Download Business Credit Application Template

Misconceptions

Understanding the Business Credit Application form is crucial for businesses seeking credit. However, several misconceptions can lead to confusion. Here are nine common misconceptions explained:

-

All businesses automatically qualify for credit.

This is not true. Approval depends on various factors, including credit history and financial stability.

-

The application is only for large businesses.

Small businesses can also apply. Credit options are available for businesses of all sizes.

-

Providing personal information is unnecessary.

In many cases, personal guarantees may be required, especially for new businesses.

-

Once submitted, the application cannot be changed.

Applicants can often update their information if circumstances change before approval.

-

The application guarantees credit approval.

Submitting an application does not guarantee approval. Lenders assess various risk factors.

-

Credit history is the only factor considered.

While credit history is important, lenders also evaluate income, business plan, and market conditions.

-

There are no fees associated with the application.

Some lenders may charge fees for processing applications or for credit checks.

-

All lenders use the same criteria for approval.

Different lenders have unique criteria and risk assessments, leading to varying approval outcomes.

-

Once approved, credit terms are fixed.

Terms can change based on the business's ongoing financial performance and market conditions.

Awareness of these misconceptions can help businesses navigate the credit application process more effectively.

File Details

| Fact Name | Description |

|---|---|

| Purpose of the Form | The Business Credit Application form is used by businesses to apply for credit from suppliers or financial institutions. |

| Information Required | Typically, the form requires basic information about the business, including its name, address, tax identification number, and financial details. |

| Creditworthiness Assessment | Submitting this application allows lenders to assess the creditworthiness of the business based on the provided information. |

| State-Specific Forms | Some states may have specific requirements for the form, governed by local business and lending laws. |

| Confidentiality | Information provided in the application is generally kept confidential and used solely for the purpose of evaluating credit. |

| Approval Process | Once submitted, the application undergoes a review process, which may involve additional documentation or verification steps. |

Key takeaways

When filling out and using the Business Credit Application form, it is important to keep the following key takeaways in mind:

- Provide accurate and complete information. Ensure that all sections of the application are filled out truthfully.

- Include your business's legal name. This helps to avoid confusion and ensures that credit checks are conducted correctly.

- List all owners and key stakeholders. This information is essential for the lender to assess the creditworthiness of the business.

- Disclose your business structure. Indicate whether your business is a sole proprietorship, partnership, LLC, or corporation.

- Provide financial statements if required. Some lenders may ask for recent financial documents to evaluate your business’s financial health.

- Be prepared to offer personal guarantees. Some lenders may require personal guarantees from business owners to secure credit.

- Understand the terms and conditions. Review the credit terms carefully before signing the application to avoid any misunderstandings.

- Follow up after submission. It’s wise to check in with the lender after submitting your application to ensure it is being processed.

- Keep a copy of the application. Retaining a copy for your records can be helpful for future reference and follow-ups.

Dos and Don'ts

When filling out a Business Credit Application form, it’s important to ensure that you provide accurate and complete information. Here are some guidelines to follow:

- Do: Provide accurate financial information. This helps lenders assess your creditworthiness.

- Do: Include all required documentation. Missing documents can delay the approval process.

- Do: Double-check your application for errors. Simple mistakes can lead to misunderstandings.

- Do: Be honest about your business's financial history. Transparency builds trust with lenders.

- Don't: Leave any fields blank unless specified. Incomplete applications may be rejected.

- Don't: Provide misleading information. This can result in serious consequences, including denial of credit.

Following these guidelines can help streamline the application process and improve your chances of approval.

Common mistakes

-

Incomplete Information: Many applicants forget to fill out all required fields. Missing details can delay the process.

-

Incorrect Business Structure: Some people don’t specify their business type correctly, whether it’s a sole proprietorship, partnership, or corporation.

-

Wrong Contact Information: Providing outdated or incorrect phone numbers and email addresses can lead to missed communications.

-

Neglecting to Include Financial Statements: Applicants often overlook attaching necessary financial documents, which are crucial for evaluating creditworthiness.

-

Not Reviewing Credit History: Some individuals submit their applications without checking their credit scores, which can lead to surprises later on.

-

Ignoring Terms and Conditions: Many fail to read the fine print. Understanding the terms can prevent future misunderstandings.

-

Submitting Multiple Applications: Applying to several lenders at once can hurt your credit score. It’s better to focus on one application at a time.

What You Should Know About This Form

-

What is a Business Credit Application form?

