Printable Business Bill of Sale Template

Misconceptions

The Business Bill of Sale form is an important document for transferring ownership of a business. However, several misconceptions surround its use. Here are nine common misunderstandings:

- It is only necessary for large businesses. Many people believe that only large businesses require a Bill of Sale. In reality, any business transaction involving the transfer of ownership, regardless of size, should use this document to ensure clarity and legal protection.

- It is the same as a personal Bill of Sale. While both documents serve to transfer ownership, a Business Bill of Sale includes specific details relevant to business transactions, such as assets, liabilities, and business structure, which a personal Bill of Sale does not cover.

- It can be verbal. Some assume that a verbal agreement suffices for business transactions. However, having a written Bill of Sale provides legal proof and can help prevent disputes in the future.

- It is not legally binding. A properly executed Business Bill of Sale is legally binding. This means that both parties are obligated to adhere to the terms outlined in the document.

- It only protects the seller. This form protects both the buyer and the seller. It ensures that the buyer receives the agreed-upon assets and that the seller is compensated for the sale.

- It is only needed if the business has physical assets. Even businesses that primarily operate online or have intangible assets, such as intellectual property, benefit from a Business Bill of Sale to document the transfer of ownership.

- It does not require notarization. While notarization is not always mandatory, having the document notarized adds an extra layer of authenticity and can be beneficial in case of disputes.

- Once signed, it cannot be changed. While the document is binding, parties can agree to modify the terms later. Any changes should be documented in writing and signed by both parties.

- It is a one-size-fits-all document. Each Business Bill of Sale should be tailored to the specific transaction. Factors such as the type of business, assets involved, and any unique terms should be considered when drafting the document.

Understanding these misconceptions can help ensure that all parties involved in a business transaction are adequately protected and informed.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business from one party to another. |

| Purpose | This form serves as proof of the transaction and outlines the terms of the sale. |

| Components | Typically includes details such as the sale price, business description, and buyer/seller information. |

| State-Specific Forms | Some states require specific forms; check local regulations for compliance. |

| Governing Laws | Each state has its own laws governing the sale of businesses, often found in the Uniform Commercial Code (UCC). |

| Notarization | In some states, notarization of the Bill of Sale may be required to validate the document. |

| Liabilities | The Bill of Sale may outline any liabilities the buyer assumes upon purchase. |

| Payment Terms | It should clearly state the payment terms, including any deposits or financing arrangements. |

| Asset Description | All assets included in the sale must be described accurately to avoid disputes. |

| Legal Advice | Consulting with a legal professional before finalizing the sale is advisable to ensure compliance and protection. |

Key takeaways

Understanding the Business Bill of Sale form is essential for any business transaction. Here are key takeaways to consider:

- Purpose: The form serves as a legal document that transfers ownership of a business or its assets from one party to another.

- Details Matter: Include all relevant information, such as the names of the buyer and seller, the date of the sale, and a description of the assets involved.

- Consideration: Clearly state the purchase price or other forms of compensation agreed upon by both parties.

- Asset Description: Provide a detailed list of the assets being sold, including equipment, inventory, and any intangible assets like trademarks.

- As-Is Clause: If applicable, include an "as-is" clause to clarify that the buyer accepts the assets in their current condition.

- Signatures Required: Both parties must sign the document to validate the transaction. Ensure that all signatures are dated.

- Notarization: Although not always required, having the document notarized can add an extra layer of authenticity.

- Record Keeping: Keep a copy of the completed Bill of Sale for your records and provide one to the buyer as well.

- Legal Compliance: Ensure that the sale complies with local, state, and federal regulations to avoid future legal issues.

Taking these steps can help ensure a smooth transaction and protect both parties involved.

Dos and Don'ts

When filling out a Business Bill of Sale form, it's important to approach the task with care. Here are some essential dos and don'ts to keep in mind:

- Do ensure all parties involved understand the terms of the sale.

- Do provide accurate and complete information about the business being sold.

- Do include the date of the transaction for record-keeping purposes.

- Do sign and date the form in the appropriate sections.

- Don't leave any sections blank; incomplete forms can lead to confusion.

- Don't use vague language; clarity is key to avoiding misunderstandings.

By following these guidelines, you can help ensure that the Business Bill of Sale form is filled out correctly and effectively. This can contribute to a smoother transaction process for everyone involved.

