. Do not use a deposit slip for verification, as the numbers may be displayed differently.

-

What happens if I make a mistake on the form?

If you make an error, it is important to correct it before submitting the form. Double-check all entries, especially the account and routing numbers, to avoid any issues with deposits.

-

Can I use this form for any bank account?

This form can be used for any bank account, provided that your financial institution accepts direct deposits. Always confirm with your bank to ensure compliance with their requirements.

-

What should I do after submitting the form?

After submitting the form, monitor your bank account to confirm that direct deposits are occurring as expected. If there are any issues, contact your employer or the organization responsible for the deposits.

Generic Direct Deposit Example

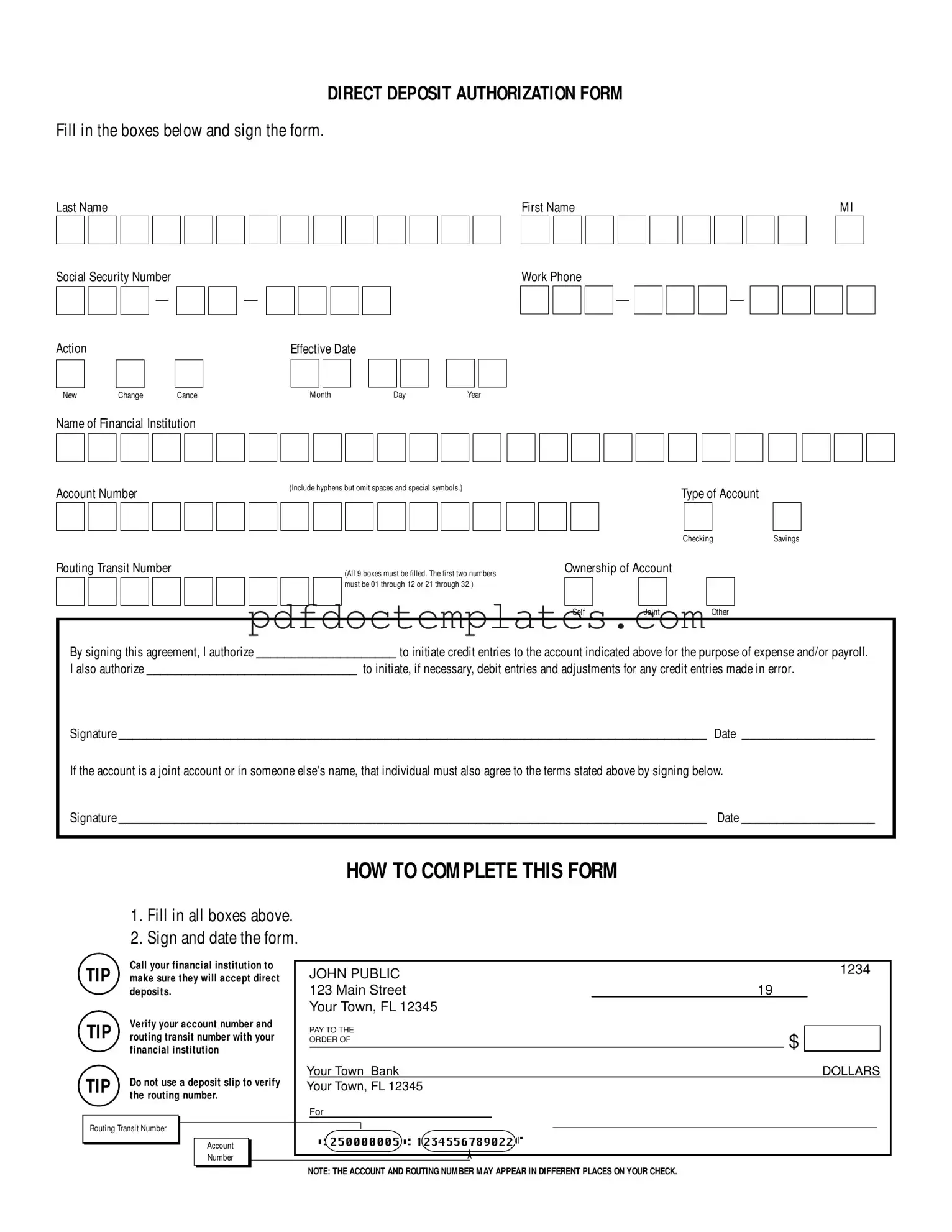

DIRECT DEPOSIT AUTHORIZATION FORM

Fill in the boxes below and sign the form.

