Printable Corrective Deed Template

Misconceptions

Understanding the Corrective Deed form is crucial for property owners and those involved in real estate transactions. However, several misconceptions often cloud its purpose and usage. Below is a list of common misunderstandings surrounding this important legal document.

- It is only for correcting typos. Many believe that a Corrective Deed is solely for fixing minor errors, such as spelling mistakes. In reality, it can address more significant issues like incorrect legal descriptions or the omission of a grantor or grantee.

- It can change ownership. Some think that a Corrective Deed can alter the ownership of the property. However, this form is designed to clarify existing ownership, not to transfer or change it.

- It requires court approval. There is a misconception that all Corrective Deeds must be approved by a court. In most cases, this is not necessary, as the deed can be executed and recorded without judicial intervention.

- It is the same as a Quitclaim Deed. While both documents involve property transfers, a Corrective Deed serves a different purpose. It corrects errors in an existing deed rather than transferring new interests in the property.

- Only attorneys can prepare a Corrective Deed. Some believe that only legal professionals can draft this form. In fact, property owners can prepare it themselves, provided they follow the necessary guidelines and requirements.

- It is not necessary if the error is minor. There is a notion that small mistakes do not warrant a Corrective Deed. However, even minor errors can lead to complications in the future, making it prudent to correct them promptly.

- It can be used to fix any type of deed. Some individuals assume that a Corrective Deed can rectify issues in any deed. However, it is specifically intended for correcting errors in previously executed deeds, not for altering other types of legal documents.

- Once filed, it cannot be revoked. Many people think that a Corrective Deed, once recorded, is permanent and cannot be undone. In truth, if errors persist or new issues arise, further corrective actions can be taken to amend the record.

Being aware of these misconceptions can help property owners navigate the complexities of real estate transactions more effectively. Proper understanding ensures that the Corrective Deed serves its intended purpose, safeguarding ownership rights and clarifying property records.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | A Corrective Deed is used to fix errors in a previously recorded deed. |

| Common Errors | It addresses mistakes such as misspellings, incorrect property descriptions, or wrong names. |

| Governing Law | Each state has its own laws regarding corrective deeds. For example, in California, it falls under the California Civil Code. |

| Parties Involved | The grantor (the person correcting the deed) and the grantee (the person receiving the property) must both sign the form. |

| Recording Requirement | The Corrective Deed must be recorded with the county recorder's office to be effective. |

| Effect on Title | Once recorded, it clarifies the title and resolves any issues caused by the original deed. |

| Legal Advice | It is often recommended to seek legal advice before filing a Corrective Deed. |

| Notarization | Most states require the Corrective Deed to be notarized before it can be recorded. |

| Time Frame | There is typically no time limit to file a Corrective Deed, but it is best done promptly after discovering an error. |

Key takeaways

When filling out and using the Corrective Deed form, it is important to keep the following key takeaways in mind:

- Ensure that all parties involved are accurately identified. This includes the current owners and any individuals who may have an interest in the property.

- Double-check the legal description of the property. A precise description helps avoid future disputes and confusion.

- Use clear and concise language throughout the form. Ambiguities can lead to complications during the execution process.

- Signatures must be obtained from all parties involved. Without the necessary signatures, the deed may not be legally binding.

- Consider having the deed notarized. Notarization adds an extra layer of authenticity and can help ensure the document is accepted by relevant authorities.

- File the Corrective Deed with the appropriate local government office. This step is crucial for public record and property title updates.

- Keep copies of the completed form for personal records. Having documentation can be beneficial for future reference or legal matters.

By following these guidelines, you can navigate the process of using the Corrective Deed form with greater confidence and clarity.

Dos and Don'ts

When filling out a Corrective Deed form, it's essential to approach the process carefully. Here are some key do's and don'ts to consider:

- Do double-check the information you are correcting. Ensure that all details are accurate.

- Do clearly state the reason for the correction. This helps clarify the intent behind the changes.

- Do sign the form in the presence of a notary. This adds an extra layer of validity to your document.

- Do keep a copy of the completed form for your records. This can be useful for future reference.

- Do file the form with the appropriate county office. Make sure you know where to submit it.

- Don't rush through the form. Take your time to avoid mistakes that could complicate the process.

- Don't leave any sections blank. Each part of the form needs to be filled out completely.

- Don't use incorrect terminology. Stick to the language used in the form to prevent confusion.

- Don't forget to check local requirements. Different states may have specific rules regarding corrective deeds.

- Don't ignore deadlines. Ensure you submit the form within any time limits set by your local laws.

