Printable Durable Power of Attorney Template

Durable Power of Attorney - Customized for State

Misconceptions

Many people have misunderstandings about the Durable Power of Attorney (DPOA) form. Here are six common misconceptions, along with explanations to clarify them.

- A Durable Power of Attorney is only for older adults. This is not true. Anyone can create a DPOA, regardless of age. It is a useful tool for anyone who wants to plan for future incapacity.

- The DPOA gives unlimited power to the agent. This is a misconception. The authority granted to the agent can be limited to specific tasks or decisions. The principal can define what powers the agent has.

- A Durable Power of Attorney is the same as a living will. This is incorrect. A DPOA allows someone to make financial or legal decisions on your behalf, while a living will focuses on medical decisions and end-of-life care.

- The DPOA is effective only when the principal is incapacitated. This is misleading. A DPOA can be effective immediately upon signing or can be set to activate only when the principal becomes incapacitated, depending on how it is drafted.

- You cannot revoke a Durable Power of Attorney. This is false. A principal can revoke a DPOA at any time as long as they are mentally competent. It is important to follow the proper steps to ensure the revocation is valid.

- All Durable Power of Attorney forms are the same. This is not accurate. DPOA forms can vary by state and can be tailored to fit individual needs. It is important to use a form that complies with state laws.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney is a legal document that allows a person to appoint someone else to manage their financial and legal affairs, even if they become incapacitated. |

| Durability | This type of power of attorney remains effective even after the person who created it becomes unable to make decisions due to illness or disability. |

| Appointee's Authority | The person designated as the agent has the authority to make decisions regarding finances, property, and other legal matters on behalf of the principal. |

| State-Specific Requirements | Each state has its own requirements for creating a Durable Power of Attorney, including witnessing and notarization rules. For example, in California, the governing law is the California Probate Code. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

| Importance of Choosing an Agent | It is crucial to choose a trustworthy agent, as they will have significant control over financial and legal decisions. The relationship should be based on mutual respect and understanding. |

Key takeaways

When filling out and using a Durable Power of Attorney form, several important considerations should be kept in mind:

- Understand the Purpose: A Durable Power of Attorney allows an individual to designate someone else to make decisions on their behalf, particularly in financial or legal matters, if they become incapacitated.

- Choose the Right Agent: Selecting a trustworthy and competent agent is crucial. This person will have significant authority and responsibility over your affairs.

- Specify Powers Clearly: Clearly outline the powers granted to the agent. This can include managing bank accounts, selling property, or making healthcare decisions, depending on your needs.

- Review and Update Regularly: Regularly reviewing the document ensures that it reflects current wishes and circumstances. Changes in relationships or health may necessitate updates.

Dos and Don'ts

When filling out a Durable Power of Attorney form, certain practices can help ensure that the document is valid and effective. Below are six important dos and don'ts to consider.

- Do choose a trustworthy agent. Select someone who will act in your best interest.

- Do clearly specify the powers granted. Be explicit about what decisions your agent can make.

- Do sign the document in the presence of a notary. This adds an extra layer of legitimacy.

- Do discuss your wishes with your agent. Ensure they understand your preferences and intentions.

- Don't leave the form incomplete. Every section should be filled out to avoid confusion later.

- Don't use vague language. Ambiguity can lead to misinterpretation of your wishes.

Common mistakes

-

Not selecting the right agent: It is crucial to choose someone trustworthy and capable. Many people select family members or friends without considering their ability to handle financial or medical decisions effectively.

-

Leaving out specific powers: Some individuals fail to specify the powers they wish to grant. This can lead to confusion and limit the agent's ability to act in your best interest.

-

Not signing the document: A Durable Power of Attorney is not valid unless it is signed by the principal. Some forget this essential step, rendering the document useless.

-

Ignoring state requirements: Each state has its own laws regarding Durable Power of Attorney forms. Failing to follow these regulations can invalidate the document.

-

Not including alternate agents: Designating only one agent without a backup can create issues if that person is unavailable or unwilling to serve. It is wise to name an alternate.

-

Forgetting to date the form: A Durable Power of Attorney should always be dated. Without a date, questions may arise about its validity and when the powers were intended to begin.

