Printable Articles of Incorporation Template

Articles of Incorporation - Customized for State

Misconceptions

The Articles of Incorporation is a crucial document for establishing a corporation. However, several misconceptions surround this form. Understanding these misconceptions can aid individuals and businesses in navigating the incorporation process more effectively.

- Misconception 1: The Articles of Incorporation are only necessary for large businesses.

- Misconception 2: Filing Articles of Incorporation guarantees business success.

- Misconception 3: The Articles of Incorporation are the same in every state.

- Misconception 4: You can file Articles of Incorporation at any time without restrictions.

- Misconception 5: The Articles of Incorporation do not need to be updated.

- Misconception 6: Only lawyers can file Articles of Incorporation.

- Misconception 7: The Articles of Incorporation are the only document needed to start a corporation.

- Misconception 8: Once filed, the Articles of Incorporation cannot be changed.

- Misconception 9: The Articles of Incorporation are a public document and can be accessed by anyone.

This is false. Any business entity that wishes to incorporate, regardless of size, must file Articles of Incorporation.

Incorporation does not ensure profitability or success. It merely provides a legal structure and liability protection.

Each state has its own requirements and forms for Articles of Incorporation. It is essential to refer to the specific regulations of the state where incorporation is sought.

While there are generally no strict deadlines, certain business activities may require timely filing to comply with state laws.

Changes in the corporation, such as amendments to the structure or purpose, may necessitate updates to the Articles of Incorporation.

While legal assistance can be beneficial, individuals can file the Articles of Incorporation themselves, provided they follow the state guidelines.

In addition to the Articles of Incorporation, businesses may need other documents, such as bylaws and operating agreements, depending on their structure.

Amendments to the Articles of Incorporation can be made, allowing for adjustments as the business evolves.

While the Articles are generally public records, access may vary by state, and certain information may be restricted.

Form Properties

| Fact Name | Description |

|---|---|

| Purpose | The Articles of Incorporation establish a corporation's existence and outline its basic structure, including its name, purpose, and registered agent. |

| State-Specific Requirements | Each state has unique requirements for filing Articles of Incorporation, including specific information that must be included and fees that must be paid. |

| Governing Laws | In the United States, the governing laws for Articles of Incorporation vary by state. For example, in California, the relevant law is the California Corporations Code. |

| Filing Process | To complete the incorporation process, the Articles must be filed with the appropriate state agency, often the Secretary of State, along with any required fees. |

Key takeaways

Filling out the Articles of Incorporation form is a crucial step in establishing a corporation. Here are some key takeaways to consider:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for a corporation, outlining its structure and purpose.

- Choose a Name: Select a unique name for your corporation that complies with state regulations and is not already in use.

- Designate a Registered Agent: Appoint a registered agent who will receive legal documents on behalf of the corporation.

- Include Business Purpose: Clearly state the purpose of the corporation, which can be broad or specific depending on your business goals.

- Identify Directors: List the names and addresses of the initial directors who will oversee the corporation.

- Specify Stock Information: Indicate the number of shares the corporation is authorized to issue and their par value, if applicable.

- Filing Fees: Be aware that there are filing fees associated with submitting the Articles of Incorporation, which vary by state.

- Review State Requirements: Each state has specific requirements for the Articles of Incorporation, so ensure compliance with local laws.

- Obtain Copies: After filing, obtain certified copies of the Articles for your records and for future business needs.

Taking these steps will help ensure a smooth incorporation process and establish a solid foundation for your business.

Dos and Don'ts

When filling out the Articles of Incorporation form, it is essential to be thorough and accurate. Here is a list of dos and don'ts to consider:

- Do ensure that all information is complete and accurate.

- Do use clear and concise language throughout the form.

- Do double-check the names and addresses of all incorporators.

- Do include the purpose of the corporation in the designated section.

- Don't leave any sections blank unless specifically instructed.

- Don't use abbreviations that may cause confusion.

- Don't forget to sign and date the form before submission.

- Don't submit the form without reviewing the filing fees required.

Common mistakes

-

Incorrect Business Name: Many individuals fail to ensure that the chosen name for their corporation is unique and not already in use. It's essential to conduct a thorough name search to avoid potential legal issues down the line.

-

Missing Registered Agent Information: A registered agent is necessary for receiving legal documents. Some people neglect to provide accurate details or fail to designate an agent altogether, which can lead to complications.