Common mistakes

When filling out a Corrective Deed form, it is essential to be meticulous and thorough. Even minor errors can lead to complications in property ownership or legal disputes. Below are some common mistakes that individuals often make:

-

Incorrect Names: One of the most frequent errors involves misspelling names or using the wrong legal names. It is crucial to ensure that all names are spelled correctly and match those on the original deed.

-

Missing Signatures: Failing to obtain all necessary signatures can render the deed invalid. Every party involved must sign the document to ensure its legality.

-

Inaccurate Property Descriptions: A precise description of the property is vital. Errors in the legal description can lead to confusion about what property is being corrected.

-

Not Including the Original Deed: Some individuals forget to attach the original deed that is being corrected. This attachment is often required for the corrective deed to be processed.

-

Improper Notarization: Not having the document properly notarized can cause issues. A notary public must witness the signing of the document to validate it.

-

Neglecting to Check Local Requirements: Each jurisdiction may have specific requirements for corrective deeds. Failing to adhere to these local regulations can delay the process or invalidate the deed.

-

Overlooking Filing Deadlines: Many people forget that there are deadlines for filing corrective deeds. Missing these deadlines can complicate matters further and may require additional legal steps.

Being aware of these common mistakes can help ensure that your Corrective Deed form is completed accurately and efficiently. Taking the time to review each section carefully can save you from future headaches.

What You Should Know About This Form

-

What is a Corrective Deed?

A Corrective Deed is a legal document used to amend or correct an existing deed. This document is particularly useful when there are errors or omissions in the original deed that could affect ownership rights or property descriptions. It serves to clarify the intent of the parties involved and ensures that the public record accurately reflects the true ownership and terms of the property transfer.

-

When should I use a Corrective Deed?

You should consider using a Corrective Deed if you discover mistakes in the original deed after it has been recorded. Common issues include misspelled names, incorrect property descriptions, or errors in the legal description of the property. By addressing these issues promptly with a Corrective Deed, you can prevent future disputes or complications regarding ownership.

-

How do I prepare a Corrective Deed?

Preparing a Corrective Deed involves several steps. First, identify the specific errors in the original deed. Next, draft the Corrective Deed, clearly stating the corrections to be made. It is essential to include the original deed's details, such as the date it was executed and the parties involved. After drafting, have the Corrective Deed signed by the appropriate parties, and then record it with the local land records office to ensure it is legally binding and publicly accessible.

-

Do I need an attorney to file a Corrective Deed?

While it is not legally required to have an attorney prepare or file a Corrective Deed, seeking legal advice can be beneficial. An attorney can help ensure that the document is correctly drafted and complies with local laws. This can save you time and potential legal issues down the road. If you are unsure about the process or the implications of the corrections, consulting with a legal professional is a wise choice.

-

What happens after I file a Corrective Deed?

Once you file a Corrective Deed with the appropriate local land records office, it becomes part of the public record. This means that anyone searching for property records will see the updated information. The Corrective Deed does not transfer ownership; rather, it clarifies or corrects the existing deed. It is important to keep a copy of the Corrective Deed for your records, as it serves as proof of the corrections made.

-

Can a Corrective Deed affect my property taxes?

A Corrective Deed itself does not directly affect property taxes. However, if the corrections made in the deed result in a change in ownership or property description that alters the assessed value, it could potentially impact your property tax obligations. It is advisable to check with your local tax authority to understand any implications that may arise from the changes made in the Corrective Deed.

