Download Citibank Direct Deposit Template

Misconceptions

Understanding the Citibank Direct Deposit form is crucial for anyone looking to streamline their banking experience. However, several misconceptions can create confusion. Here are seven common misunderstandings about this form:

-

Direct deposit is only for employees.

This is not true. While many employees use direct deposit for their paychecks, anyone can set up direct deposit for various types of income, including government benefits, pensions, and even personal payments.

-

Setting up direct deposit is complicated.

In reality, the process is quite straightforward. Most banks, including Citibank, provide clear instructions on how to fill out the form and where to send it. It typically involves providing your account number and routing number.

-

You need to visit a branch to set it up.

Many people believe that they must physically go to a bank branch to initiate direct deposit. However, you can often complete the process online or by mailing in the form.

-

Direct deposit is only for checking accounts.

This is a misconception. You can also set up direct deposit into savings accounts. Just ensure you provide the correct account information on the form.

-

Once set up, direct deposit cannot be changed.

In fact, you can change your direct deposit information at any time. If you switch banks or accounts, simply fill out a new form and submit it to your employer or the payment source.

-

Direct deposit is not secure.

Many people worry about the security of direct deposit. However, it is generally considered safer than paper checks, which can be lost or stolen. Direct deposits are encrypted and processed through secure banking systems.

-

It takes a long time to set up.

While there may be a slight delay when you first set up direct deposit, once it is established, payments are usually deposited quickly and reliably. Most employers process direct deposits on a regular schedule, often aligning with payroll dates.

By dispelling these misconceptions, individuals can take full advantage of the benefits that direct deposit offers, including convenience and security.

File Details

| Fact Name | Details |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize direct deposit of funds into a bank account. |

| Account Information | The form requires the account holder's bank account number and routing number. |

| Employer Information | Employees must provide their employer's name and address on the form. |

| Signature Requirement | A signature is necessary to validate the authorization for direct deposit. |

| Processing Time | It typically takes one to two pay cycles for the direct deposit to begin after submission. |

| State-Specific Forms | Some states may have specific requirements, but the federal law governs direct deposit processes. |

| Revocation | Account holders can revoke authorization by submitting a new form indicating cancellation. |

| Privacy Protection | The form includes measures to protect the account holder's personal and financial information. |

| Availability | The form is available online through Citibank's official website and at bank branches. |

| Contact Information | For questions, account holders can contact Citibank customer service directly. |

Key takeaways

When filling out and using the Citibank Direct Deposit form, it’s essential to keep a few key points in mind to ensure a smooth process. Here are some important takeaways:

- Gather Necessary Information: Before starting, collect all relevant information such as your bank account number, routing number, and personal identification details.

- Complete the Form Accurately: Fill out each section of the form carefully. Double-check for any typos or errors to avoid delays.

- Use the Correct Routing Number: Ensure you are using the routing number specific to your Citibank account. This number varies by location.

- Choose the Right Account Type: Indicate whether your account is a checking or savings account, as this affects the deposit process.

- Sign and Date the Form: Your signature is required to authorize the direct deposit. Don’t forget to date the form as well.

- Submit the Form to Your Employer: Once completed, provide the form to your employer or the relevant payroll department for processing.

- Keep a Copy for Your Records: Always retain a copy of the completed form for your personal records. This can be helpful for future reference.

- Monitor Your Bank Account: After submitting, keep an eye on your account to ensure that deposits are being made correctly and on time.

- Update the Form if Necessary: If you change accounts or wish to alter your deposit instructions, fill out a new form and submit it promptly.

- Contact Customer Service for Help: If you encounter any issues or have questions about the process, don’t hesitate to reach out to Citibank customer service for assistance.

By following these guidelines, you can ensure that your direct deposit setup with Citibank is efficient and hassle-free.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to follow specific guidelines to ensure accuracy and efficiency. Here are some do's and don'ts to keep in mind:

- Do double-check your account number for accuracy.