A Business Credit Application form is a document that businesses complete to apply for credit from suppliers or lenders. This form collects essential information about the business, including its financial history, ownership structure, and creditworthiness.

-

Why do I need to fill out a Business Credit Application?

Completing a Business Credit Application is crucial for obtaining credit. It helps lenders or suppliers assess the risk of extending credit to your business. This assessment is based on your financial stability and payment history.

-

What information is typically required on the application?

Common information required includes:

- Business name and address

- Type of business entity (e.g., LLC, corporation)

- Employer Identification Number (EIN)

- Owner's personal information (name, address, social security number)

- Banking information

- Trade references

- Financial statements or tax returns

-

How long does it take to process the application?

The processing time can vary significantly depending on the lender or supplier. Generally, it can take anywhere from a few days to a couple of weeks. Factors influencing this timeframe include the completeness of the application and the thoroughness of the credit review process.

-

What happens if my application is denied?

If your application is denied, you will typically receive a notification explaining the reasons for the denial. Common reasons include insufficient credit history, poor credit score, or inadequate financial information. You may have the opportunity to address these issues and reapply.

-

Can I apply for credit if my business is new?

Yes, new businesses can apply for credit. However, they may face more scrutiny due to a lack of established credit history. Providing personal credit information of the owners and detailed financial projections can help strengthen the application.

-

Is there a fee associated with submitting the application?

Most Business Credit Application forms do not require a fee for submission. However, some lenders or suppliers may charge fees for processing or for running a credit check. It's essential to confirm this before submitting your application.

-

What should I do if my information changes after submitting the application?

If any of your information changes after submission—such as your business address or financial status—it's important to inform the lender or supplier promptly. Keeping them updated ensures that they have the most accurate information for their assessment.

-

How can I improve my chances of getting approved?

To enhance your chances of approval, consider the following:

- Ensure that all information provided is accurate and complete.

- Maintain a strong personal and business credit score.

- Provide solid financial statements and projections.

- Include references from other suppliers or lenders.

-

What should I do if I have questions about the application?

If you have questions regarding the Business Credit Application, it is best to reach out directly to the lender or supplier. They can provide specific guidance and clarify any uncertainties you may have about the process or required information.

