Printable Deed in Lieu of Foreclosure Template

Deed in Lieu of Foreclosure - Customized for State

Misconceptions

There are several misconceptions surrounding the Deed in Lieu of Foreclosure form. Understanding these can help homeowners make informed decisions. Here are six common misconceptions:

- It's the same as foreclosure. Many believe a Deed in Lieu of Foreclosure is just another name for foreclosure. In reality, it's a voluntary agreement where the homeowner transfers the property to the lender to avoid the lengthy foreclosure process.

- It eliminates all debt. Some think that signing a Deed in Lieu of Foreclosure wipes out all their mortgage debt. However, if there is a remaining balance after the property is sold, the lender may still pursue the borrower for that amount unless otherwise agreed upon.

- It has no impact on credit scores. Many assume that a Deed in Lieu of Foreclosure will not affect their credit. In fact, it can significantly impact credit scores, similar to a foreclosure, and may remain on the credit report for several years.

- It's a quick solution. Some homeowners believe that a Deed in Lieu of Foreclosure is a fast way to resolve their financial issues. While it can be quicker than foreclosure, the process still requires time for negotiations and approvals from the lender.

- All lenders accept it. Many think that every lender is open to a Deed in Lieu of Foreclosure. In reality, not all lenders offer this option, and acceptance can depend on the lender's policies and the borrower's specific situation.

- It absolves you of all legal responsibilities. Some homeowners think that once they sign the Deed in Lieu of Foreclosure, they are free from all obligations. However, legal responsibilities, such as property taxes or homeowner association fees, may still apply until the property is officially transferred.

Understanding these misconceptions can help homeowners navigate their options more effectively. Always consult with a financial advisor or legal expert before making decisions related to property and debt.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is an agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure proceedings. |

| Benefits | This process can help borrowers avoid the lengthy and costly foreclosure process, and it may have less impact on their credit score compared to a foreclosure. |

| Governing Laws | The specific laws governing Deeds in Lieu of Foreclosure vary by state. For example, in California, it is governed by California Civil Code Section 2943. |

| Requirements | Typically, lenders require that the borrower be in default and that the property is free of liens other than the mortgage being addressed. |

Key takeaways

When considering a Deed in Lieu of Foreclosure, it's important to understand the implications and steps involved. Here are some key takeaways to keep in mind:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer the property title to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require you to be in financial distress and unable to keep up with mortgage payments.

- Consult with Professionals: Before proceeding, it’s wise to consult with a real estate attorney or financial advisor. They can provide guidance tailored to your situation.

- Gather Necessary Documentation: Prepare to provide financial documents, such as income statements, tax returns, and details about your debts.

- Communicate with Your Lender: Open a dialogue with your lender. They can explain their process and what they require from you.

- Understand the Impact on Credit: While a Deed in Lieu of Foreclosure is less damaging than a foreclosure, it will still affect your credit score.

- Consider Tax Implications: There may be tax consequences associated with the forgiveness of any remaining mortgage debt. Consulting a tax professional can clarify this.

- Obtain a Release of Liability: Ensure that the agreement includes a release of liability for any remaining debt on the mortgage, if applicable.

By keeping these points in mind, you can navigate the process more effectively and make informed decisions regarding your property and financial future.

Dos and Don'ts

When considering a Deed in Lieu of Foreclosure, it is crucial to approach the process with care. Below is a list of important dos and don’ts to keep in mind while filling out the form.

- Do consult with a legal professional to understand your rights and obligations.

- Do ensure that all personal information is accurate and complete.

- Do review your mortgage documents to confirm that you are eligible for this option.

- Do communicate openly with your lender about your situation.

- Do keep copies of all documents submitted for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't ignore any potential tax implications of the deed.

- Don't assume that the lender will automatically accept the deed.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't overlook the importance of understanding the impact on your credit score.

Common mistakes

-

Not Reading the Entire Form: Many people rush through the form without fully understanding each section. This can lead to mistakes that could have been easily avoided.

-

Incorrect Property Description: Failing to provide an accurate description of the property can cause delays or even invalidate the deed. Always double-check the legal description.

-

Missing Signatures: Some individuals forget to sign the document or overlook the need for a witness or notary. Each signature is crucial for the form's validity.

-

Not Including All Required Information: Omitting necessary details, such as the lender's information or the borrower's current address, can lead to complications later on.