- Do include your routing number, which can be found on your checks.

- Do ensure that your name matches the name on your bank account.

- Do keep a copy of the completed form for your records.

- Don't use a temporary account number.

- Don't forget to sign and date the form.

- Don't leave any required fields blank.

- Don't submit the form without confirming your employer's direct deposit process.

Common mistakes

-

Incorrect Account Number: One of the most common mistakes is entering the wrong account number. This can lead to delays or errors in deposit. Always double-check the account number with your bank statement or online banking.

-

Wrong Routing Number: Each bank has a unique routing number. Using an incorrect routing number can prevent your funds from being deposited correctly. Verify the routing number with Citibank’s official resources before submitting the form.

-

Missing Signature: Some individuals forget to sign the form. A missing signature can result in the rejection of your direct deposit request. Ensure that you sign and date the form before submission.

-

Not Updating Information: If you change banks or accounts, failing to update your direct deposit information can lead to missed payments. Always notify your employer or payer of any changes to your banking details promptly.

What You Should Know About This Form

-

What is the Citibank Direct Deposit form?

The Citibank Direct Deposit form is a document that allows individuals to authorize their employer or other sources of income to deposit funds directly into their Citibank account. This method is convenient, secure, and often faster than receiving a physical check. By completing this form, you ensure that your payments, such as salary or government benefits, are deposited automatically into your account on payday.

-

How do I fill out the Citibank Direct Deposit form?

Filling out the form is straightforward. You will need to provide your personal information, including your name, address, and account details. Typically, you must include your Citibank account number and the bank's routing number. Make sure to double-check these numbers to avoid any errors. Once completed, submit the form to your employer or the entity responsible for your payments.

-

How long does it take for direct deposits to start?

The timeline for direct deposits to begin can vary. Generally, after you submit the Citibank Direct Deposit form, it may take one to two pay cycles for the changes to take effect. Employers usually need time to process the form and update their payroll systems. If you do not see your deposit after this period, it is advisable to follow up with your employer’s payroll department.

-

What should I do if I change my bank account?

If you decide to change your bank account, you will need to complete a new Citibank Direct Deposit form. This ensures that your payments are directed to your new account. Be sure to submit the updated form to your employer or payment source as soon as possible. It is also wise to monitor your old account until you confirm that the direct deposit has switched to the new account to avoid any missed payments.