-

Failing to notify the agent: It is important to inform the chosen agent that they have been designated. Many people neglect this step, which can lead to confusion when the time comes for them to act.

-

Not reviewing the document regularly: Life circumstances change. Failing to review and update the Durable Power of Attorney can lead to outdated information or an agent who is no longer appropriate.

-

Overlooking witness and notarization requirements: Some states require witnesses or notarization for the document to be valid. Ignoring these requirements can invalidate the entire form.

What You Should Know About This Form

-

What is a Durable Power of Attorney?

A Durable Power of Attorney (DPOA) is a legal document that allows an individual, known as the principal, to appoint someone else, referred to as the agent or attorney-in-fact, to make decisions on their behalf. This authority remains effective even if the principal becomes incapacitated. It can cover a wide range of decisions, including financial matters, healthcare, and property management.

-

Why is a Durable Power of Attorney important?

This document is crucial because it ensures that someone the principal trusts can manage their affairs if they are unable to do so themselves. Without a DPOA, family members may face legal challenges and delays in accessing the principal's accounts or making healthcare decisions, which can lead to unnecessary stress during difficult times.

-

Who can be appointed as an agent in a Durable Power of Attorney?

Generally, any competent adult can be appointed as an agent. This could be a family member, friend, or professional advisor. It is essential to choose someone who is trustworthy, understands the principal's values, and is willing to take on the responsibilities involved.

-

Can a Durable Power of Attorney be revoked?

Yes, a principal can revoke a Durable Power of Attorney at any time, as long as they are mentally competent. The revocation should be done in writing and communicated to the agent and any relevant institutions. Once revoked, the agent no longer has authority to act on behalf of the principal.

-

What happens if the principal becomes incapacitated without a Durable Power of Attorney?

If a principal becomes incapacitated and does not have a DPOA in place, family members may need to go through a court process to obtain guardianship or conservatorship. This process can be time-consuming, costly, and may not reflect the principal’s wishes.

-

Is a Durable Power of Attorney the same as a regular Power of Attorney?

No, a regular Power of Attorney typically becomes invalid if the principal becomes incapacitated. In contrast, a Durable Power of Attorney remains in effect during incapacity. This distinction is vital for ensuring that the agent can continue to act on the principal's behalf when they are no longer able to do so themselves.

-

How can one create a Durable Power of Attorney?

Creating a Durable Power of Attorney usually involves filling out a state-specific form, which can often be obtained online or through legal professionals. The principal must sign the document in the presence of a notary public or witnesses, depending on state laws. It is advisable to consult with an attorney to ensure that the document meets all legal requirements and accurately reflects the principal's wishes.

