Printable Employee Loan Agreement Template

Misconceptions

Understanding the Employee Loan Agreement form is essential for both employers and employees. However, several misconceptions can lead to confusion and mismanagement. Here are six common misconceptions:

- It is not a legally binding document. Many people believe that an Employee Loan Agreement is merely a formality. In reality, this document serves as a legally binding contract, outlining the terms and conditions of the loan. Both parties are expected to adhere to these terms.

- Only large companies need an Employee Loan Agreement. Some assume that only large organizations require such agreements. However, any employer offering loans to employees, regardless of size, should have a written agreement to protect both parties and ensure clarity.

- All loans to employees are interest-free. A common belief is that loans provided to employees do not accrue interest. This is not always the case. Employers may choose to charge interest, and the terms should be clearly outlined in the agreement.

- Employee Loan Agreements are the same as payroll deductions. While payroll deductions may be a method of repayment, they are not synonymous with the loan agreement itself. The agreement should specify the repayment terms, including the method and schedule of deductions.

- Once signed, the terms cannot be changed. Some individuals think that once the agreement is signed, it is set in stone. In fact, the terms can be renegotiated if both parties agree to the changes, but this should be documented properly.

- There are no tax implications for the employer or employee. Many people overlook the potential tax implications associated with employee loans. Depending on the structure of the loan, both the employer and employee may have tax responsibilities that should be considered and discussed.

Addressing these misconceptions can lead to better understanding and management of Employee Loan Agreements, ultimately benefiting both employers and employees.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a contract between an employer and an employee outlining the terms under which the employer provides a loan to the employee. |

| Purpose | This agreement helps to clarify the responsibilities of both parties regarding repayment, interest rates, and any applicable fees. |

| Repayment Terms | Repayment terms usually specify the amount to be repaid, the repayment schedule, and the consequences of missed payments. |

| Interest Rates | Interest rates on employee loans can vary, and should be clearly stated in the agreement to avoid confusion. |

| Governing Law | The agreement should specify the governing law, which varies by state. For example, in California, it would be governed by California Civil Code. |

| Loan Amount | The total amount of the loan must be clearly indicated to ensure both parties are aware of the financial commitment. |

| Default Clause | A default clause outlines what happens if the employee fails to repay the loan as agreed, including potential legal actions. |

| Confidentiality | Confidentiality provisions can be included to protect the privacy of the employee's financial information. |

| Signature Requirement | Both the employer and employee must sign the agreement to make it legally binding, indicating their acceptance of the terms. |

Key takeaways

When filling out and using the Employee Loan Agreement form, it is important to consider several key points to ensure clarity and compliance.

- Accurate Information: Provide correct and complete details about both the employee and the employer. This includes names, addresses, and contact information.

- Loan Amount: Clearly state the total amount being loaned. This figure should be precise to avoid any misunderstandings.

- Repayment Terms: Outline the repayment schedule, including the frequency of payments and the duration of the loan. Specify any interest rates if applicable.

- Default Conditions: Include terms that define what constitutes a default on the loan. This may involve missed payments or failure to comply with the agreement.

- Signatures: Ensure that both the employee and an authorized representative of the employer sign the agreement. This confirms mutual consent to the terms.

- Record Keeping: Maintain a copy of the signed agreement for both parties. This serves as a reference in case of disputes or questions in the future.

By adhering to these guidelines, both parties can foster a transparent and professional relationship regarding the loan agreement.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is important to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Do provide accurate personal information, including your full name and contact details.

- Do clearly state the loan amount requested.

- Do specify the purpose of the loan, if required.

- Don't leave any required fields blank.

- Don't provide false information or misrepresent your financial situation.

- Don't forget to review the terms and conditions of the loan.

- Don't submit the form without your signature and date.

Common mistakes

-

Incomplete Information: One of the most common mistakes is not filling out all required fields. Ensure that every section is completed, including personal details, loan amount, and repayment terms.

