Download Cg 20 10 07 04 Liability Endorsement Template

Misconceptions

Misconceptions about the CG 20 10 07 04 Liability Endorsement form can lead to confusion regarding its purpose and coverage. Here are four common misconceptions:

- All parties are automatically covered. Many believe that simply being listed as an additional insured guarantees full coverage. However, coverage only applies to specific liabilities related to the acts or omissions of the named insured.

- This endorsement increases policy limits. Some assume that adding additional insureds increases the overall limits of the policy. In reality, the endorsement does not raise the limits of insurance; it merely provides coverage within the existing limits.

- Coverage applies regardless of contract terms. There is a misconception that the endorsement provides comprehensive coverage without regard to contractual obligations. In fact, the coverage for additional insureds is limited to what is required by the contract or agreement.

- Coverage lasts indefinitely. A common belief is that coverage for additional insureds continues indefinitely. However, the insurance only applies until the work is completed or the project is put to its intended use, which can limit the duration of coverage significantly.

File Details

| Fact Name | Description |

|---|---|

| Policy Number | CG 20 10 12 19 is the official policy number for this endorsement. |

| Purpose | This endorsement adds additional insureds, such as owners, lessees, or contractors, to the policy. |

| Coverage Scope | It covers liability for bodily injury, property damage, and personal and advertising injury. |

| Location Requirement | The endorsement specifies locations of covered operations for additional insureds. |

| Legal Limitations | Coverage is limited to the extent permitted by law and does not exceed contractual obligations. |

| Exclusions | Bodily injury or property damage occurring after project completion is excluded. |

| Insurance Limits | The maximum amount payable for additional insureds is limited to contract requirements or available insurance limits. |

| Governing Law | This endorsement is governed by the laws of the state where the policy is issued. |

Key takeaways

When filling out and using the CG 20 10 07 04 Liability Endorsement form, consider the following key takeaways:

- Policy Number: Ensure you have the correct policy number for your Commercial General Liability coverage.

- Additional Insured: Clearly list the names of additional insured persons or organizations in the designated schedule.

- Location Details: Specify the locations of covered operations where the additional insureds will be protected.

- Coverage Scope: Understand that the endorsement covers liability for bodily injury, property damage, or personal and advertising injury.

- Acts and Omissions: Coverage applies to liabilities arising from your actions or those acting on your behalf during ongoing operations.

- Legal Limits: The insurance for additional insureds is only effective to the extent permitted by law.

- Contractual Obligations: If a contract requires coverage, it cannot exceed what the contract stipulates.

- Exclusions: Be aware that coverage does not apply if the work has been completed or if the work has been put to intended use by someone other than another contractor.

- Limits of Insurance: The endorsement does not increase the overall limits of insurance; it is capped at the lesser of the contract requirement or available limits.

- Review Carefully: Read the endorsement thoroughly to understand how it modifies your existing policy.

Dos and Don'ts

When filling out the CG 20 10 07 04 Liability Endorsement form, it is crucial to approach the task with care and attention to detail. Here are some important dos and don'ts to keep in mind:

- Do read the entire endorsement carefully to understand its implications on your coverage.

- Do provide accurate and complete information for the additional insured person(s) or organization(s) in the designated fields.

- Do ensure that the locations of covered operations are clearly specified to avoid any confusion later.

- Do verify that the coverage aligns with any contractual obligations you may have.

- Do keep a copy of the completed form for your records and future reference.

- Don't leave any sections blank; incomplete forms may lead to delays or denial of coverage.

- Don't misrepresent any information, as this could result in serious consequences for your policy.

- Don't assume that the endorsement automatically broadens your coverage without confirming the specifics.

- Don't submit the form without double-checking for any errors or omissions that could affect its validity.

Common mistakes

-

Incomplete Information: Failing to provide all necessary details, such as the names of additional insured persons or organizations, can lead to coverage gaps.

-

Incorrect Policy Number: Entering the wrong policy number can result in the endorsement being applied to the wrong insurance policy.

-

Misunderstanding Coverage Limits: Not recognizing that the limits of insurance for additional insureds may be lower than expected can lead to insufficient coverage.

-

Omitting Location Details: Failing to specify the locations of covered operations can create confusion about where the coverage applies.

-

Ignoring Contract Requirements: Not aligning the endorsement with contractual obligations may result in inadequate protection for additional insureds.

-

Neglecting Exclusions: Overlooking the specific exclusions related to bodily injury or property damage can lead to unexpected denials of claims.

-

Not Reviewing the Endorsement: Failing to read the endorsement thoroughly can lead to misunderstandings about the coverage provided.