Last NameFirst NameM I

□□□□□□□□□□□□□□ □□□□□□□□□

□

□

Social Security Number

□□□- □□

- □□□□

- □□□□

Action |

□ □ |

Effective Date |

□New |

□□ □□ □□ |

|

|

ChangeCancel |

M onthDayYear |

Work Phone

Name of Financial Institution

□□□□□□□□□□□□□□□□□□□□□□□□□□

Account Number |

(Include hyphens but omit spaces and special symbols.) |

Type of Account |

|

|

Savings |

||

|

|

Checking |

|

□□□□□□□□□□□□□□□□□ |

□ |

□ |

|

Routing Transit Number

□□□□□□□□□

(All 9 boxes must be filled. The first two numbers |

Ownership of Account |

|

|||

|

|

|

|

|

|

must be 01 through 12 or 21 through 32.) |

|

|

|

|

|

|

|

|

|

|

|

|

Self |

Joint |

Other |

||

|

□ |

□ |

□ |

||

By signing this agreement, I authorize ____________________ to initiate credit entries to the account indicated above for the purpose of expense and/or payroll.

I also authorize ______________________________ to initiate, if necessary, debit entries and adjustments for any credit entries made in error.

Signature ____________________________________________________________________________________ Date ___________________

If the account is a joint account or in someone else's name, that individual must also agree to the terms stated above by signing below.

Signature ____________________________________________________________________________________ Date ___________________

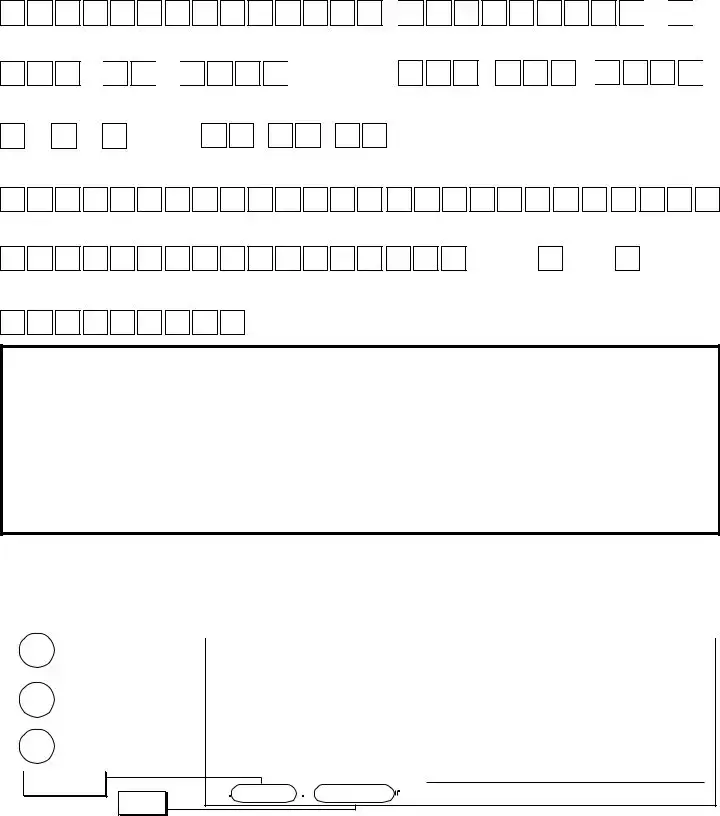

HOW TO COM PLETE THIS FORM

1.Fill in all boxes above.

2.Sign and date the form.

|

TIP |

Call your financial institution to |

|

JOHN PUBLIC |

1234 |

|

|||||

|

make sure they will accept direct |

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|||

0 deposit s. |

|

123 MAIN STREET |

19 |

|

|

|

|

||||

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|

|

TIP |

Verify your account number and |

|

PAY TO THE |

|

|

|

|

|

||

|

routing transit number with your |

|

ORDER OF |

|

|

|

|

|

|||

0 financial institution |

|

|

|

|

$ |

|

|

|

|||

|

|

|

|

|

|

||||||

YOUR TOWN BANK |

|

|

|

DOLLARS |

|||||||

|

TIP |

Do not use a deposit slip to verify |

|

|

|

|

|

|

|

|

|

|

YOUR TOWN, FL 12345 |

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

||||

|

0 the routing |

number. |

|

FOR |

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

IRouting Transit Number |

I |

|

➤ |

I |

Account |

l~::::::::,(~::250000005::)•:(~:=1234556789022~):..1·___________ J |

|

|

|

Number |

➤ |

NOTE: THE ACCOUNT AND ROUTING NUM BER M AY APPEAR IN DIFFERENT PLACES ON YOUR CHECK.

Consider More Forms

Navpers 1336 3 - Several recommended approvals are required from ranking officials.

For those looking to navigate the complexities of ownership transfer, understanding the specifics of a California Boat Bill of Sale document is crucial. This document not only formalizes the sale but also ensures all necessary information is documented clearly for both parties involved.

T-47 - The T-47 serves as proof for real estate agents during their transactions.