Citibank Direct Deposit Example

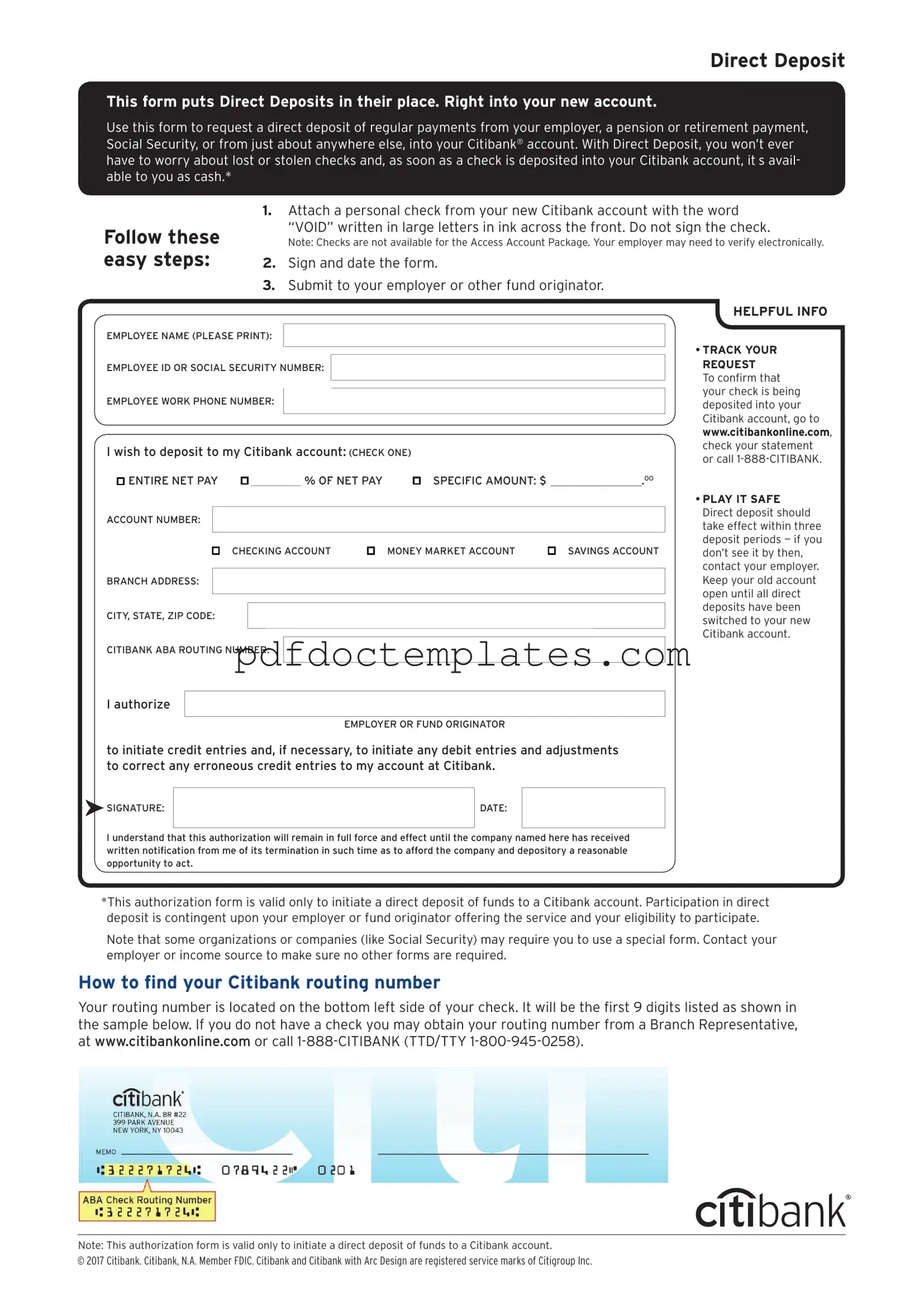

Direct Deposit

This form puts Direct Deposits in their place. Right into your new account.

Use this form to request a direct deposit of regular payments from your employer, a pension or retirement payment, Social Security, or from just about anywhere else, into your Citibank® account. With Direct Deposit, you won’t ever have to worry about lost or stolen checks and, as soon as a check is deposited into your Citibank account, it’s avail- able to you as cash.*

Follow these easy steps:

1.Attach a personal check from your new Citibank account with the word

“VOID” written in large letters in ink across the front. Do not sign the check.

Note: Checks are not available for the Access Account Package. Your employer may need to verify electronically.

2.Sign and date the form.

3.Submit to your employer or other fund originator.

HELPFUL INFO

EMPLOYEE NAME (PLEASE PRINT):

• TRACK YOUR

EMPLOYEE ID OR SOCIAL SECURITY NUMBER:

EMPLOYEE WORK PHONE NUMBER:

I wish to deposit to my Citibank account: (CHECK ONE)

ENTIRE NET PAY ı__________ % OF NET PAY |

ı SPECIFIC AMOUNT: $ ________________.OO |

ACCOUNT NUMBER:

ı CHECKING ACCOUNT |

ı MONEY MARKET ACCOUNT |

ı SAVINGS ACCOUNT |

BRANCH ADDRESS:

CITY, STATE, ZIP CODE:

CITIBANK ABA ROUTING NUMBER:

REQUEST

To confirm that your check is being deposited into your Citibank account, go to www.citibankonline.com, check your statement or call

•PLAY IT SAFE Direct deposit should take effect within three deposit periods — if you don’t see it by then, contact your employer. Keep your old account open until all direct deposits have been switched to your new Citibank account.