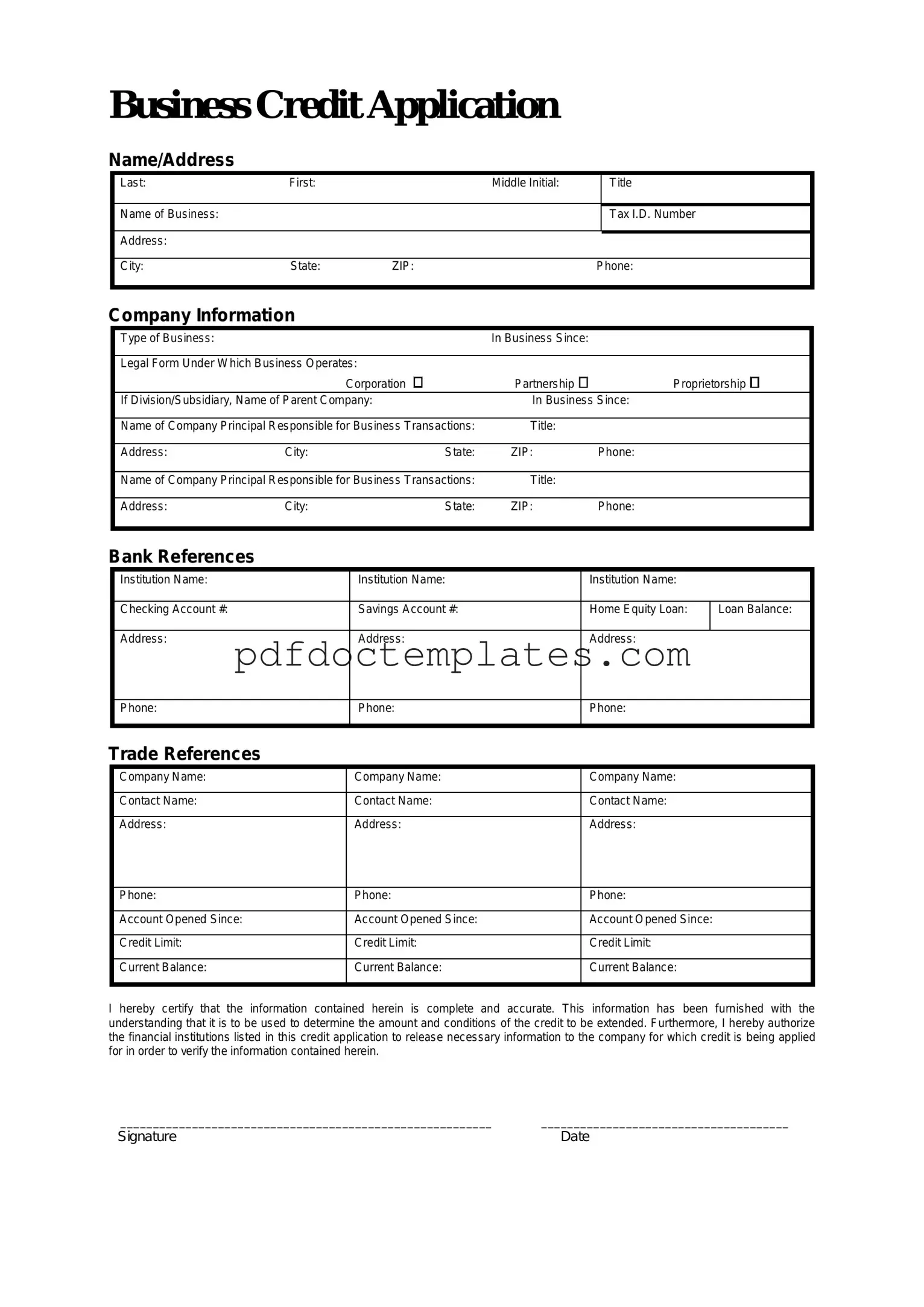

Business Credit Application Example

Business Credit Application

Name/Address

Last: |

First: |

|

Middle Initial: |

|

Title |

|

|

|

|

|

|

Name of Business: |

|

|

|

|

Tax I.D. Number |

|

|

|

|

|

|

Address: |

|

|

|

|

|

|

|

|

|

|

|

City: |

State: |

ZIP: |

|

Phone: |

|

|

|

|

|

|

|

Company Information

|

Type of Business: |

|

|

|

In Business Since: |

|

|

|

|

|

|

|

|

|

|

||

|

Legal Form Under Which Business Operates: |

|

|

|

|

|||

|

|

|

Corporation |

Partnership |

Proprietorship |

|

||

|

If Division/Subsidiary, Name of Parent Company: |

In Business Since: |

|

|||||

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

||

|

Name of Company Principal Responsible for Business Transactions: |

Title: |

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

Address: |

City: |

|

State: |

ZIP: |

Phone: |

|

|

|

|

|

|

|

|

|

|

|

Bank References |

|

|

|

|

|

|

|

|

|

Institution Name: |

|

|

Institution Name: |

|

Institution Name: |

||

|

|

|

|

|

|

|

|

|

|

Checking Account #: |

|

|

Savings Account #: |

|

Home Equity Loan: |

ILoan Balance: |

|

|

Address: |

|

|

Address: |

|

Address: |

|

|

Phone:

Phone:

Phone:

Trade References

Company Name: |

Company Name: |

Company Name: |

|

|

|

Contact Name: |

Contact Name: |

Contact Name: |

|

|

|

Address: |

Address: |

Address: |

|

|

|

Phone: |

Phone: |

Phone: |

|

|

|

Account Opened Since: |

Account Opened Since: |

Account Opened Since: |

|

|

|

Credit Limit: |

Credit Limit: |

Credit Limit: |

|

|

|

Current Balance: |

Current Balance: |

Current Balance: |

|

|

|

I hereby certify that the information contained herein is complete and accurate. This information has been furnished with the understanding that it is to be used to determine the amount and conditions of the credit to be extended. Furthermore, I hereby authorize the financial institutions listed in this credit application to release necessary information to the company for which credit is being applied for in order to verify the information contained herein.

_________________________________________________________ ______________________________________

Signature |

Date |

Consider More Forms

Broward County Animal Care and Adoption - Stay on top of your pet’s health by completing their rabies vaccination certification promptly.

Completing the claims process is made easier with the Asurion F-017-08 MEN form, which can be accessed online. For users ready to proceed with their device protection claims, it is essential to provide accurate information. To assist with this, you can Fill PDF Forms swiftly and securely, ensuring a smooth experience in resolving your device issues.

Tb Skin Testing - Test results can be either negative or positive, indicating health status.