Download Employee Advance Template

Misconceptions

Here are some common misconceptions about the Employee Advance form, along with clarifications for each:

- Only full-time employees can request an advance. Part-time employees may also be eligible for an advance, depending on company policy.

- Advances are loans that must be repaid with interest. Employee advances typically do not incur interest, but they do need to be repaid through payroll deductions.

- The form is only for emergencies. While many use it for emergencies, advances can be requested for various reasons, such as travel expenses or unexpected bills.

- Submitting the form guarantees approval. Approval is based on company policy and individual circumstances. Not all requests will be granted.

- There is no limit to how much can be requested. There are usually limits set by the employer on the amount that can be advanced.

- The process is quick and does not require documentation. Depending on the situation, supporting documentation may be needed, and processing times can vary.

- Once the form is submitted, no further communication is needed. Employees should follow up if they do not receive confirmation or if there are questions regarding their request.

- Advances can be requested at any time without restrictions. Some companies have specific times or conditions under which advances can be requested.

- All advances are treated the same regardless of the reason. Different types of requests may be evaluated differently based on the company's criteria.

Understanding these misconceptions can help employees navigate the Employee Advance process more effectively.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Employee Advance form is used to request funds in advance of expected expenses related to work duties. |

| Eligibility | Typically, only full-time employees may submit an Employee Advance request, subject to company policy. |

| Repayment Terms | Employees must agree to repay the advance through payroll deductions or other agreed-upon methods. |

| Documentation | Supporting documentation for the anticipated expenses must be provided alongside the form. |

| Approval Process | The form usually requires approval from a supervisor or manager before funds are disbursed. |

| State-Specific Regulations | In some states, such as California, specific labor laws govern the advance of wages and deductions. |

| Tax Implications | Advances may have tax implications, and employees should consult with a tax professional for guidance. |

| Company Policy | Each company may have its own policy regarding the issuance of employee advances, which should be reviewed before submission. |

Key takeaways

Filling out the Employee Advance form correctly is essential for ensuring a smooth process. Here are some key takeaways to keep in mind:

- Complete all required fields to avoid delays in processing your advance request.

- Provide a clear and detailed description of the purpose of the advance.

- Attach any necessary documentation that supports your request, such as receipts or estimates.

- Submit the form well in advance of when you need the funds to allow for processing time.

- Keep a copy of the completed form for your records and future reference.

- Review your company’s policy on employee advances to ensure compliance with all guidelines.

- Contact your supervisor or the finance department if you have any questions about the process.

By following these steps, you can help ensure that your request is handled efficiently and effectively.

Dos and Don'ts

When filling out the Employee Advance form, it's important to follow certain guidelines to ensure a smooth process. Here’s a list of things you should and shouldn’t do:

- Do double-check all personal information for accuracy.

- Do provide a clear and specific reason for the advance.

- Do keep a copy of the form for your records.

- Do submit the form to the correct department or supervisor.

- Don’t leave any required fields blank.

- Don’t provide vague or unclear explanations for the advance.

Following these guidelines will help ensure your request is processed efficiently and without unnecessary delays.

Common mistakes

-

Incomplete Information: Many individuals forget to fill out all required fields. Missing details can delay the approval process or lead to outright rejection.

-

Incorrect Amounts: Double-checking the requested advance amount is crucial. A simple error can lead to financial discrepancies.

-

Failure to Provide Justification: Employees often neglect to explain why they need the advance. A clear justification helps decision-makers understand the request better.

-

Not Following Company Policy: Each organization has specific guidelines for advances. Ignoring these can result in the form being rejected.

-

Missing Signatures: Forgetting to sign the form or obtain necessary approvals is a common oversight. Signatures are often required to validate the request.

-

Submitting at the Wrong Time: Timing matters. Submitting the form too late can lead to missed opportunities for financial assistance.

-

Not Keeping a Copy: Failing to retain a copy of the submitted form can be problematic. Having a record helps track the status of the request.

-

Ignoring Deadlines: Each company typically sets deadlines for submitting advance requests. Missing these can result in automatic denial.

-

Assuming Approval: Some individuals mistakenly assume their request will be approved without proper review. Always be prepared for a potential denial and understand the reasons behind it.

What You Should Know About This Form

-

What is the Employee Advance form?

The Employee Advance form is a document that allows employees to request an advance on their salary or wages. This can help employees manage unexpected expenses or financial emergencies before their regular paycheck is issued.

-

Who is eligible to request an advance?

Generally, all employees who have been with the company for a specified period are eligible to request an advance. However, eligibility may vary based on company policy. It is important to review your company’s specific guidelines regarding eligibility.

-

How do I fill out the Employee Advance form?

To complete the form, provide your personal information, including your name, employee ID, and department. Clearly state the amount you wish to request and the reason for the advance. Ensure that you sign and date the form before submission.

-

What information do I need to provide?

You will need to include your contact information, the amount of the advance requested, and a brief explanation of why the advance is needed. Providing accurate and complete information will help expedite the approval process.

-

How long does it take to process the request?

The processing time for an Employee Advance request can vary. Typically, it takes a few business days for the request to be reviewed and approved. If additional information is required, this may extend the processing time.

-

Will I have to repay the advance?

Yes, the advance will usually be deducted from your future paychecks. The repayment terms will be outlined when your request is approved. Be sure to understand these terms before accepting the advance.

-

What happens if my request is denied?

If your request is denied, you will receive a notification explaining the reason for the denial. You may have the option to appeal the decision or submit a new request with additional information, depending on your company’s policy.

-

Can I request an advance more than once?

