Download Cash Receipt Template

Misconceptions

The Cash Receipt form is a crucial document in financial transactions, but several misconceptions surround its use and purpose. Here are ten common misconceptions explained.

- All cash receipts are the same. Not all cash receipts serve the same purpose. They can vary based on the type of transaction, the entity involved, and the specific information required.

- Cash receipts are only for cash transactions. While they primarily document cash transactions, cash receipts can also include payments made via checks or electronic transfers.

- Cash receipts do not need to be recorded. Failing to record cash receipts can lead to inaccuracies in financial reporting. Proper documentation is essential for tracking revenue and maintaining transparency.

- Only businesses need cash receipts. Individuals can also use cash receipts for personal transactions, such as paying for services or making purchases, to keep track of their finances.

- Cash receipts are not legally binding. Although they are often used for record-keeping, cash receipts can serve as evidence of a transaction in legal disputes.

- Cash receipts are only needed for large transactions. Regardless of the amount, all cash transactions should be documented to ensure accurate accounting and financial management.

- Cash receipts can be created after the transaction. Ideally, cash receipts should be issued at the time of the transaction to ensure accuracy and provide immediate proof of payment.

- Electronic cash receipts are not valid. Electronic cash receipts are just as valid as paper ones, provided they contain all necessary information and comply with relevant regulations.

- Cash receipts do not require signatures. Many organizations require signatures on cash receipts to confirm that the transaction has been acknowledged by both parties.

- Once issued, cash receipts cannot be amended. While it is best to issue a new receipt for corrections, amendments can be made if documented properly to maintain an accurate record.

Understanding these misconceptions can help individuals and businesses use cash receipts more effectively and ensure proper financial management.

File Details

| Fact Name | Description |

|---|---|

| Definition | A Cash Receipt form is a document used to record the receipt of cash payments. |

| Purpose | This form serves as proof of payment for both the payer and the recipient. |

| Components | Typically includes date, amount received, payer’s information, and signature. |

| Usage | Commonly used in businesses, non-profits, and personal transactions. |

| Legal Requirement | In many states, maintaining cash receipt records is required for tax purposes. |

| State-Specific Laws | For example, California requires businesses to keep accurate records as per the California Revenue and Taxation Code. |

| Format | Can be printed or created digitally, ensuring easy access and storage. |

| Retention Period | Generally, cash receipts should be retained for at least three years for tax audit purposes. |

| Variations | Different industries may have specific formats or additional requirements for cash receipts. |

Key takeaways

Understanding the Cash Receipt form is essential for accurate financial tracking and reporting. Here are key takeaways to consider:

- Purpose: The Cash Receipt form is used to document cash transactions, ensuring that all received funds are properly recorded.

- Completeness: Fill out all required fields to maintain a clear record of the transaction. Missing information can lead to confusion.

- Date of Receipt: Always include the date when the cash was received. This helps in tracking the timing of transactions.

- Source of Funds: Clearly identify who provided the cash. This could be a customer, donor, or another source.

- Amount Received: Enter the exact amount of cash received. Double-check this figure to avoid discrepancies.

- Payment Method: Specify how the cash was received, whether it was in person, via mail, or through another method.

- Purpose of Payment: Include a brief description of what the payment is for. This provides context for future reference.

- Authorized Signatures: Ensure that the form is signed by an authorized individual. This adds an extra layer of accountability.

- Record Keeping: Store completed forms in a secure location. This facilitates easy access for audits and reviews.

- Regular Reconciliation: Regularly compare cash receipts with bank deposits to ensure accuracy and identify any discrepancies promptly.

By following these key points, individuals can effectively utilize the Cash Receipt form to maintain accurate financial records and streamline cash management processes.

Dos and Don'ts

When filling out the Cash Receipt form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here is a list of things you should and shouldn't do:

- Do double-check the date of the transaction to ensure it is correct.