Durable Power of Attorney Example

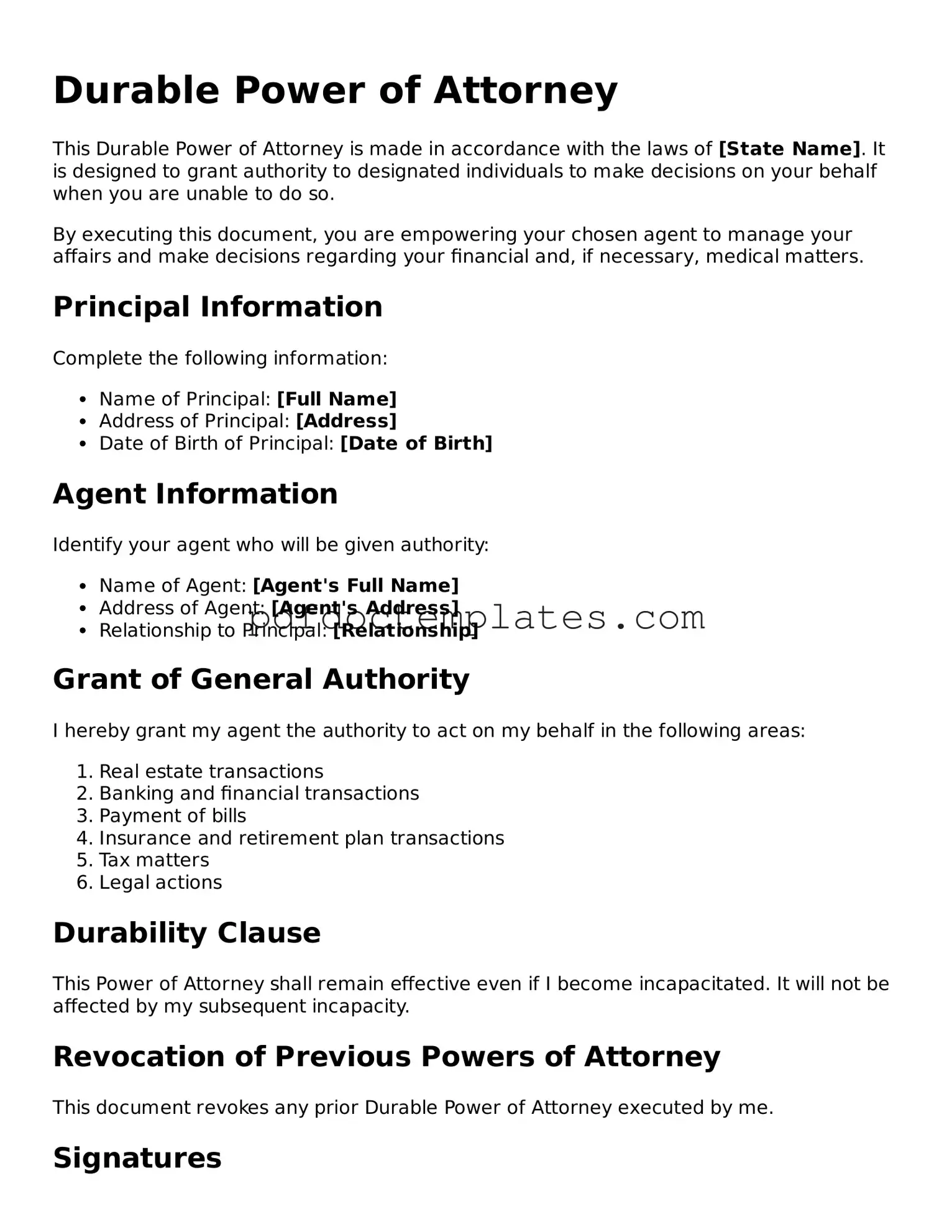

Durable Power of Attorney

This Durable Power of Attorney is made in accordance with the laws of [State Name]. It is designed to grant authority to designated individuals to make decisions on your behalf when you are unable to do so.

By executing this document, you are empowering your chosen agent to manage your affairs and make decisions regarding your financial and, if necessary, medical matters.

Principal Information

Complete the following information:

- Name of Principal: [Full Name]

- Address of Principal: [Address]

- Date of Birth of Principal: [Date of Birth]

Agent Information

Identify your agent who will be given authority:

- Name of Agent: [Agent's Full Name]

- Address of Agent: [Agent's Address]

- Relationship to Principal: [Relationship]

Grant of General Authority

I hereby grant my agent the authority to act on my behalf in the following areas:

- Real estate transactions

- Banking and financial transactions

- Payment of bills

- Insurance and retirement plan transactions

- Tax matters

- Legal actions

Durability Clause

This Power of Attorney shall remain effective even if I become incapacitated. It will not be affected by my subsequent incapacity.

Revocation of Previous Powers of Attorney

This document revokes any prior Durable Power of Attorney executed by me.

Signatures

Please sign and date below:

- Signature of Principal: [Signature]

- Date: [Date]

Notarization

This Durable Power of Attorney must be notarized to ensure its validity.

- Notary Public: [Name]

- Commission Expires: [Expiration Date]

Different Types of Durable Power of Attorney Forms:

Revoke Power of Attorney Form California - This document can help protect vulnerable individuals from exploitation.

For those looking to ensure a smooth transfer of canine ownership, the essential California Dog Bill of Sale form is invaluable. This document safeguards the interests of both the seller and the buyer, making it crucial for a successful transaction. For more information, visit the California Dog Bill of Sale guide.