-

Ignoring Local Laws: Each state has specific requirements for a deed in lieu of foreclosure. Failing to comply with these can render the deed ineffective.

-

Assuming the Lender Will Accept It: Some people mistakenly think that submitting the deed guarantees acceptance by the lender. It's essential to confirm acceptance before proceeding.

-

Not Seeking Legal Advice: Many individuals fill out the form without consulting a legal professional. This oversight can lead to significant issues down the line.

What You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers ownership of their property to the lender to avoid foreclosure. This option is often considered when the homeowner can no longer afford their mortgage payments and wants to mitigate the negative impact of foreclosure on their credit score.

-

How does a Deed in Lieu of Foreclosure work?

The process begins when the homeowner contacts their lender to express interest in a Deed in Lieu of Foreclosure. The lender will typically require a review of the homeowner's financial situation. If approved, the homeowner signs the deed, transferring the property to the lender. In return, the lender may forgive the remaining mortgage debt, although this can vary based on the agreement.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

- It can help avoid the lengthy and stressful foreclosure process.

- The homeowner may have a less severe impact on their credit score compared to a foreclosure.

- It allows the homeowner to walk away from the property without owing additional debt.

-

Are there any drawbacks to a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential drawbacks. The homeowner may still face tax implications, as forgiven debt can sometimes be considered taxable income. Additionally, not all lenders accept Deeds in Lieu of Foreclosure, and the homeowner may need to provide extensive documentation to qualify.

-

Who is eligible for a Deed in Lieu of Foreclosure?

Eligibility typically includes homeowners who are facing financial hardship and are unable to keep up with mortgage payments. Lenders usually assess the homeowner's financial situation, including income, expenses, and the value of the property, to determine eligibility. It’s important for homeowners to communicate openly with their lender during this process.

-

What should a homeowner do before pursuing a Deed in Lieu of Foreclosure?

Homeowners should first explore all available options, including loan modifications or repayment plans. It is also advisable to consult with a financial advisor or a housing counselor to understand the implications of a Deed in Lieu of Foreclosure. Gathering all necessary financial documents in advance can streamline the process with the lender.

-

Can a Deed in Lieu of Foreclosure affect my credit score?

Yes, a Deed in Lieu of Foreclosure can affect your credit score, but generally less severely than a foreclosure. While it will still be noted on your credit report, the impact may be less damaging in the long run. The exact effect on your credit score will depend on various factors, including your overall credit history.

-

What happens to the homeowner's belongings after a Deed in Lieu of Foreclosure?

Once the Deed in Lieu of Foreclosure is finalized, the homeowner is expected to vacate the property. It is advisable to remove personal belongings before the transfer of ownership occurs. Homeowners should coordinate with the lender to understand any specific timelines or requirements related to vacating the property.