Common mistakes

-

Neglecting to include all necessary details: Failing to provide complete information about the buyer, seller, and the business being sold can lead to confusion and potential legal issues.

-

Using incorrect or outdated forms: Always ensure you are using the most current version of the Business Bill of Sale form. Using an outdated form may result in missing important legal protections.

-

Not specifying the terms of the sale: Clearly outline the terms, including payment methods, any warranties, and the date of the transaction. Vague terms can lead to disputes later.

-

Overlooking signatures: Both the buyer and seller must sign the document. Without signatures, the sale may not be legally binding.

-

Failing to date the document: Not including the date of the transaction can create uncertainty about when the sale took place, which is crucial for legal and tax purposes.

-

Ignoring local laws and regulations: Different states have different requirements for business sales. Be sure to check local laws to ensure compliance.

-

Not keeping a copy: After completing the form, both parties should retain a copy for their records. This helps protect both the buyer and seller in case of future disputes.

-

Assuming verbal agreements are enough: Relying on verbal agreements can lead to misunderstandings. Always document the sale in writing to ensure clarity and legal protection.

What You Should Know About This Form

-

What is a Business Bill of Sale?

A Business Bill of Sale is a legal document that records the transfer of ownership of a business or its assets from one party to another. This document outlines the terms of the sale, including the purchase price, the assets being sold, and any conditions attached to the sale. It serves as proof of the transaction and can be important for tax and legal purposes.

-

Why do I need a Business Bill of Sale?

This document is essential for both buyers and sellers. For sellers, it provides a record that they have sold the business or its assets, protecting them from future claims. For buyers, it offers proof of ownership, which is crucial for establishing rights to the business and its assets. Additionally, having a formal bill of sale can help clarify the terms of the sale, reducing the likelihood of disputes later on.

-

What information is included in a Business Bill of Sale?

A typical Business Bill of Sale includes several key pieces of information:

- The names and addresses of the buyer and seller

- A description of the business or assets being sold

- The purchase price

- The date of the sale

- Any warranties or representations made by the seller

- Signatures of both parties

Including all relevant details helps ensure clarity and can prevent misunderstandings in the future.

-

Is a Business Bill of Sale required by law?

While a Business Bill of Sale is not always legally required, it is highly recommended. Some states may have specific regulations regarding the sale of certain types of businesses or assets, which could necessitate a bill of sale. Even if it’s not required, having this document can protect both parties and provide a clear record of the transaction.

-

Can I create my own Business Bill of Sale?

Yes, you can create your own Business Bill of Sale. However, it’s important to ensure that it includes all necessary information and complies with state laws. Many templates are available online, but customizing a template to fit your specific transaction is advisable. Consulting a legal professional can also help ensure that your document is valid and enforceable.

-

What should I do after completing the Business Bill of Sale?

Once the Business Bill of Sale is completed and signed by both parties, it’s important to keep copies for your records. The seller should provide the buyer with the original document. Depending on the nature of the business, you may also need to file the bill of sale with local or state authorities, especially if it involves real estate or registered assets.