-

Submitting Late: Delaying the submission of the endorsement can cause issues with timely coverage, especially if a claim arises shortly after the endorsement is needed.

What You Should Know About This Form

-

What is the purpose of the CG 20 10 07 04 Liability Endorsement form?

This endorsement is designed to add specific individuals or organizations as additional insureds under a Commercial General Liability policy. It ensures that these additional insureds are covered for certain liabilities that arise from the actions or omissions of the policyholder or those acting on their behalf during ongoing operations.

-

Who qualifies as an additional insured under this endorsement?

The additional insureds are the persons or organizations listed in the endorsement's schedule. They are covered for liabilities related to bodily injury, property damage, or personal and advertising injury, but only for incidents that occur in connection with the policyholder's ongoing operations at specified locations.

-

Are there limitations on the coverage provided to additional insureds?

Yes, there are important limitations. The coverage applies only to the extent permitted by law. Additionally, if the coverage is required by a contract, it cannot exceed what the policyholder is obligated to provide under that contract. This means that the endorsement does not broaden the coverage beyond what is legally or contractually required.

-

What types of incidents are excluded from coverage?

There are specific exclusions to be aware of. Coverage does not apply to bodily injury or property damage that occurs after all work related to the project has been completed. This includes materials, parts, or equipment furnished for the project. Furthermore, if the injury or damage arises after the work has been put to its intended use by someone other than another contractor or subcontractor, coverage will not apply.

-

How does this endorsement affect the limits of insurance?

The endorsement does not increase the overall limits of insurance. If the coverage for additional insureds is required by a contract, the maximum amount payable is either the amount specified in that contract or the available limits under the policy, whichever is less.

-

What should I do if I need to add an additional insured?

If you need to add an additional insured, ensure that their name and the relevant locations of covered operations are specified in the endorsement's schedule. It is important to communicate with your insurance provider to make sure all necessary details are included and to understand how this might affect your coverage.

-

Can the CG 20 10 07 04 Liability Endorsement be modified?

While the endorsement itself contains specific terms and conditions, modifications can sometimes be made through discussions with your insurance agent or provider. It's crucial to understand that any changes must comply with legal requirements and the terms of your underlying policy.

Cg 20 10 07 04 Liability Endorsement Example

POLICY NUMBER: |

COMMERCIAL GENERAL LIABILITY |

|

CG 20 10 12 19 |

THIS ENDORSEMENT CHANGES THE POLICY. PLEASE READ IT CAREFULLY.

ADDITIONAL INSURED – OWNERS, LESSEES OR

CONTRACTORS – SCHEDULED PERSON OR

ORGANIZATION

This endorsement modifies insurance provided under the following:

