Download Childcare Receipt Template

Misconceptions

There are several common misconceptions about the Childcare Receipt form that can lead to confusion. Understanding these can help ensure that the form is used correctly and effectively.

- All childcare providers must use the same format. Many believe that there is a specific format mandated by law for childcare receipts. In reality, while the receipt must contain certain key information, providers can create their own format as long as it includes the necessary details.

- Receipts are only necessary for tax purposes. Some think that receipts are only needed for tax deductions. However, receipts serve multiple purposes, including providing proof of payment for parents and ensuring accountability for childcare providers.

- Only licensed providers need to issue receipts. There is a misconception that only licensed childcare providers are required to give receipts. In fact, any provider, regardless of licensing status, can issue a receipt to document the services provided.

- Receipts do not need to be signed. Many assume that a signature is not necessary on the receipt. However, having the provider's signature adds legitimacy to the receipt and confirms that the transaction took place.

File Details

| Fact Name | Description |

|---|---|

| Date of Service | The form requires the date on which the child care services were provided, ensuring clarity on when the services took place. |

| Amount Received | Providers must indicate the total payment received for the services, which helps in maintaining accurate financial records. |

| Recipient Information | The form includes a section for the name of the individual who made the payment, establishing accountability and traceability. |

| Child's Name | It is essential to list the name(s) of the child(ren) receiving care, ensuring that the receipt is linked to the specific services rendered. |

| Provider's Signature | The signature of the child care provider is required, serving as verification of the transaction and the services provided. |

Key takeaways

When filling out and using the Childcare Receipt form, keep these key takeaways in mind:

- Complete All Fields: Ensure every section is filled out completely. This includes the date, amount, and names involved.

- Accurate Amount: Double-check the amount entered. Mistakes can lead to confusion later.

- Provider’s Signature: The form must be signed by the childcare provider. This confirms that the services were rendered.

- Keep Copies: Always make copies of the completed receipts for your records. This can help with tax deductions or disputes.

- Use for Tax Purposes: These receipts can be used to claim childcare expenses on your tax return. Save them throughout the year.

- Document Dates: Clearly indicate the period during which the childcare services were provided. This helps in tracking care over time.

- Provide Child’s Name: List the names of the child or children receiving care. This ensures clarity on who the services were for.

Dos and Don'ts

When filling out the Childcare Receipt form, it’s important to ensure that all information is accurate and complete. Here’s a list of things you should and shouldn’t do to make the process smoother.

- Do write clearly and legibly to avoid any confusion.

- Do fill in all required fields, including dates and amounts.

- Do double-check the name of the child(ren) to ensure accuracy.

- Do keep a copy of the receipt for your records.

- Don’t leave any blank spaces; if a field doesn’t apply, write “N/A.”

- Don’t forget to obtain the provider’s signature before submitting.

- Don’t use abbreviations or shorthand; clarity is key.

Common mistakes

-

Failing to include the date of the receipt. This is essential for record-keeping and tax purposes.

-

Leaving the amount field blank. Without this, the receipt cannot serve its purpose of documenting the payment made.

-

Not providing the name of the child(ren). This detail is crucial to identify which child received care.

-

Omitting the provider’s signature. A signature validates the receipt and confirms that the service was rendered.

-

Incorrectly filling in the dates of service. Both the start and end dates must be accurate to reflect the period of care.

-

Using illegible handwriting. If the receipt cannot be read, it may lead to disputes or confusion later.

-

Not keeping a copy of the receipt for personal records. This is important for future reference, especially during tax season.

-

Filling out multiple receipts without consistency in format. Each receipt should follow the same structure to avoid confusion.

-

Failing to provide a contact number for the childcare provider. This can be important if there are questions about the receipt later on.

What You Should Know About This Form

-

What is the purpose of the Childcare Receipt form?

The Childcare Receipt form serves as an official record of payment for childcare services. It provides essential details such as the date of service, the amount paid, and the names of the children receiving care. This documentation can be useful for parents seeking reimbursement from employers or for tax purposes.

-

What information is required on the form?

To complete the Childcare Receipt form, several key pieces of information must be included:

- The date of the service.

- The total amount paid for childcare services.

- The name of the individual making the payment.

- The names of the children who received care.

- The specific dates for which childcare services were provided.

- The signature of the childcare provider confirming receipt of payment.

-

How can I obtain a Childcare Receipt form?

Childcare Receipt forms can typically be obtained from your childcare provider. Many providers may have their own version of the form, while others may use a standard template. If you need a specific format, consider asking your provider directly or checking their website for downloadable resources.

-

Is the Childcare Receipt form necessary for tax purposes?

Yes, the Childcare Receipt form is often necessary for tax purposes. Parents may need to provide proof of childcare expenses when filing taxes or applying for tax credits. Keeping accurate records, including receipts, can help ensure that you receive any eligible deductions or credits.

-

What should I do if I lose my Childcare Receipt?

If a Childcare Receipt is lost, it is advisable to contact the childcare provider as soon as possible. They may be able to issue a duplicate receipt or provide an alternative form of documentation to verify the payment. It is important to maintain accurate records for financial and tax purposes.