- Do write clearly and legibly to avoid any misunderstandings.

- Do include the correct amount received, ensuring it matches any accompanying documentation.

- Do specify the payment method, whether cash, check, or credit card.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill in all required information.

- Don't use abbreviations or shorthand that may confuse others.

- Don't make corrections with white-out; instead, cross out errors neatly and initial them.

- Don't forget to sign the form if required.

- Don't submit the form without reviewing it for accuracy first.

Common mistakes

-

Not including the date of the transaction. The date is crucial for record-keeping and tracking payments.

-

Failing to write the correct amount received. Double-checking figures helps prevent discrepancies.

-

Omitting the payer’s name. This information is essential for identifying who made the payment.

-

Not specifying the payment method. Indicating whether it was cash, check, or credit card is important for accounting purposes.

-

Using unclear or illegible handwriting. Clear writing ensures that all parties can read the information without confusion.

-

Neglecting to sign the form. A signature validates the transaction and confirms receipt of payment.

-

Leaving out reference numbers when applicable. Reference numbers help link the payment to invoices or accounts.

-

Not keeping a copy of the receipt for personal records. Retaining a copy can be useful for future reference or disputes.

-

Failing to provide a description of the payment. A brief note about what the payment is for can clarify the purpose.

-

Forgetting to check for errors before submitting the form. Taking a moment to review can save time and trouble later.

What You Should Know About This Form

-

What is a Cash Receipt form?

A Cash Receipt form is a document used to record cash transactions. It serves as proof of payment received for goods or services. This form helps keep track of cash flow and ensures accurate financial records.

-

When should I use a Cash Receipt form?

You should use a Cash Receipt form whenever you receive cash payments. This includes payments for products sold, services rendered, or any other cash income. It’s important to document these transactions to maintain clear financial records.

-

What information is typically included on a Cash Receipt form?

A Cash Receipt form usually includes the following information:

- Date of the transaction

- Name of the payer

- Amount received

- Purpose of the payment

- Signature of the person receiving the payment

-

How do I fill out a Cash Receipt form?

To fill out a Cash Receipt form, start by entering the date of the transaction. Next, write the name of the person or business making the payment. Then, indicate the amount received and the reason for the payment. Finally, sign the form to confirm receipt of the cash.

-

Do I need to keep a copy of the Cash Receipt form?

Yes, it’s essential to keep a copy of the Cash Receipt form for your records. This helps in tracking income and provides documentation for accounting purposes. It can also be useful in case of disputes or audits.

-

Can I use a digital Cash Receipt form?

Absolutely! Many businesses now use digital Cash Receipt forms. These can be filled out and stored electronically, making it easier to manage records. Just ensure that the digital format captures all necessary information and is securely stored.