Deed in Lieu of Foreclosure Example

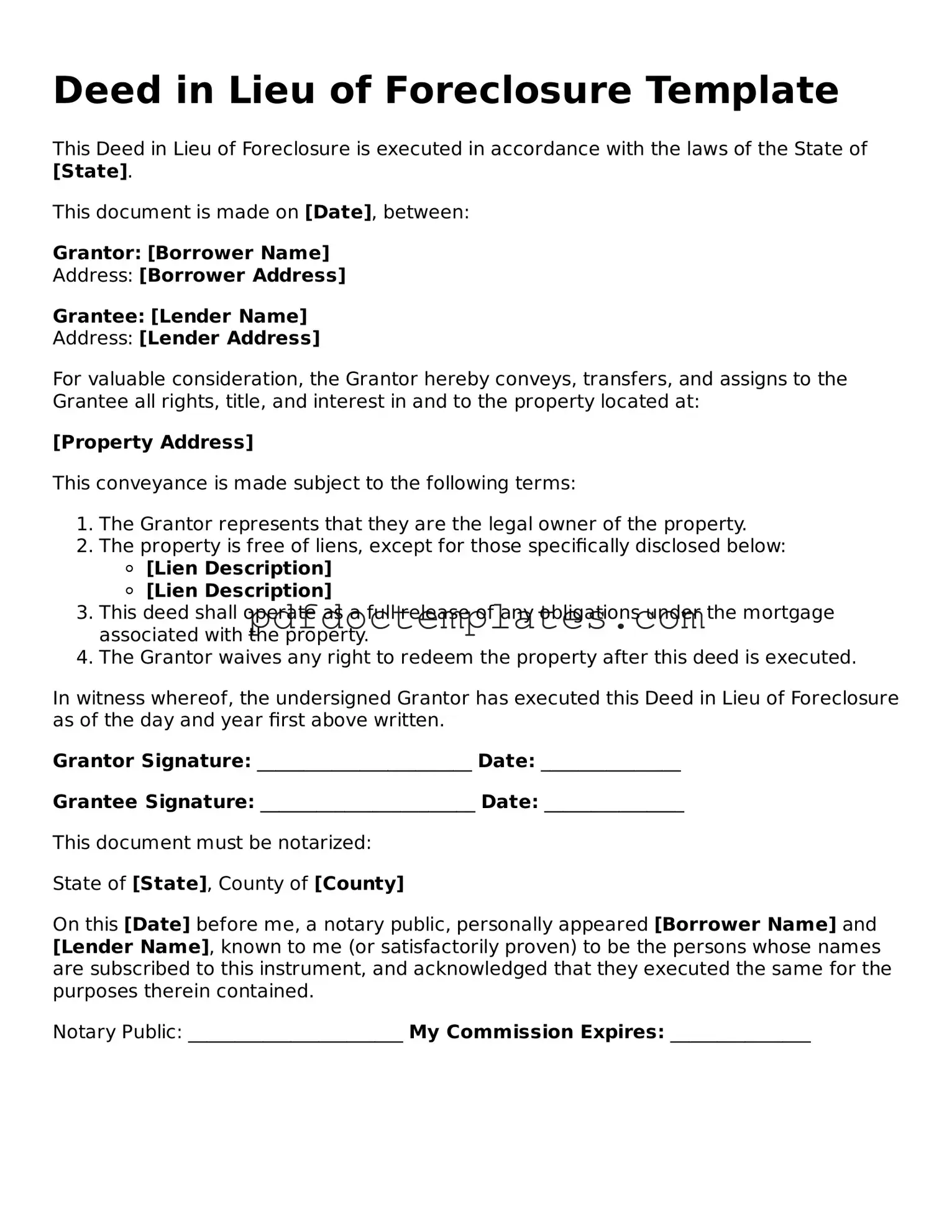

Deed in Lieu of Foreclosure Template

This Deed in Lieu of Foreclosure is executed in accordance with the laws of the State of [State].

This document is made on [Date], between:

Grantor: [Borrower Name]

Address: [Borrower Address]

Grantee: [Lender Name]

Address: [Lender Address]

For valuable consideration, the Grantor hereby conveys, transfers, and assigns to the Grantee all rights, title, and interest in and to the property located at:

[Property Address]

This conveyance is made subject to the following terms:

- The Grantor represents that they are the legal owner of the property.

- The property is free of liens, except for those specifically disclosed below:

- [Lien Description]

- [Lien Description]

- This deed shall operate as a full release of any obligations under the mortgage associated with the property.

- The Grantor waives any right to redeem the property after this deed is executed.

In witness whereof, the undersigned Grantor has executed this Deed in Lieu of Foreclosure as of the day and year first above written.

Grantor Signature: _______________________ Date: _______________

Grantee Signature: _______________________ Date: _______________

This document must be notarized:

State of [State], County of [County]

On this [Date] before me, a notary public, personally appeared [Borrower Name] and [Lender Name], known to me (or satisfactorily proven) to be the persons whose names are subscribed to this instrument, and acknowledged that they executed the same for the purposes therein contained.

Notary Public: _______________________ My Commission Expires: _______________

Different Types of Deed in Lieu of Foreclosure Forms:

Where Can I Get a Quit Claim Deed Form - When ownership is not contested, a quitclaim deed is a straightforward option for transferring property.

The New York Articles of Incorporation form is essential for anyone looking to establish a corporation in New York, serving as a foundational legal document that outlines the necessary details for official registration. To ensure compliance and avoid any ambiguities, it’s vital to use a comprehensive template, such as the one available at All New York Forms, which guides users through the required information including the corporation's name, purpose, office address, and incorporator details.

Does California Have a Transfer on Death Deed - This deed does not impact your property taxes while you are alive.