Business Bill of Sale Example

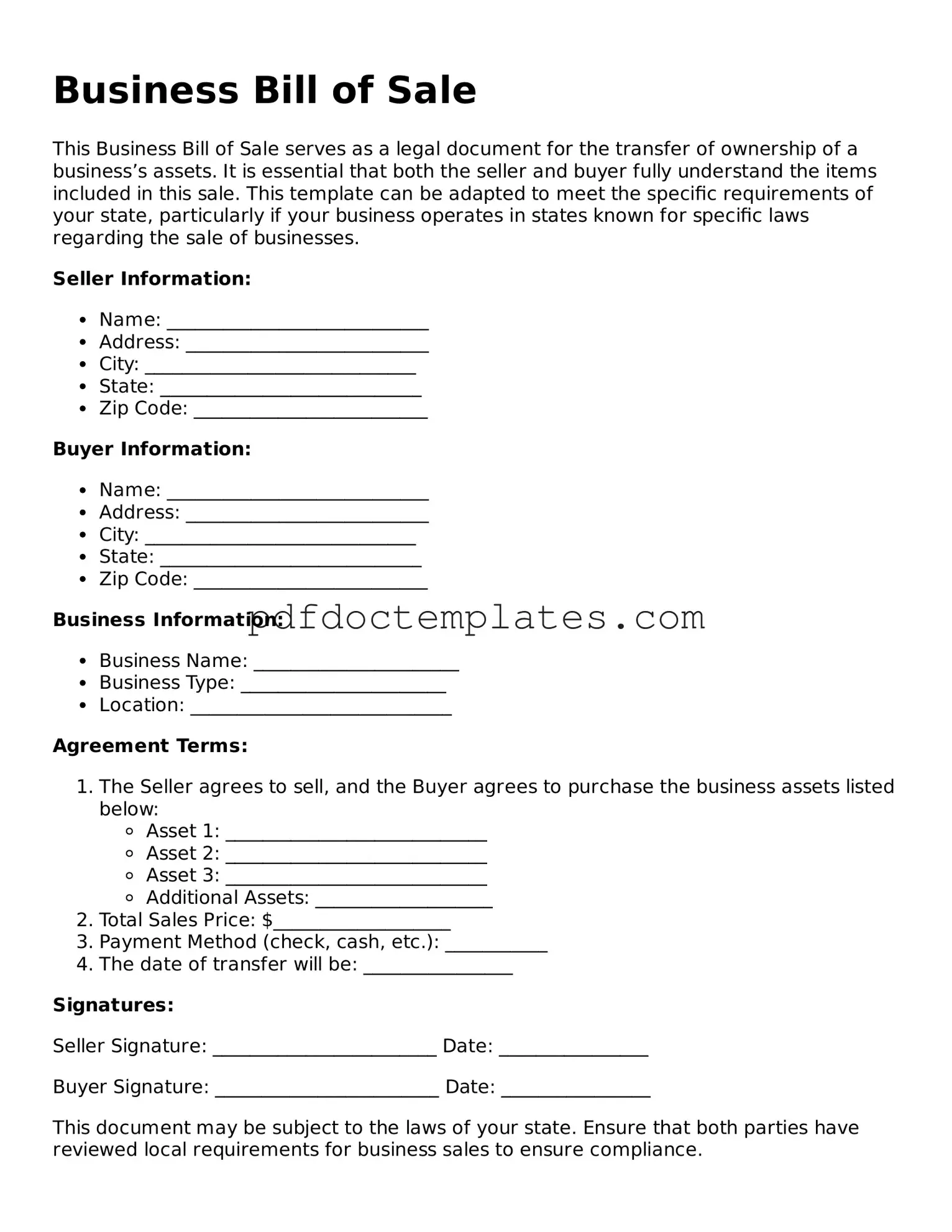

Business Bill of Sale

This Business Bill of Sale serves as a legal document for the transfer of ownership of a business’s assets. It is essential that both the seller and buyer fully understand the items included in this sale. This template can be adapted to meet the specific requirements of your state, particularly if your business operates in states known for specific laws regarding the sale of businesses.

Seller Information:

- Name: ____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- Zip Code: _________________________

Buyer Information:

- Name: ____________________________

- Address: __________________________

- City: _____________________________

- State: ____________________________

- Zip Code: _________________________

Business Information:

- Business Name: ______________________

- Business Type: ______________________

- Location: ____________________________

Agreement Terms:

- The Seller agrees to sell, and the Buyer agrees to purchase the business assets listed below:

- Asset 1: ____________________________

- Asset 2: ____________________________

- Asset 3: ____________________________

- Additional Assets: ___________________

- Total Sales Price: $___________________

- Payment Method (check, cash, etc.): ___________

- The date of transfer will be: ________________

Signatures:

Seller Signature: ________________________ Date: ________________

Buyer Signature: ________________________ Date: ________________

This document may be subject to the laws of your state. Ensure that both parties have reviewed local requirements for business sales to ensure compliance.

Different Types of Business Bill of Sale Forms:

Equine Bill of Sale - The document can serve as a deterrent against misrepresentation during the sale.

The Texas Bill of Sale form is essential for documenting the transfer of ownership when buying or selling items in Texas. This legal document acts as proof of purchase and includes vital information such as the item description, sale price, and transaction date. To ensure a smooth sale, it's important to accurately complete the form. For further assistance, you can find templates that cater to your needs at All Texas Forms.