Download Cash Drawer Count Sheet Template

Misconceptions

Understanding the Cash Drawer Count Sheet form is essential for accurate financial management. However, several misconceptions often arise regarding its purpose and use. Below are four common misconceptions:

- It is only necessary for large businesses. Many people believe that only large retail operations require a Cash Drawer Count Sheet. In reality, any business that handles cash transactions can benefit from this form, regardless of its size. It helps maintain accountability and accuracy in cash handling.

- It is used solely for end-of-day reporting. Some think that the Cash Drawer Count Sheet is only relevant at the end of the business day. In truth, it can be used at various points throughout the day to ensure that cash levels are accurate and to identify any discrepancies promptly.

- It is complicated and time-consuming to fill out. Many individuals feel intimidated by the idea of completing a Cash Drawer Count Sheet. However, the form is designed to be straightforward and user-friendly. With practice, it can be filled out quickly and efficiently, saving time in the long run.

- Only managers should complete the form. Some believe that only managers or supervisors are responsible for the Cash Drawer Count Sheet. In fact, all employees who handle cash should be familiar with the form. This shared responsibility promotes transparency and teamwork within the organization.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to track cash transactions and balances in a cash drawer. |

| Importance | It helps businesses maintain accurate financial records and aids in preventing theft or errors. |

| Frequency of Use | This form is typically used at the end of each business day or shift. |

| Components | The sheet usually includes sections for cash counts, credit card transactions, and discrepancies. |

| Legal Requirements | Some states may have specific requirements for cash handling and record-keeping under state finance laws. |

| Record Keeping | Businesses should retain completed Cash Drawer Count Sheets for a specified period, often for tax purposes. |

| Audit Trail | These sheets can serve as an important audit trail during financial reviews or investigations. |

| Signature Requirement | Many businesses require a manager's signature to validate the accuracy of the counts. |

| Digital vs. Paper | Some businesses opt for digital versions of the Cash Drawer Count Sheet for easier tracking and reporting. |

| State-Specific Forms | In states like California, businesses must comply with specific cash handling regulations outlined in the California Business and Professions Code. |

Key takeaways

When using the Cash Drawer Count Sheet form, it's essential to follow these key takeaways to ensure accuracy and efficiency.

- Accuracy is Crucial: Always double-check the amounts entered to avoid discrepancies.

- Complete All Sections: Fill out every part of the form, including date, time, and employee information.

- Use Clear Handwriting: Ensure that all entries are legible to prevent misunderstandings during audits.

- Document Every Transaction: Record all cash transactions leading up to the count for transparency.

- Perform Regular Counts: Schedule consistent cash drawer counts to maintain accountability.

- Secure the Form: Store completed sheets in a safe location to protect sensitive information.

- Review for Errors: After filling out the form, take a moment to review it for any mistakes.

- Communicate Findings: Share the results of the cash count with relevant team members promptly.

By keeping these points in mind, you can ensure that the cash handling process runs smoothly and efficiently.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, it is essential to follow specific guidelines to ensure accuracy and compliance. Here are ten things you should and shouldn't do:

- Do double-check all cash amounts before recording them.

- Do use clear and legible handwriting or type the information.

- Do include the date and your name on the form.

- Do ensure that all denominations are counted and recorded separately.

- Do verify the total cash against the expected amount.

- Don't leave any blank spaces on the form.

- Don't use correction fluid or erasers on the form.

- Don't forget to sign the form after completion.

- Don't mix personal funds with business funds on the sheet.

- Don't submit the form without a supervisor's review, if required.

Common mistakes

-

Not double-checking the starting cash amount. It’s essential to ensure that the amount recorded matches what is actually in the drawer at the beginning of the shift.

-

Failing to record all transactions accurately. Every sale, refund, and void must be documented to maintain an accurate count.

-

Omitting to include tips or other cash received. If tips are part of the cash drawer, they should be included in the count.

-

Using incorrect denominations. It’s important to tally the cash in the correct bill and coin amounts. Mistakes here can lead to discrepancies.

-

Not reconciling the cash drawer at the end of the shift. This step is crucial to ensure that the cash on hand matches the recorded totals.

-

Leaving out the date and time. This information is vital for tracking purposes and for any future audits.

-

Not signing the form. A signature adds accountability and confirms that the count was completed by the individual responsible.