-

Incorrect Loan Amount: Double-check the amount you are requesting. Errors can lead to confusion and delays in processing your application.

-

Ignoring Repayment Terms: Failing to clearly outline how and when the loan will be repaid can create misunderstandings later. Be specific about the repayment schedule.

-

Not Reviewing the Agreement: Skipping a thorough review of the entire document can result in overlooking important clauses. Take the time to read through every section.

-

Missing Signatures: Both the employee and the employer need to sign the agreement. Forgetting to include a signature can invalidate the document.

-

Using Unclear Language: Avoid vague terms and jargon. Clear language helps ensure that all parties understand the terms of the agreement.

-

Failing to Keep a Copy: After submitting the form, always retain a copy for your records. This can be crucial for future reference.

-

Not Seeking Clarification: If any part of the agreement is unclear, don’t hesitate to ask questions. Seeking clarification can prevent future disputes.

What You Should Know About This Form

-

What is an Employee Loan Agreement?

An Employee Loan Agreement is a formal document that outlines the terms and conditions under which an employer lends money to an employee. This agreement specifies the loan amount, repayment schedule, interest rates (if applicable), and any consequences for defaulting on the loan. It serves to protect both the employer's and the employee's interests.

-

Who is eligible to receive a loan under this agreement?

Typically, all employees who meet certain criteria set by the employer may be eligible for a loan. These criteria can include length of employment, job performance, and financial need. It is important for employees to check with their human resources department for specific eligibility requirements.

-

What are the common reasons employees might seek a loan?

Employees may seek a loan for various reasons, including unexpected medical expenses, home repairs, education costs, or other financial emergencies. The agreement provides a structured way for employees to obtain necessary funds while ensuring repayment terms are clear.

-

How is the repayment schedule structured?

The repayment schedule is typically outlined in the agreement and can vary based on the loan amount and the employee's financial situation. Repayments may be deducted directly from the employee's paycheck or made through other arrangements. The schedule will specify the frequency of payments, such as weekly or monthly, and the total duration of the loan.

-

Are there any interest rates associated with the loan?

Interest rates may or may not be applied to the loan, depending on the employer's policies. If interest is charged, the rate should be clearly stated in the agreement. Employees should understand how interest affects the total amount they will repay.

-

What happens if an employee cannot repay the loan?

If an employee is unable to repay the loan as agreed, the consequences will be detailed in the Employee Loan Agreement. Potential outcomes may include additional fees, wage garnishment, or other legal actions. It is advisable for employees facing repayment difficulties to communicate with their employer as soon as possible to discuss potential solutions.

-

Can an employee negotiate the terms of the loan?

Negotiating the terms of the loan is possible, but it depends on the employer's policies. Employees are encouraged to discuss their needs and concerns with their employer or HR department. Open communication may lead to a more favorable agreement for both parties.

-

Is the Employee Loan Agreement legally binding?

Yes, the Employee Loan Agreement is a legally binding document. Both parties must adhere to the terms outlined in the agreement. It is important for employees to read and understand the agreement fully before signing to ensure they are aware of their rights and obligations.