-

Inaccurate Purpose Statement: The purpose of the corporation must be clearly defined. Vague or overly broad statements can result in misunderstandings or even rejection of the application.

-

Failure to Include Required Signatures: All necessary parties must sign the Articles of Incorporation. Omitting signatures can delay the incorporation process or invalidate the document.

-

Improper Filing Fee Payment: Each state requires a specific fee for filing. Some individuals either underpay or forget to include payment altogether, which can halt the processing of their application.

-

Not Adhering to State-Specific Requirements: Each state has its own rules regarding Articles of Incorporation. Failing to follow these specific regulations can lead to rejection of the filing.

-

Ignoring Additional Documentation: Some states require supplementary documents, such as bylaws or initial reports. Overlooking these can result in delays or complications in the incorporation process.

What You Should Know About This Form

-

What is the Articles of Incorporation form?

The Articles of Incorporation form is a legal document that establishes a corporation in the United States. It outlines basic information about the corporation, such as its name, purpose, and structure. Filing this form is a crucial step in forming a corporation.

-

Why do I need to file Articles of Incorporation?

Filing the Articles of Incorporation is necessary to create a legal entity that is separate from its owners. This provides liability protection for the owners and allows the corporation to conduct business, enter contracts, and own property in its own name.

-

What information is required on the Articles of Incorporation form?

The form typically requires the following information:

- The name of the corporation

- The principal office address

- The purpose of the corporation

- The name and address of the registered agent

- The number of shares the corporation is authorized to issue

-

How do I file the Articles of Incorporation?

Filing can usually be done online through your state’s Secretary of State website. You may also file by mail. Be sure to check your state’s specific requirements and fees associated with the filing process.

-

What is the difference between Articles of Incorporation and Bylaws?

The Articles of Incorporation establish the corporation's existence and basic structure, while Bylaws provide the rules for how the corporation will operate. Bylaws cover topics like management, meetings, and voting procedures.

-

Are there any fees associated with filing the Articles of Incorporation?

Yes, there are typically filing fees that vary by state. These fees can range from a few hundred dollars to over a thousand. It's important to check your state’s website for the exact fee and payment methods.

-

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary widely by state. Some states may process your filing within a few days, while others may take several weeks. You can often find estimated processing times on your state’s Secretary of State website.

-

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation if changes are needed. This typically involves filing an amendment form with your state’s Secretary of State and may require additional fees.

-

What happens if I don’t file the Articles of Incorporation?

If you do not file the Articles of Incorporation, your business will not be recognized as a corporation. This means you will not have the legal protections that come with incorporation, and you may be personally liable for business debts and obligations.

-

Can I file the Articles of Incorporation myself?

Yes, individuals can file the Articles of Incorporation without a lawyer. However, it is often beneficial to consult with a legal professional to ensure that all information is accurate and that you are meeting all state requirements.