-

Failing to store the form securely. After filling it out, the form should be kept in a safe place to prevent unauthorized access.

-

Not reviewing the form for errors before submission. A quick review can catch mistakes that might otherwise go unnoticed.

What You Should Know About This Form

-

What is the Cash Drawer Count Sheet?

The Cash Drawer Count Sheet is a form used to document the amount of cash present in a cash drawer at the end of a shift or business day. It helps ensure accurate financial reporting and accountability for cash handling.

-

Why is the Cash Drawer Count Sheet important?

This sheet is crucial for tracking cash flow and preventing discrepancies. It provides a clear record that can be referenced during audits and helps identify any potential cash shortages or overages.

-

How do I fill out the Cash Drawer Count Sheet?

To complete the form, start by entering the date and your name. Next, list the denominations of cash in the drawer, including bills and coins. Finally, total the amounts for each denomination to arrive at the overall cash total.

-

What should I do if I find a discrepancy?

If a discrepancy arises between the recorded total and the actual cash count, it is important to investigate. Review transactions, check for errors in counting, and consult with colleagues if necessary. Document any findings on the form.

-

How often should I use the Cash Drawer Count Sheet?

The sheet should be used at the end of each shift or business day. Regular use helps maintain accurate records and ensures that any issues are identified promptly.

-

Who is responsible for completing the Cash Drawer Count Sheet?

The responsibility typically falls on the cashier or employee who handled the cash during the shift. However, management may also review and verify the counts to ensure accuracy.

-

Can the Cash Drawer Count Sheet be used for other types of transactions?

While primarily designed for cash transactions, it can also be adapted for tracking other payment methods if necessary. However, it is best to keep separate records for different types of transactions for clarity.

-

What should I do with the completed Cash Drawer Count Sheet?

Once completed, the form should be submitted to management or kept in a designated location for record-keeping. This ensures that there is a reliable history of cash counts available for future reference.

-

Is there a digital version of the Cash Drawer Count Sheet?

Many businesses now offer digital versions of the Cash Drawer Count Sheet. These can be filled out electronically, making it easier to track and store records. Check with your organization for availability.

-

What happens if I lose the Cash Drawer Count Sheet?

If the form is lost, it is important to recreate the information as accurately as possible. Speak with colleagues who may have been involved in the cash handling process to gather necessary details. Maintaining a backup system can help prevent future losses.