I authorize

EMPLOYER OR FUND ORIGINATOR

to initiate credit entries and, if necessary, to initiate any debit entries and adjustments to correct any erroneous credit entries to my account at Citibank.

SIGNATURE:

SIGNATURE:

DATE:

I understand that this authorization will remain in full force and effect until the company named here has received written notification from me of its termination in such time as to afford the company and depository a reasonable opportunity to act.

*This authorization form is valid only to initiate a direct deposit of funds to a Citibank account. Participation in direct deposit is contingent upon your employer or fund originator offering the service and your eligibility to participate.

Note that some organizations or companies (like Social Security) may require you to use a special form. Contact your employer or income source to make sure no other forms are required.

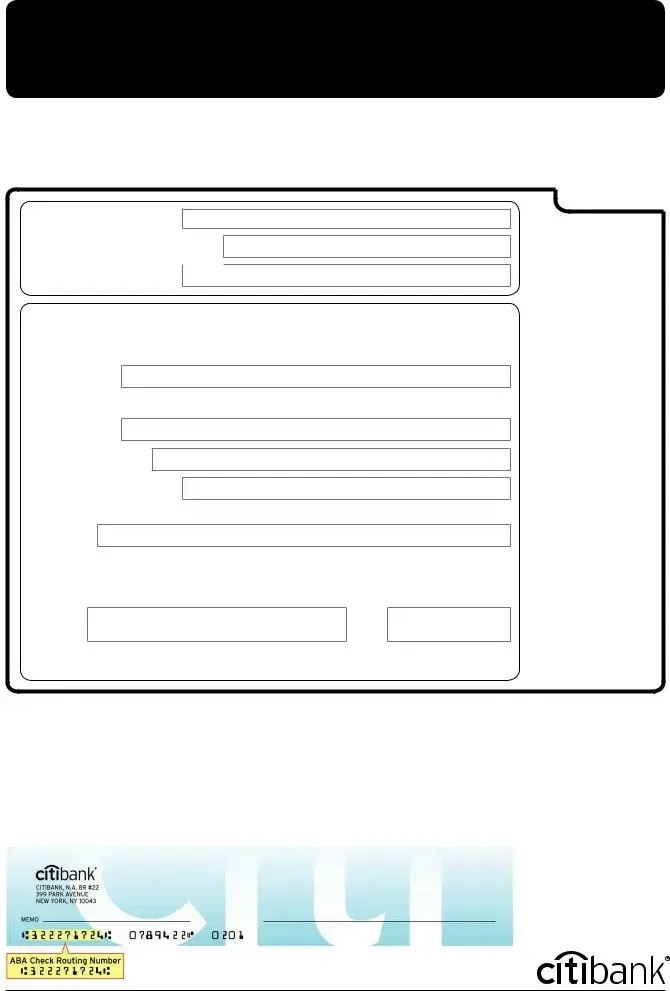

How to find your Citibank routing number

Your routing number is located on the bottom left side of your check. It will be the first 9 digits listed as shown in the sample below. If you do not have a check you may obtain your routing number from a Branch Representative, at www.citibankonline.com or call

Note: This authorization form is valid only to initiate a direct deposit of funds to a Citibank account.

© 2017 Citibank. Citibank, N.A. Member FDIC. Citibank and Citibank with Arc Design are registered service marks of Citigroup Inc.

Consider More Forms

Complete the Record Ncoer - The form supports transparency and accountability within military evaluations.

When dealing with property transactions, it's crucial to understand the importance of a reliable document. This informative guide on how to complete a Florida bill of sale form provides necessary steps for both parties, ensuring clarity and legal protection throughout the transfer process.

Who Owns Geico and Progressive - A timely submission can lead to quicker responses and resolutions.