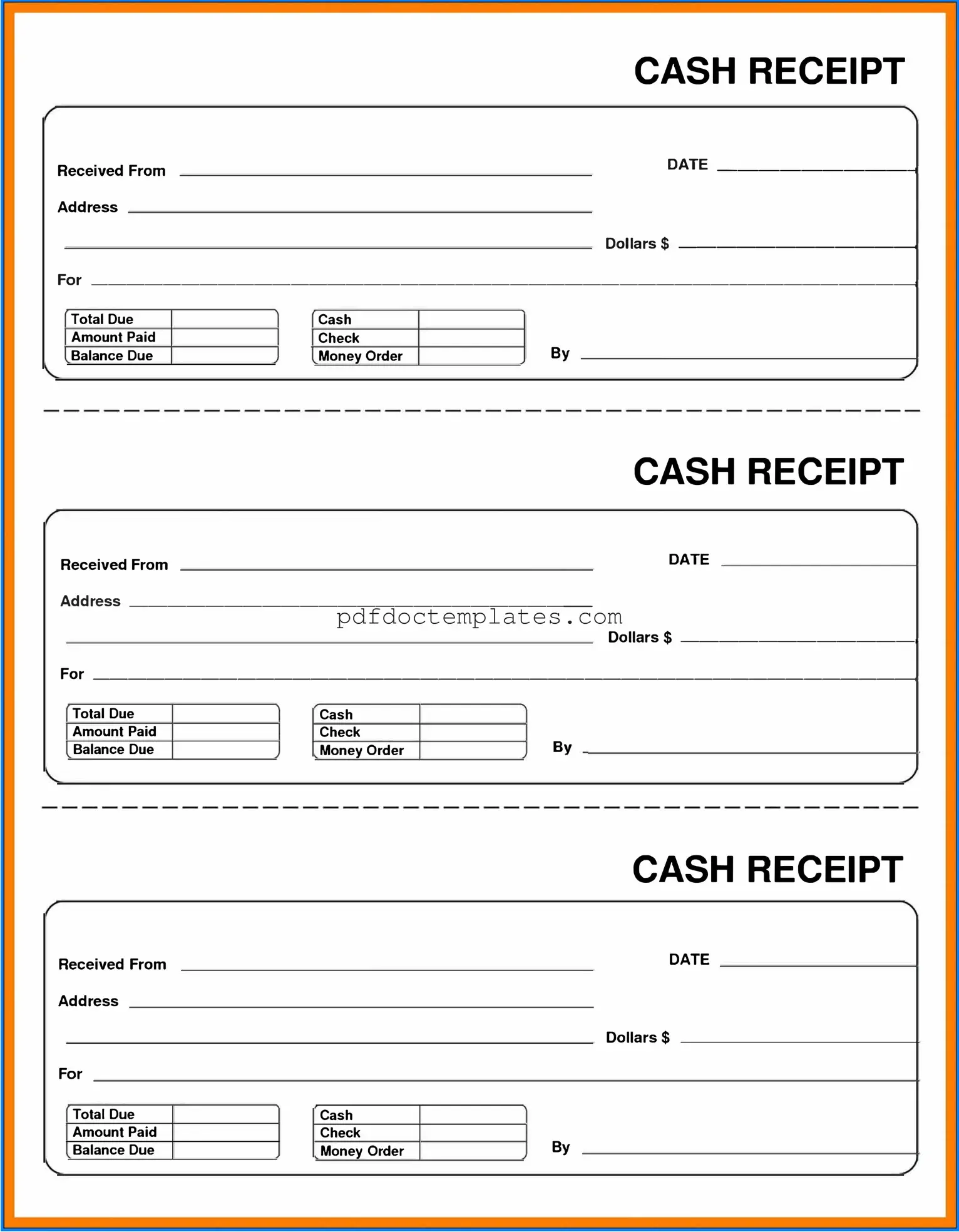

Cash Receipt Example

CASH RECEIPT

Received From |

|

� |

|||

Address |

|

|

Dollars$ |

||

|

|

|

|

||

|

� |

||||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

CASH RECEIPT

Received From |

|

|

|

|

|

|

|

|

|

DATE |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||||||

Address ________________________ |

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

Dollars$ |

+ |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Due |

|

|

|

|

|

Cash |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

Amount Paid |

|

|

|

|

|

Check |

|

|

By |

|

|

|

|

|

|

Balance Due |

|

|

|

|

|

Money Order |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CASH RECEIPT

Received From |

|

DATE |

|||

Address |

|

|

|

||

|

|

|

|

Dollars$ |

|

For |

|

|

|

||

Total Due

Amount Paid

Balance Due

Cash

Check

Money Order

By

Consider More Forms

Who Can Write Esa Letters - Support your journey toward improved mental health with recognized documentation.

Da - This form can be used as a reference during inspections of property accountability.

For a thorough understanding of the process involved, refer to this useful guide on the important bill of sale documentation which aids in ensuring proper ownership transfer.

Spa Facial Consent Form - Clients acknowledge the importance of following professional advice regarding their skin.