Employee Loan Agreement Example

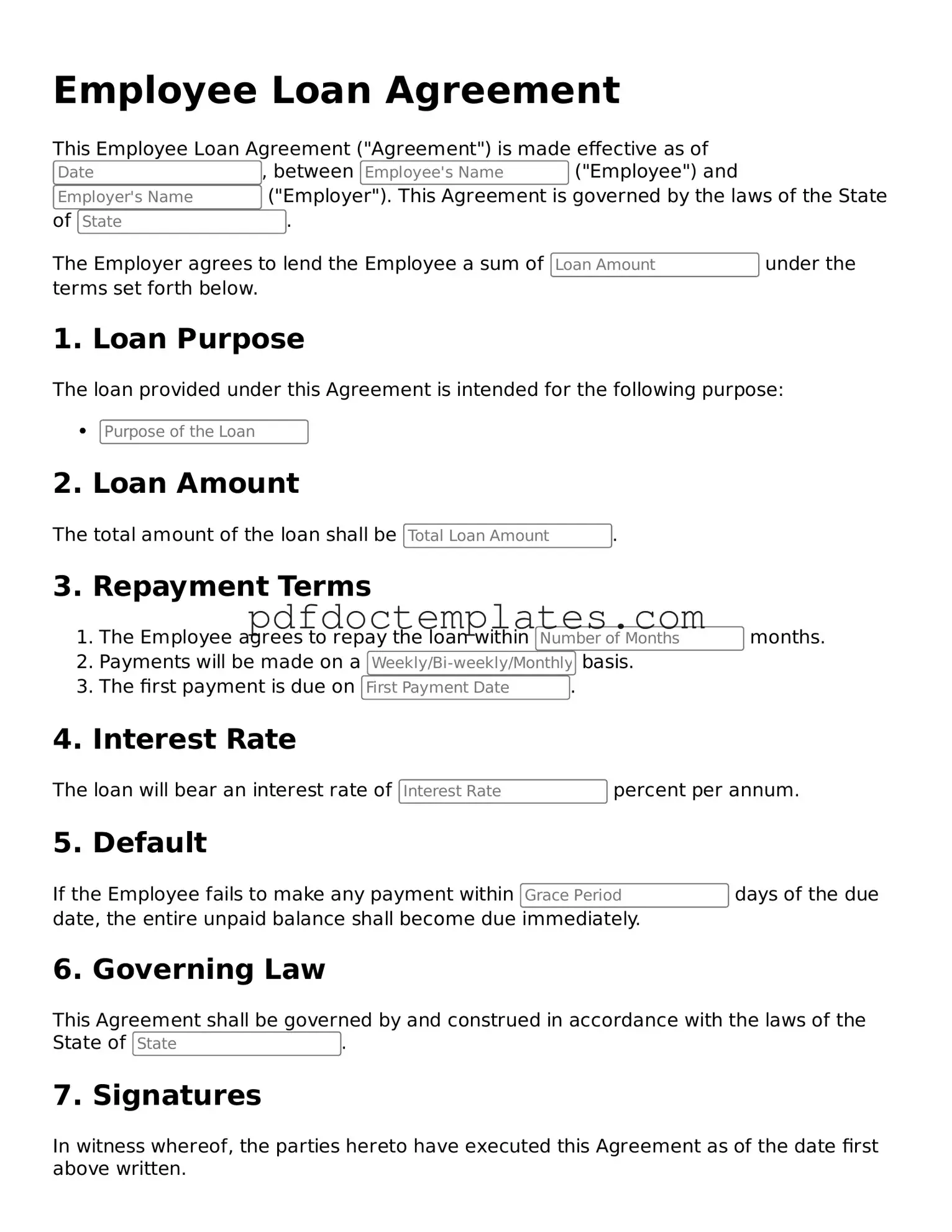

Employee Loan Agreement

This Employee Loan Agreement ("Agreement") is made effective as of , between ("Employee") and ("Employer"). This Agreement is governed by the laws of the State of .

The Employer agrees to lend the Employee a sum of under the terms set forth below.

1. Loan Purpose

The loan provided under this Agreement is intended for the following purpose:

2. Loan Amount

The total amount of the loan shall be .

3. Repayment Terms

- The Employee agrees to repay the loan within months.

- Payments will be made on a basis.

- The first payment is due on .

4. Interest Rate

The loan will bear an interest rate of percent per annum.

5. Default

If the Employee fails to make any payment within days of the due date, the entire unpaid balance shall become due immediately.

6. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of .

7. Signatures

In witness whereof, the parties hereto have executed this Agreement as of the date first above written.

Employer: __________________________ Employee: __________________________

Employer's Signature: __________________ Employee's Signature: __________________

Date: _________________________________ Date: _________________________________