Articles of Incorporation Example

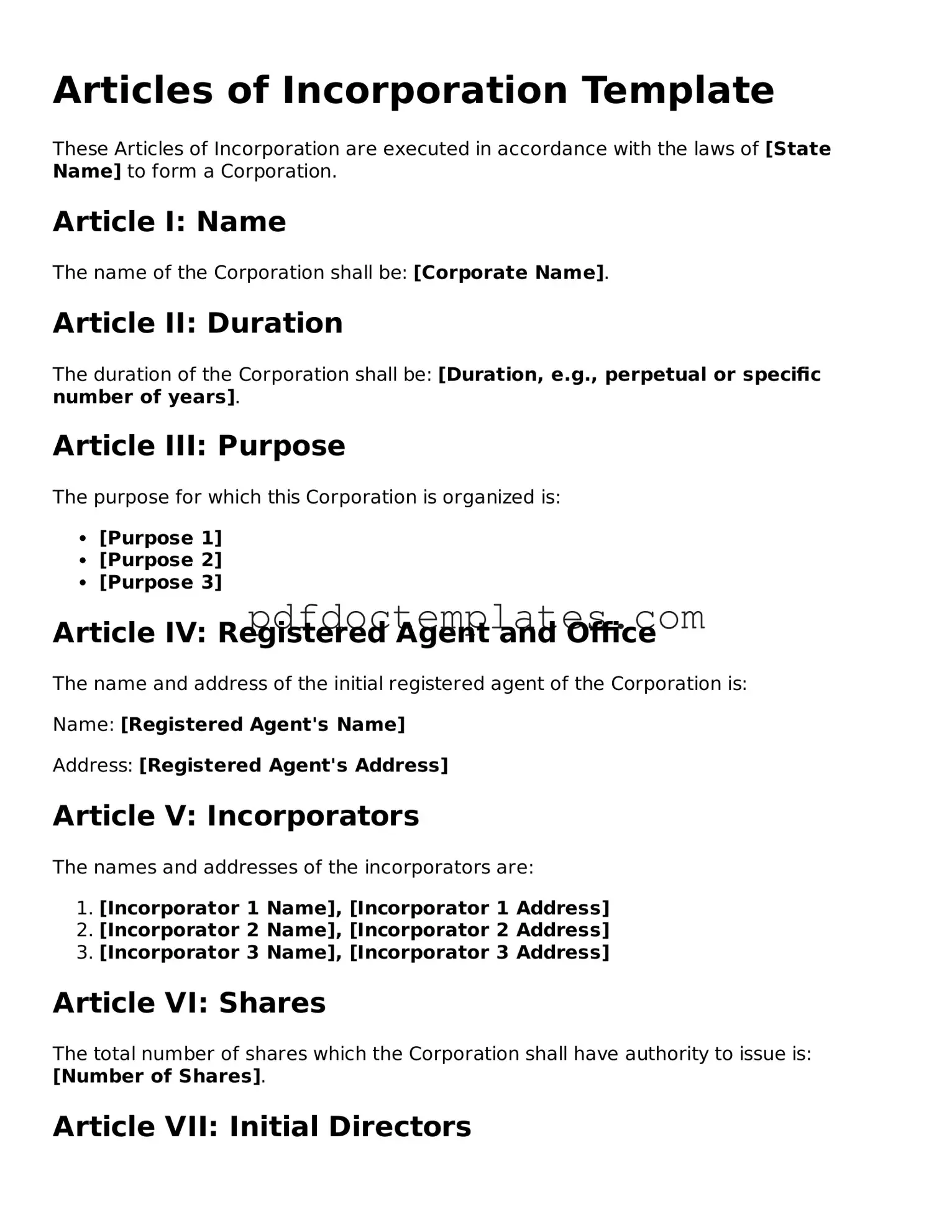

Articles of Incorporation Template

These Articles of Incorporation are executed in accordance with the laws of [State Name] to form a Corporation.

Article I: Name

The name of the Corporation shall be: [Corporate Name].

Article II: Duration

The duration of the Corporation shall be: [Duration, e.g., perpetual or specific number of years].

Article III: Purpose

The purpose for which this Corporation is organized is:

- [Purpose 1]

- [Purpose 2]

- [Purpose 3]

Article IV: Registered Agent and Office

The name and address of the initial registered agent of the Corporation is:

Name: [Registered Agent's Name]

Address: [Registered Agent's Address]

Article V: Incorporators

The names and addresses of the incorporators are:

- [Incorporator 1 Name], [Incorporator 1 Address]

- [Incorporator 2 Name], [Incorporator 2 Address]

- [Incorporator 3 Name], [Incorporator 3 Address]

Article VI: Shares

The total number of shares which the Corporation shall have authority to issue is: [Number of Shares].

Article VII: Initial Directors

The number of initial directors constituting the board of directors of the Corporation is: [Number of Directors].

Article VIII: Indemnification

The Corporation shall indemnify its officers and directors to the fullest extent permitted by the laws of [State Name].

Signature

We, the undersigned incorporators, hereby declare and affirm under penalty of perjury that the facts stated herein are true and correct.

Executed on this [Execution Date].

Incorporators:

- [Incorporator 1 Signature]

- [Incorporator 2 Signature]

- [Incorporator 3 Signature]

Find Other Forms

Gift Letter Sample - Many lenders provide a template for the Gift Letter for convenience.

When entering into agreements that involve sensitive information, it is crucial for individuals and businesses to utilize a structured approach. The Florida Non-disclosure Agreement (NDA) form serves as a key tool in this process, ensuring that all parties involved are aware of the importance of confidentiality. For those looking for a reliable template, All Florida Forms provides an accessible resource that meets the specific legal requirements necessary in the state, facilitating a trustworthy environment for sharing important data.

Doctors Return to Work Note - This form must be completed to initiate the work release process.