Corrective Deed Example

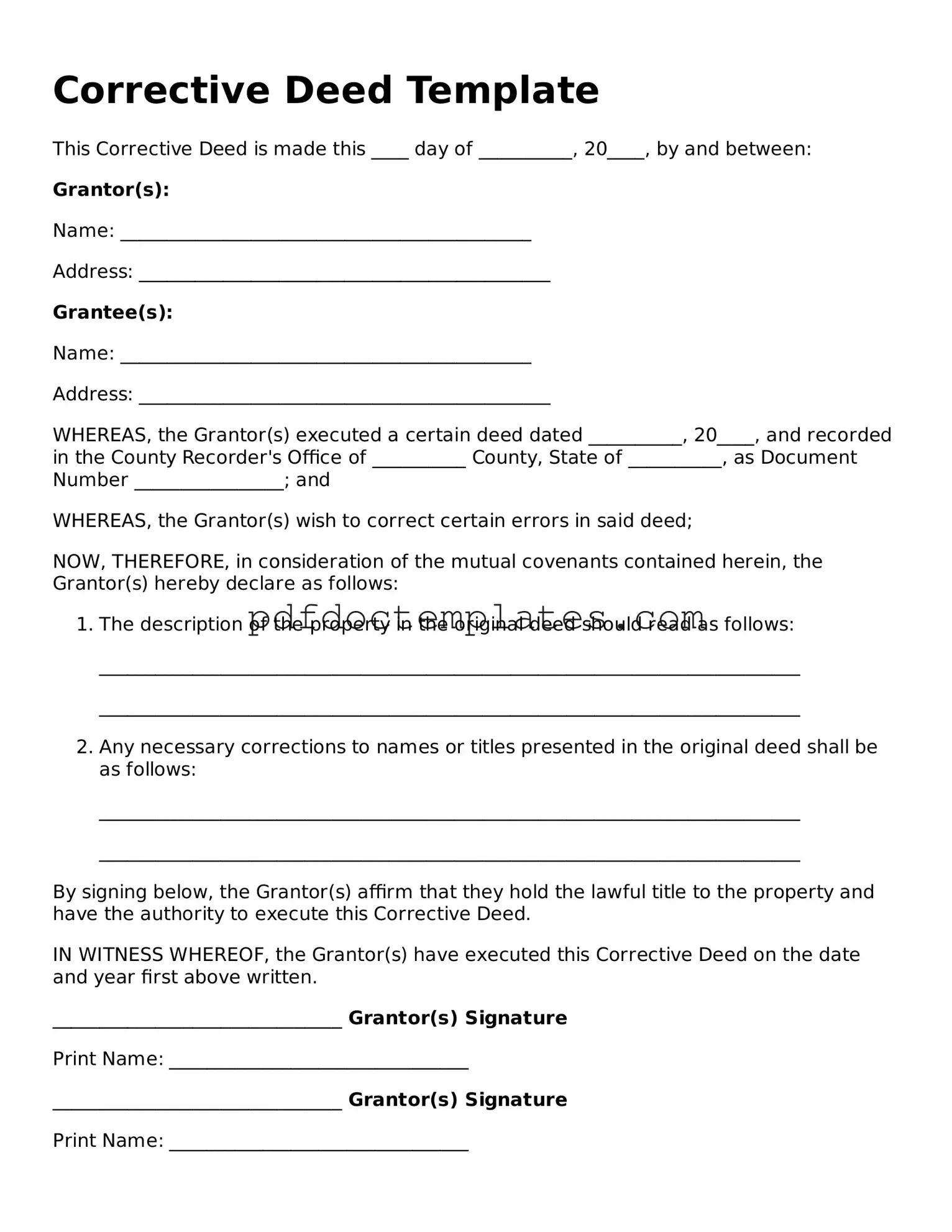

Corrective Deed Template

This Corrective Deed is made this ____ day of __________, 20____, by and between:

Grantor(s):

Name: ____________________________________________

Address: ____________________________________________

Grantee(s):

Name: ____________________________________________

Address: ____________________________________________

WHEREAS, the Grantor(s) executed a certain deed dated __________, 20____, and recorded in the County Recorder's Office of __________ County, State of __________, as Document Number ________________; and

WHEREAS, the Grantor(s) wish to correct certain errors in said deed;

NOW, THEREFORE, in consideration of the mutual covenants contained herein, the Grantor(s) hereby declare as follows:

- The description of the property in the original deed should read as follows:

- Any necessary corrections to names or titles presented in the original deed shall be as follows:

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

___________________________________________________________________________

By signing below, the Grantor(s) affirm that they hold the lawful title to the property and have the authority to execute this Corrective Deed.

IN WITNESS WHEREOF, the Grantor(s) have executed this Corrective Deed on the date and year first above written.

_______________________________ Grantor(s) Signature

Print Name: ________________________________

_______________________________ Grantor(s) Signature

Print Name: ________________________________

STATE OF __________)

COUNTY OF __________)

On this ____ day of __________, 20____, before me, a Notary Public in and for said State, personally appeared __________ and __________, known to me to be the persons described in and who executed the foregoing Corrective Deed, and they acknowledged that they executed the same as their free and voluntary act.

Witness my hand and official seal.

_______________________________

Notary Public

My commission expires: ________________

Different Types of Corrective Deed Forms:

Ladybug Deed - A Lady Bird Deed can assist in avoiding family disputes regarding property after an owner passes away.

For those looking to complete their property transactions smoothly, utilizing a Georgia Deed form is essential, and you can find the necessary resources for this process at Georgia PDF, where you can access the form and ensure all details are properly outlined.