Printable Business Purchase and Sale Agreement Template

Misconceptions

Understanding the Business Purchase and Sale Agreement (BPSA) is crucial for anyone involved in buying or selling a business. However, several misconceptions often arise regarding this important document. Here are five common misconceptions:

-

The BPSA is only necessary for large transactions.

This is not true. Regardless of the size of the business, a BPSA provides essential legal protection for both the buyer and the seller. It helps clarify the terms of the sale and ensures that both parties are on the same page.

-

Once signed, the BPSA cannot be changed.

This misconception overlooks the possibility of amendments. Both parties can agree to modify the terms of the BPSA before the transaction is finalized. It is important to document any changes in writing.

-

The BPSA guarantees a successful sale.

While a BPSA outlines the terms of the transaction, it does not guarantee that the sale will proceed as planned. Issues may arise during due diligence or financing that could derail the sale.

-

Only lawyers can draft a BPSA.

This is a common belief, but it is not entirely accurate. While legal expertise can be beneficial, business owners can draft a BPSA themselves. However, consulting a lawyer is advisable to ensure that all legal requirements are met.

-

The BPSA is the same as a letter of intent.

This misconception confuses two different documents. A letter of intent outlines preliminary agreements and intentions, while a BPSA is a binding contract that details the final terms of the sale.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Business Purchase and Sale Agreement is a legal document that outlines the terms of the sale of a business from one party to another. |

| Key Components | This agreement typically includes details about the purchase price, payment terms, and any assets or liabilities being transferred. |

| Governing Law | The agreement is usually governed by state-specific laws, which can vary significantly. For example, California law may apply in California, while Texas law would apply in Texas. |

| Importance of Due Diligence | Both parties should conduct thorough due diligence before signing to ensure all terms are understood and agreed upon. |

| Legal Advice | It is advisable to seek legal counsel when drafting or reviewing this agreement to protect your interests and ensure compliance with applicable laws. |

Key takeaways

Filling out and using the Business Purchase and Sale Agreement form is an important step in the process of transferring business ownership. Here are key takeaways to consider:

- Ensure that all parties involved are clearly identified, including their legal names and addresses.

- Detail the business being sold, including its assets, liabilities, and any intellectual property.

- Specify the purchase price and payment terms, including any deposits or financing arrangements.

- Include a timeline for the transaction, outlining important dates such as closing and transfer of ownership.

- Address any contingencies that must be met before the sale can be finalized, such as inspections or financing approvals.

- Outline the responsibilities of both the seller and buyer during the transition period.

- Incorporate any warranties or representations made by the seller regarding the business's condition and operations.

- Include provisions for dispute resolution, should any issues arise after the agreement is signed.

- Consult with a legal professional to ensure compliance with local laws and regulations.

Completing this form accurately can help facilitate a smooth business transaction and protect the interests of all parties involved.

Dos and Don'ts

When completing the Business Purchase and Sale Agreement form, it is essential to follow certain guidelines to ensure accuracy and clarity. Below is a list of things you should and shouldn't do:

- Do read the entire form carefully before filling it out.

- Do provide accurate and complete information about the business.

- Do ensure all parties involved sign the agreement.

- Do include any necessary attachments or exhibits.

- Do consult with a legal professional if you have questions.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be specific in your descriptions.

- Don't rush through the process; take your time to review.

- Don't ignore deadlines for submission.

- Don't forget to keep a copy for your records.

Common mistakes

-

Not clearly defining the business assets: Many individuals fail to specify which assets are included in the sale. This can lead to misunderstandings later on. It’s crucial to list tangible assets like equipment, inventory, and intangible assets like trademarks or customer lists.

-

Ignoring the liabilities: Some buyers overlook existing liabilities that come with the business. It’s important to understand any debts or obligations that may transfer with the sale, as these can impact the overall value of the business.

-

Overlooking contingencies: Buyers and sellers often forget to include contingencies that protect their interests. These might involve financing conditions or inspections. Including these can safeguard both parties from unexpected issues.

-

Not specifying the purchase price: A common mistake is failing to clearly state the purchase price or how it will be determined. This should be explicitly outlined to avoid confusion and disputes later.