-

Can I modify the Childcare Receipt form?

While it is important to keep the integrity of the Childcare Receipt form intact, you may add additional information if necessary. However, any modifications should be agreed upon by both the parent and the childcare provider. Altering the form without consent could lead to issues regarding the validity of the receipt.

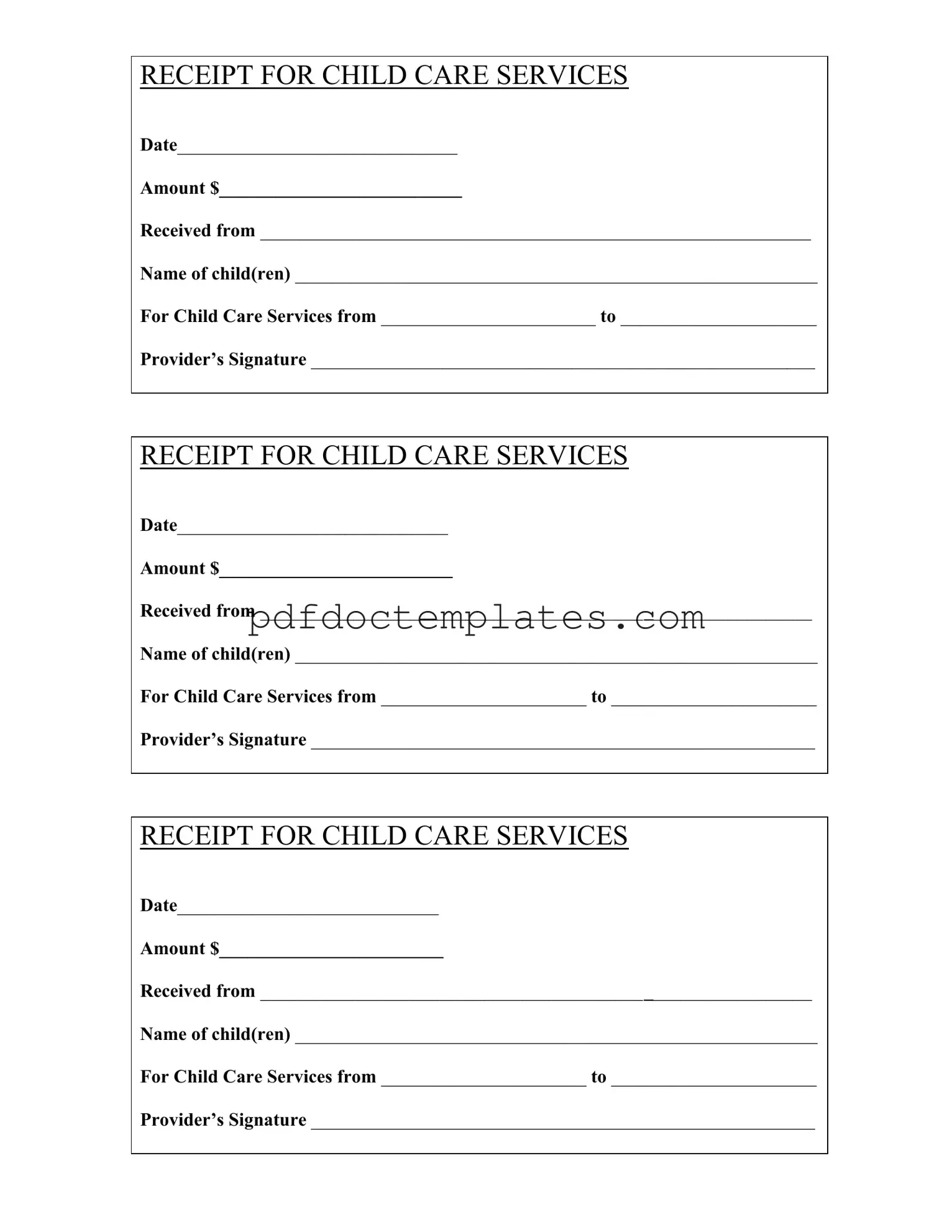

Childcare Receipt Example

RECEIPT FOR CHILD CARE SERVICES

Date______________________________

Amount $__________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from _______________________ to _____________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date_____________________________

Amount $_________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

RECEIPT FOR CHILD CARE SERVICES

Date____________________________

Amount $________________________

Received from ___________________________________________________________

Name of child(ren) ________________________________________________________

For Child Care Services from ______________________ to ______________________

Provider’s Signature ______________________________________________________

Consider More Forms

Hiv Test Report Sample - Report the time the test result was communicated to the client.

A New York Non-disclosure Agreement form, often referred to as an NDA, is a legally binding document aimed at protecting proprietary and confidential information. When signed, it restricts the sharing of sensitive details to unauthorized parties. This tool is vital for individuals and companies looking to safeguard their intellectual property or trade secrets in New York. For additional resources, you can visit All New York Forms.

Baseball Evaluation Sheets - Helps to ensure all players receive equal opportunity for evaluation.