Yes, you may be able to request multiple advances, but this will depend on your company’s policy. Repeated requests may require additional justification, and it is advisable to check with your HR department for specific guidelines.

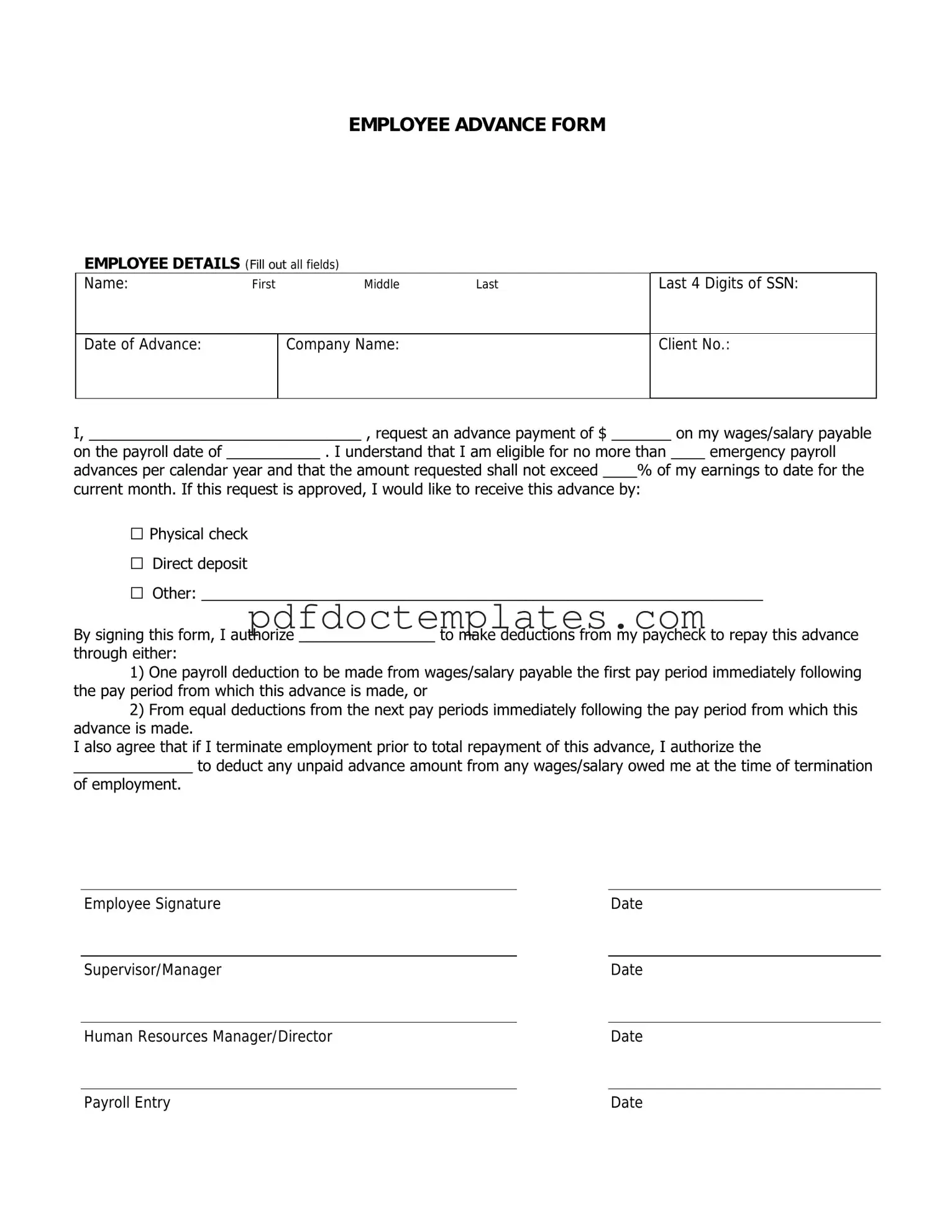

Employee Advance Example

EMPLOYEE ADVANCE FORM

EMPLOYEE DETAILS (Fill out all fields)

Name: |

First |

Middle |

Last |

|

|

|

|

Date of Advance: |

|

Company Name: |

|

|

|

|

|

Last 4 Digits of SSN:

Client No.:

I, ________________________________ , request an advance payment of $ _______ on my wages/salary payable

on the payroll date of ___________ . I understand that I am eligible for no more than ____ emergency payroll

advances per calendar year and that the amount requested shall not exceed ____% of my earnings to date for the

current month. If this request is approved, I would like to receive this advance by:

□Physical check

□Direct deposit

□Other: __________________________________________________________________

By signing this form, I authorize ________________ to make deductions from my paycheck to repay this advance

through either:

1)One payroll deduction to be made from wages/salary payable the first pay period immediately following the pay period from which this advance is made, or

2)From equal deductions from the next pay periods immediately following the pay period from which this advance is made.

I also agree that if I terminate employment prior to total repayment of this advance, I authorize the

______________ to deduct any unpaid advance amount from any wages/salary owed me at the time of termination of employment.

Employee Signature |

|

Date |

|

|

|

Supervisor/Manager |

|

Date |

|

|

|

Human Resources Manager/Director |

|

Date |

Payroll Entry |

Date |

Consider More Forms

Consolation Bracket - Players can showcase their skills and sportsmanship in every match.

One effective way to ensure clarity in your rental process is by utilizing the Florida Residential Lease Agreement form, which you can find on All Florida Forms. This form helps outline the essential terms and conditions between landlords and tenants, safeguarding the rights of both parties and minimizing misunderstandings.

Who Can Write Esa Letters - Secure a written statement confirming your emotional support animal's importance to your mental health.