-

Neglecting to include terms of payment: Some individuals do not detail how the payment will be made. Will it be a lump sum, or will there be installment payments? Clarity here can prevent future conflicts.

-

Forgetting about the closing date: A specific closing date should be established in the agreement. Without it, both parties may have different expectations about when the transaction will be finalized.

-

Not addressing non-compete clauses: Sellers often forget to include non-compete agreements, which can prevent the seller from starting a similar business nearby. This protects the buyer’s investment and market position.

-

Failing to consult with professionals: Some individuals attempt to fill out the form without seeking legal or financial advice. Consulting with professionals can provide valuable insights and help avoid costly mistakes.

-

Leaving out signatures: Lastly, a frequent oversight is neglecting to obtain all necessary signatures. Without proper signatures, the agreement may not be legally binding, leading to potential disputes.

What You Should Know About This Form

-

What is a Business Purchase and Sale Agreement?

A Business Purchase and Sale Agreement is a legal document that outlines the terms and conditions under which one party agrees to buy a business from another party. This agreement typically includes details about the purchase price, payment terms, and any contingencies that must be met before the sale can be finalized.

-

Why is this agreement important?

This agreement is crucial because it protects both the buyer and the seller by clearly defining their rights and responsibilities. It helps prevent misunderstandings and disputes that could arise during the sale process. By having everything in writing, both parties can refer back to the agreement if any issues come up.

-

What key elements should be included in the agreement?

- Purchase Price: The total amount that the buyer will pay for the business.

- Payment Terms: Details on how and when the payment will be made.

- Assets Included: A list of all assets that are part of the sale, such as equipment, inventory, and intellectual property.

- Liabilities: Information on any debts or obligations that the buyer will assume.

- Closing Date: The date when the transaction will be finalized.

- Contingencies: Conditions that must be met for the sale to proceed, such as financing approval or satisfactory inspections.

-

How does the negotiation process work?

The negotiation process typically begins with discussions between the buyer and seller about the terms of the sale. Both parties may present their expectations and concerns. Once an initial agreement is reached, the details will be drafted into the Business Purchase and Sale Agreement. It is common for both sides to review the document and suggest changes before finalizing it.

-

Do I need a lawyer to create this agreement?

While it is possible to draft a Business Purchase and Sale Agreement without legal assistance, it is highly recommended to consult with a lawyer. A legal professional can ensure that the agreement complies with state laws and adequately protects your interests. They can also help identify potential issues that you may not have considered.

-

What happens after the agreement is signed?

Once the Business Purchase and Sale Agreement is signed, both parties are legally bound to adhere to its terms. The next steps typically involve completing any contingencies outlined in the agreement, such as obtaining financing or conducting inspections. After all conditions are satisfied, the closing process will take place, officially transferring ownership of the business.