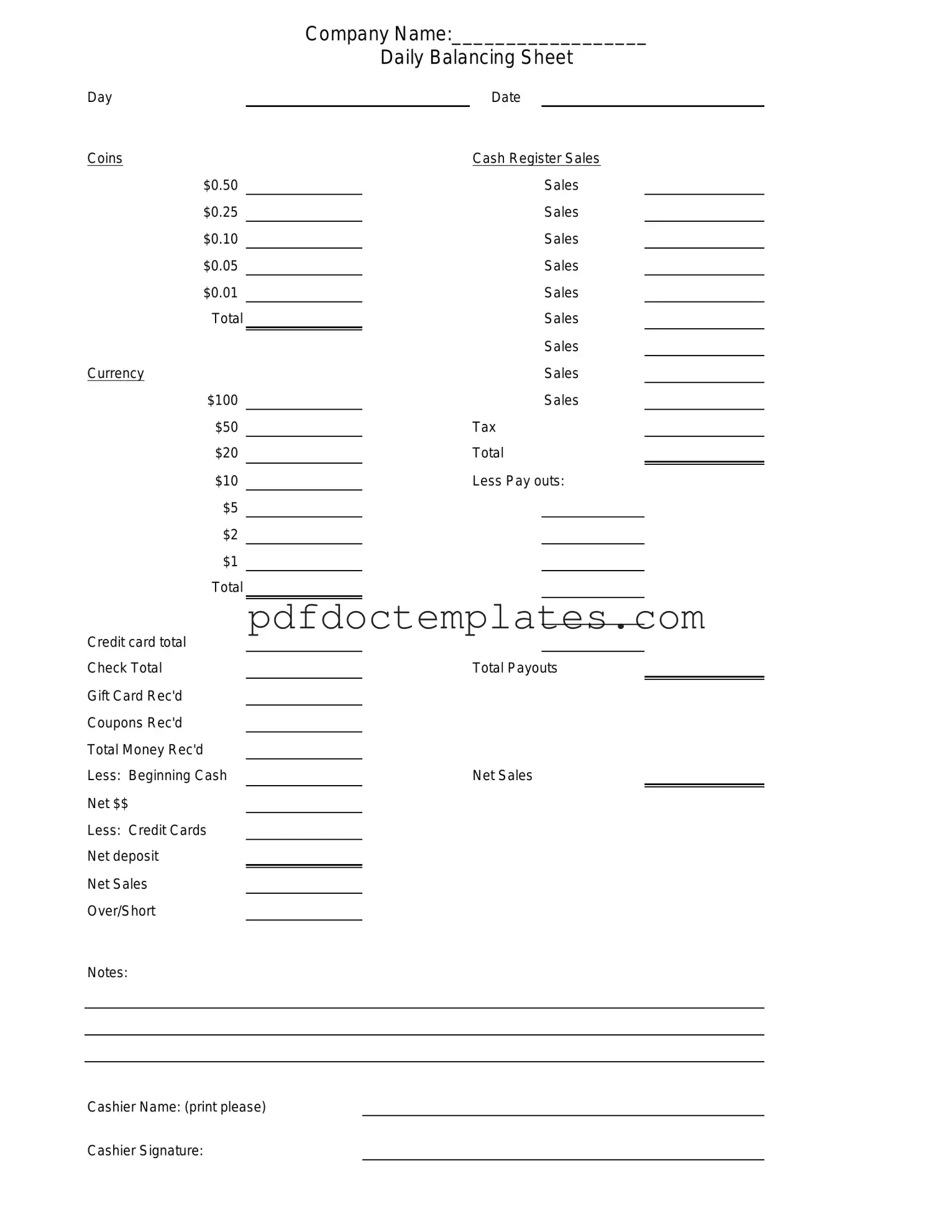

Cash Drawer Count Sheet Example

|

Company Name:__________________ |

|||||

|

|

Daily Balancing Sheet |

||||

Day |

|

|

Date |

|

||

Coins |

|

|

Cash Register Sales |

|||

$0.50 |

|

|

|

Sales |

|

|

$0.25 |

|

|

|

Sales |

|

|

$0.10 |

|

|

|

Sales |

|

|

$0.05 |

|

|

|

Sales |

|

|

$0.01 |

|

|

|

Sales |

|

|

Total |

|

|

|

Sales |

|

|

|

|

|

|

Sales |

|

|

Currency |

|

|

|

Sales |

|

|

$100 |

|

|

|

Sales |

|

|

$50 |

|

|

Tax |

|

||

$20 |

|

|

Total |

|

||

$10 |

|

|

Less Pay outs: |

|||

$5 |

|

|

|

|

|

|

$2 |

|

|

|

|

|

|

$1 |

|

|

|

|

|

|

Total |

|

|

|

|

|

|

Credit card total |

|

|

|

|

|

|

|

|

|

|

|

|

|

Check Total |

|

|

Total Payouts |

|||

Gift Card Rec'd |

|

|

|

|

|

|

Coupons Rec'd |

|

|

|

|

|

|

Total Money Rec'd |

|

|

|

|

|

|

Less: Beginning Cash |

|

|

Net Sales |

|||

Net $$ |

|

|

|

|

|

|

Less: Credit Cards |

|

|

|

|

|

|

Net deposit |

|

|

|

|

|

|

Net Sales |

|

|

|

|

|

|

|

|

|

|

|

|

|

Over/Short |

|

|

|

|

|

|

Notes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cashier Name: (print please)

Cashier Signature:

Consider More Forms

How to Make a Character Sheet - A devoted follower of a deity, spreading their teachings and ideals.

In navigating the complexities of establishing an LLC in New York, having a well-prepared Operating Agreement is crucial. This document not only delineates the internal management structures and roles of members but also addresses financial arrangements that are essential for smooth operations. While it may not be a legal requirement, the advantages of having a clear guideline to prevent disputes and misunderstandings are significant. Entrepreneurs can find a useful resource at smarttemplates.net/fillable-new-york-operating-agreement to assist in drafting a customized agreement that meets the unique needs of their business.

Chic Fil a Careers - Experience in food preparation and knowledge of menu items is a plus.

How to File a Mechanics Lien - Offers a structured process to recover money owed for construction services.