COMMERCIAL GENERAL LIABILITY COVERAGE PART

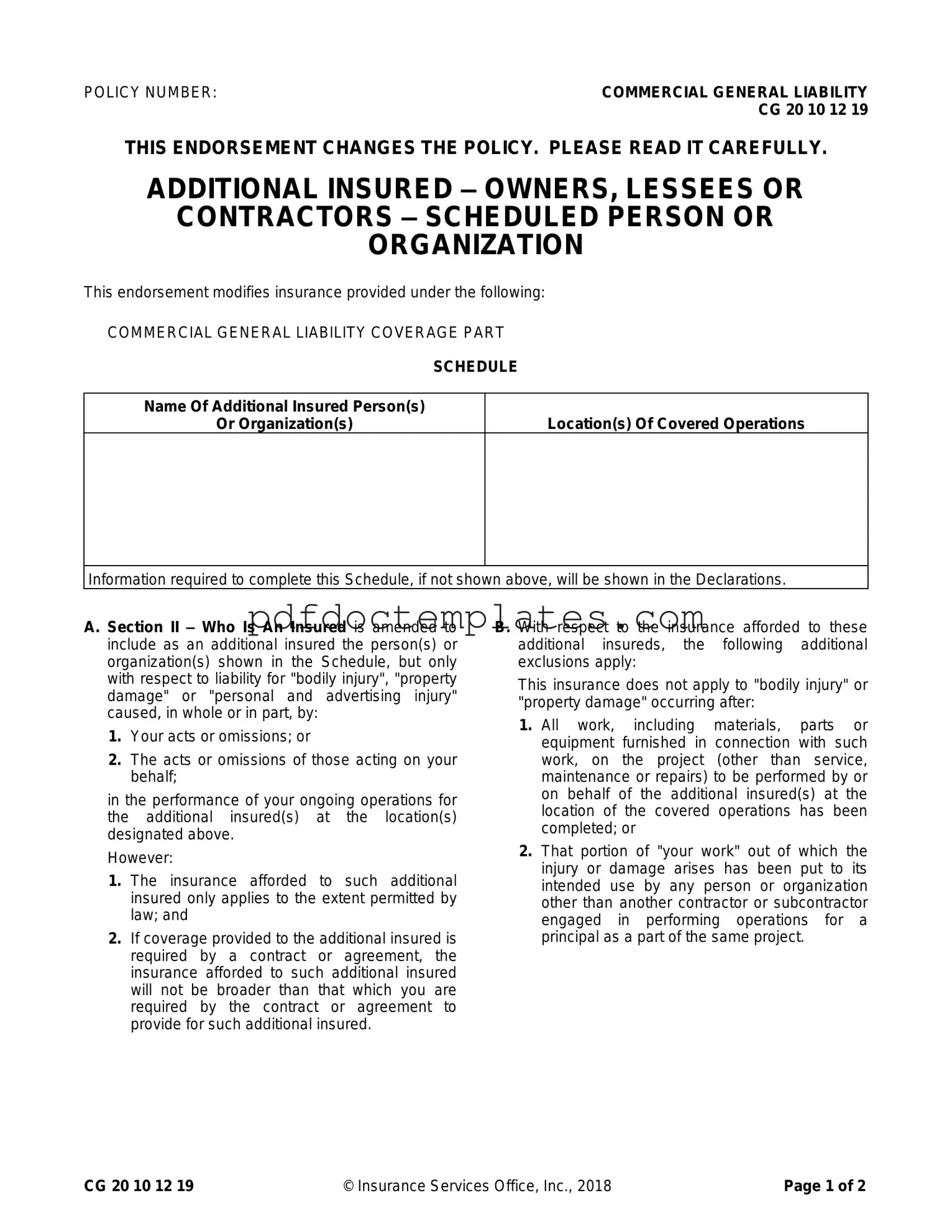

SCHEDULE

Name Of Additional Insured Person(s)

Or Organization(s)

Location(s) Of Covered Operations

Information required to complete this Schedule, if not shown above, will be shown in the Declarations.

A. Section II – Who Is An Insured is amended to include as an additional insured the person(s) or organization(s) shown in the Schedule, but only with respect to liability for "bodily injury", "property damage" or "personal and advertising injury" caused, in whole or in part, by:

1.Your acts or omissions; or

2.The acts or omissions of those acting on your behalf;

in the performance of your ongoing operations for the additional insured(s) at the location(s) designated above.

However:

1.The insurance afforded to such additional insured only applies to the extent permitted by law; and

2.If coverage provided to the additional insured is required by a contract or agreement, the insurance afforded to such additional insured will not be broader than that which you are required by the contract or agreement to provide for such additional insured.

B. With respect to the insurance afforded to these additional insureds, the following additional exclusions apply:

This insurance does not apply to "bodily injury" or "property damage" occurring after:

1.All work, including materials, parts or equipment furnished in connection with such work, on the project (other than service, maintenance or repairs) to be performed by or on behalf of the additional insured(s) at the location of the covered operations has been completed; or

2.That portion of "your work" out of which the injury or damage arises has been put to its intended use by any person or organization other than another contractor or subcontractor engaged in performing operations for a principal as a part of the same project.

CG 20 10 12 19 |

© Insurance Services Office, Inc., 2018 |

Page 1 of 2 |

C. With respect to the insurance afforded to these additional insureds, the following is added to

Section III – Limits Of Insurance:

If coverage provided to the additional insured is required by a contract or agreement, the most we will pay on behalf of the additional insured is the amount of insurance:

1.Required by the contract or agreement; or

2.Available under the applicable limits of insurance;

whichever is less.

This endorsement shall not increase the applicable limits of insurance.

Page 2 of 2 |

© Insurance Services Office, Inc., 2018 |

CG 20 10 12 19 |

Consider More Forms

Form 1099 Nec - Direct links to IRS resources help answer questions about completing and filing the form.

How to Make a Character Sheet - A stealthy assassin who strikes from the shadows with deadly precision.

A New York Non-disclosure Agreement form, often referred to as an NDA, is a legally binding document aimed at protecting proprietary and confidential information. When signed, it restricts the sharing of sensitive details to unauthorized parties. This tool is vital for individuals and companies looking to safeguard their intellectual property or trade secrets in New York. For more information and resources, you can refer to All New York Forms.

Where to Get a W9 Form - Gig economy workers often need to complete a W-9 when they register with a company.