Download Auto Insurance Card Template

Misconceptions

Understanding the Auto Insurance Card form is crucial for vehicle owners. However, several misconceptions can lead to confusion. Here are four common misunderstandings:

- The card is only needed for accidents. Many people believe that the insurance card is only necessary when an accident occurs. In reality, this card should be kept in the vehicle at all times. It serves as proof of insurance during traffic stops or when requested by law enforcement.

- All insurance cards are the same. Some individuals think that all auto insurance cards provide the same information and coverage. Each card is unique to the policyholder and includes specific details such as the policy number, effective dates, and vehicle information. Always check your card to ensure it reflects your current coverage.

- The expiration date is not important. A common belief is that as long as you have an insurance card, the expiration date does not matter. This is incorrect. An expired insurance card may not be accepted as valid proof of coverage. It is essential to renew your policy and obtain an updated card before the expiration date.

- Only the driver needs to know the details on the card. Many assume that only the driver should be aware of the information on the insurance card. In fact, all passengers should be familiar with the details, especially in case of an accident. Knowing the insurance company and policy number can expedite the claims process.

By addressing these misconceptions, vehicle owners can better understand the importance of their Auto Insurance Card and ensure they are prepared in various situations.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The Auto Insurance Card serves as proof of insurance coverage for the vehicle, ensuring that drivers can demonstrate compliance with state insurance laws. |

| Required Information | Each card must include essential details such as the insurance company number, policy number, effective date, expiration date, vehicle make/model, and the vehicle identification number (VIN). |

| Legal Requirement | Most states mandate that drivers keep this card in their vehicle at all times and present it upon request, particularly in the event of an accident. |

| Accident Protocol | In the event of an accident, the insured must report it to their insurance agent or company as soon as possible and gather information from all parties involved. |

| Watermark Feature | The front of the Auto Insurance Card includes an artificial watermark, which can be viewed by holding the card at an angle, providing an additional layer of security against fraud. |

Key takeaways

When filling out and using the Auto Insurance Card form, it is important to keep several key points in mind.

- The form includes essential information such as company number, policy number, and effective and expiration dates.

- It is crucial to accurately enter the vehicle identification number and details about the vehicle's make and model.

- This card must be kept in the insured vehicle at all times.

- In the event of an accident, present the card upon demand to law enforcement or other parties involved.

- Report all accidents to your insurance agent or company as soon as possible to ensure proper handling of claims.

- Collect necessary information from the accident scene, including the names and addresses of drivers, passengers, and witnesses.

Additionally, be aware that the front of the document contains an artificial watermark, which can be viewed by holding the card at an angle.

Dos and Don'ts

When filling out the Auto Insurance Card form, attention to detail is crucial. Below is a list of essential dos and don'ts to guide you through the process.

- Do ensure that all information is accurate and up-to-date.

- Do include your full name as it appears on your insurance policy.

- Do provide the correct vehicle identification number (VIN).

- Do double-check the effective and expiration dates for accuracy.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; every section is important.

- Don't use abbreviations that may confuse the reader.

- Don't submit the form without reviewing it for errors.

- Don't forget to sign and date the form if required.

- Don't ignore the instructions on the reverse side of the card.

By following these guidelines, you can ensure that your Auto Insurance Card form is completed correctly, helping you avoid potential issues in the future.

Common mistakes

-

Failing to include the insurance company number. This number is crucial for identifying your insurance provider.

-

Not providing the correct policy number. Ensure this number matches your insurance documents to avoid issues during claims.

-

Leaving out the effective date or expiration date. Both dates are necessary to validate the coverage period.

-

Incorrectly entering the vehicle identification number (VIN). This number must match the vehicle’s registration to confirm coverage.

-

Not keeping the card in the vehicle. Remember, it must be readily available for presentation in case of an accident.

What You Should Know About This Form

-

What is the purpose of the Auto Insurance Card?

The Auto Insurance Card serves as proof of insurance for your vehicle. It contains essential information, such as your insurance company details, policy number, and the effective and expiration dates of your coverage. Keeping this card in your vehicle is mandatory, as it must be presented upon request during traffic stops or in the event of an accident.

-

What information is included on the Auto Insurance Card?

Your Auto Insurance Card includes several critical pieces of information:

- Insurance identification card number

- Company name and number

- Your specific policy number

- Effective and expiration dates of the policy

- Year, make, and model of your vehicle

- Vehicle Identification Number (VIN)

- Agency or company that issued the card

All these details confirm that you have valid auto insurance coverage.

-

What should I do if I lose my Auto Insurance Card?

If your Auto Insurance Card is lost or damaged, contact your insurance company or agent immediately. They can issue a replacement card, ensuring you remain compliant with state laws. It is crucial to have an updated card in your vehicle at all times.

-

What happens if I do not have my Auto Insurance Card with me?

Failing to present your Auto Insurance Card when required can lead to penalties, including fines or even a citation. It is advisable to keep a physical copy in your vehicle and consider storing a digital version on your smartphone for emergencies.

-

How should I handle an accident if I have my Auto Insurance Card?

In the event of an accident, you must present your Auto Insurance Card to the other party involved. Additionally, gather important information such as:

- The names and addresses of all drivers, passengers, and witnesses

- The insurance company names and policy numbers of all vehicles involved

Report the accident to your insurance agent or company as soon as possible to initiate the claims process.

-

What is the significance of the watermark on the Auto Insurance Card?