Business Purchase and Sale Agreement Example

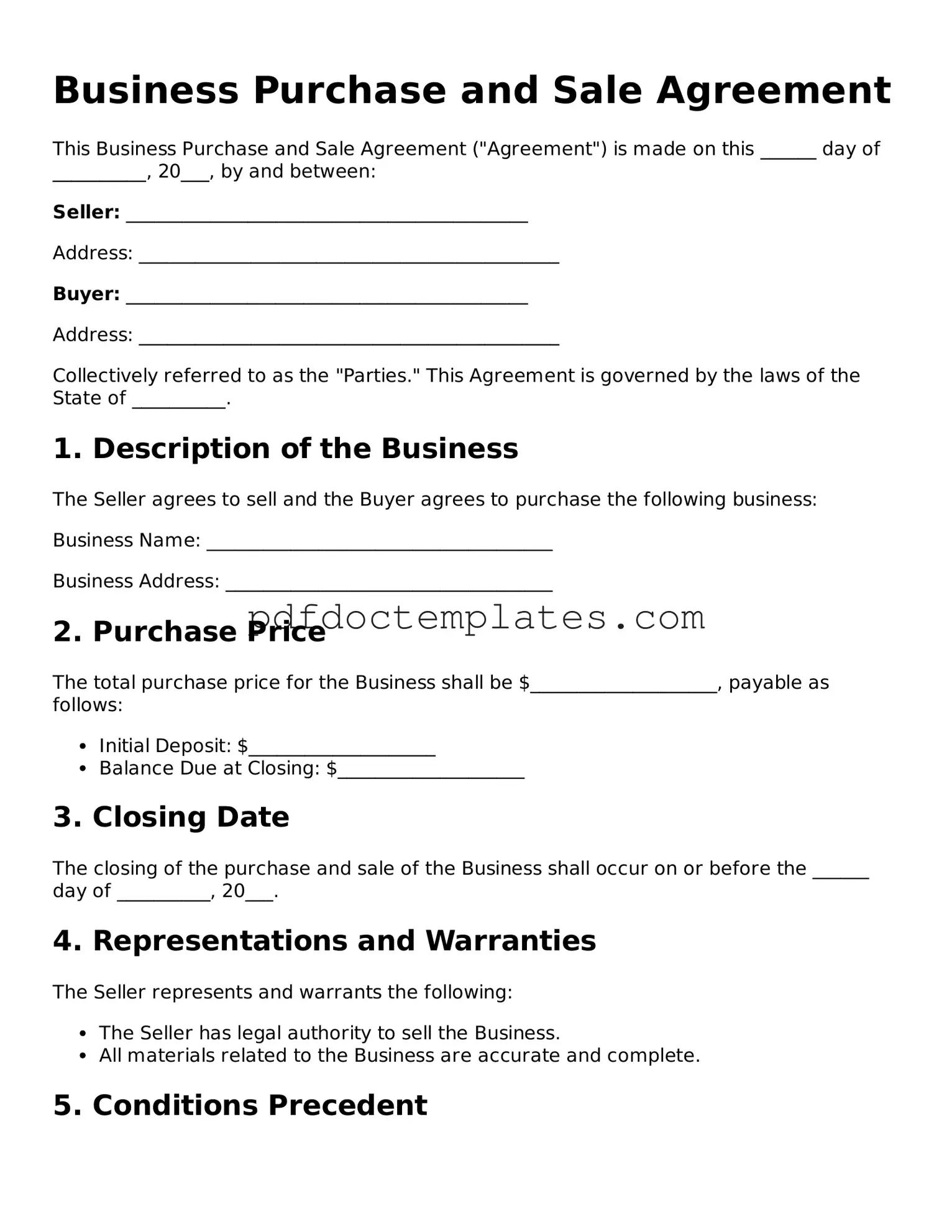

Business Purchase and Sale Agreement

This Business Purchase and Sale Agreement ("Agreement") is made on this ______ day of __________, 20___, by and between:

Seller: ___________________________________________

Address: _____________________________________________

Buyer: ___________________________________________

Address: _____________________________________________

Collectively referred to as the "Parties." This Agreement is governed by the laws of the State of __________.

1. Description of the Business

The Seller agrees to sell and the Buyer agrees to purchase the following business:

Business Name: _____________________________________

Business Address: ___________________________________

2. Purchase Price

The total purchase price for the Business shall be $____________________, payable as follows:

- Initial Deposit: $____________________

- Balance Due at Closing: $____________________

3. Closing Date

The closing of the purchase and sale of the Business shall occur on or before the ______ day of __________, 20___.

4. Representations and Warranties

The Seller represents and warrants the following:

- The Seller has legal authority to sell the Business.

- All materials related to the Business are accurate and complete.

5. Conditions Precedent

The Buyer’s obligation to complete the purchase is subject to the satisfaction of the following conditions:

- Satisfactory completion of due diligence.

- Execution of all necessary agreements.

6. Confidentiality

Both Parties agree to keep all information shared during the negotiation and execution of this Agreement confidential.

7. Governing Law

This Agreement shall be governed by and construed in accordance with the laws of the State of __________.

8. Signatures

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first above written.

_________________________________________

Seller

_________________________________________

Buyer

Find Other Forms

Employer's Quarterly Federal Tax Return - Quarterly reports help ensure timely payment of federal employment taxes by the employer.

To ensure a smooth transaction, utilizing a General Bill of Sale form is essential for both sellers and buyers, as it provides clear documentation of the sale and protects both parties involved. For more detailed information and resources, you can visit OnlineLawDocs.com, which offers guidance on how to properly complete this important legal document.

Is It Too Late to Vaccinate My Cat - Make sure to check all relevant vaccinations for your dog.