The front of the Auto Insurance Card features an artificial watermark. This design element helps verify the authenticity of the document. To view the watermark, hold the card at an angle. This measure is in place to prevent fraud and ensure that the card is legitimate.

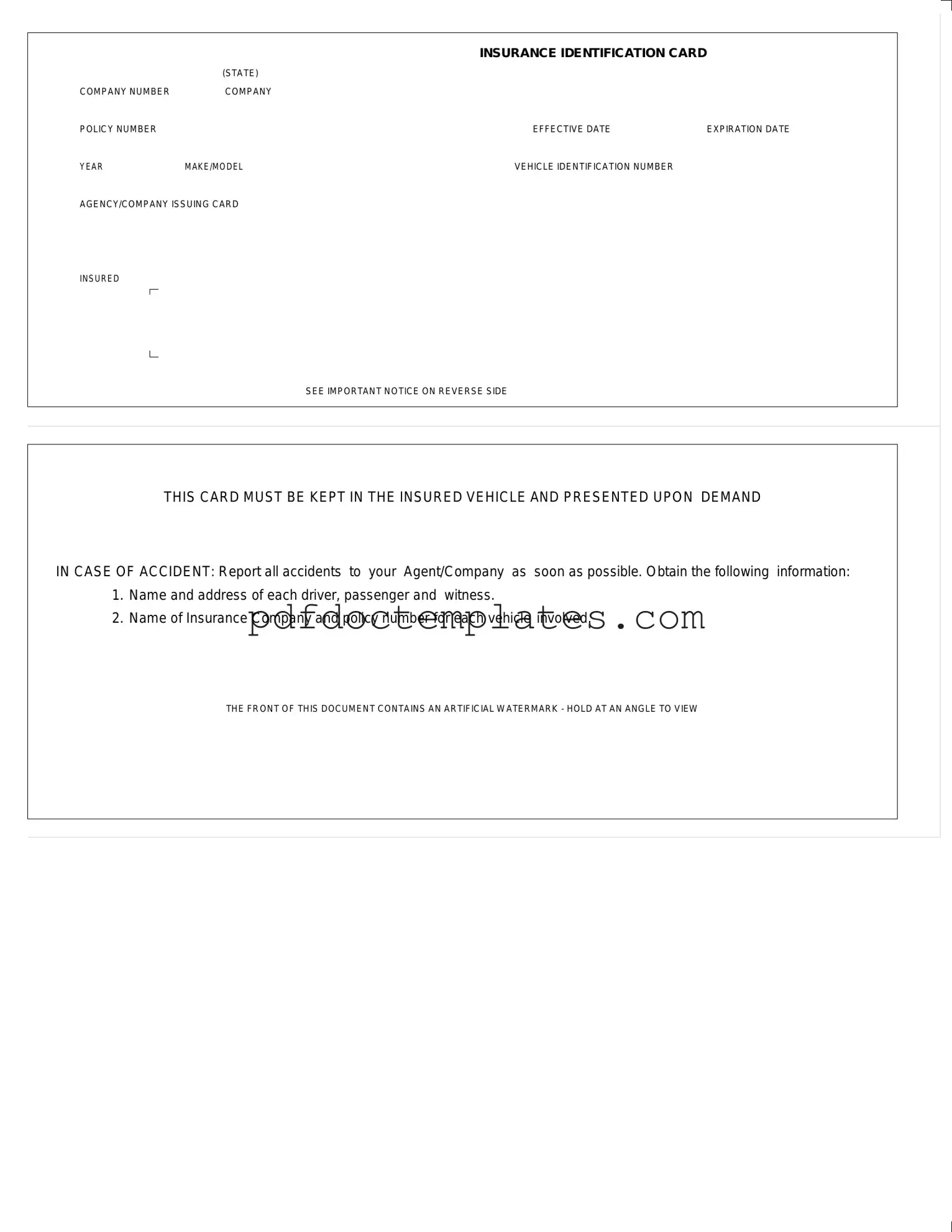

Auto Insurance Card Example

|

|

INSURANCE IDENTIFICATION CARD |

|

|

(STATE) |

|

|

COMPANY NUMBER |

COMPANY |

|

|

POLICY NUMBER |

|

EFFECTIVE DATE |

EXPIRATION DATE |

YEAR |

MAKE/MODEL |

VEHICLE IDENTIFICATION NUMBER |

|

AGENCY/COMPANY ISSUING CARD

INSURED

SEE IMPORTANT NOTICE ON REVERSE SIDE

THIS CARD MUST BE KEPT IN THE INSURED VEHICLE AND PRESENTED UPON DEMAND

IN CASE OF ACCIDENT: Report all accidents to your Agent/Company as soon as possible. Obtain the following information:

1.Name and address of each driver, passenger and witness.

2.Name of Insurance Company and policy number for each vehicle involved.

THE FRONT OF THIS DOCUMENT CONTAINS AN ARTIFICIAL WATERMARK - HOLD AT AN ANGLE TO VIEW

Consider More Forms

Cg 2010 07 04 - This endorsement can help reduce the overall risk exposure for those involved in projects.

A well-prepared Power of Attorney form in New York is essential for delegating important responsibilities to a trusted individual, ensuring that sensitive financial and medical decisions are handled competently in times of need. To help facilitate this process, you can find resources and templates through All New York Forms, which simplify the creation of this vital legal document and ensure clarity in your decision-making authority.

Faa Form 8050-2 - It is recommended to keep multiple copies of the completed form for records.