Blank Transfer-on-Death Deed Document for Arizona

Misconceptions

Understanding the Arizona Transfer-on-Death Deed (TODD) can help individuals make informed decisions about their estate planning. However, several misconceptions surround this legal tool. Here are seven common misunderstandings:

- It automatically transfers property upon death. Many believe that a TODD transfers property immediately after the owner passes away. In reality, the transfer only occurs after the death of the owner, and the deed must be recorded with the county recorder's office to be effective.

- It eliminates the need for a will. Some individuals think that using a TODD means they do not need a will. While a TODD can simplify the transfer of specific property, it does not replace a will. A will is still necessary for distributing other assets and addressing matters not covered by the TODD.

- All property can be transferred using a TODD. Not all types of property are eligible for transfer via a TODD. For instance, properties held in a trust or those that have joint ownership may not be suitable for this type of deed.

- It avoids probate entirely. A common belief is that a TODD completely bypasses the probate process. While it does allow for a smoother transfer of property, it does not eliminate the need for probate for other assets in the estate.

- It cannot be revoked. Some people think that once a TODD is executed, it cannot be changed. However, the property owner can revoke or modify the TODD at any time before their death, as long as they follow the proper legal procedures.

- Only certain individuals can be named as beneficiaries. There is a misconception that only family members can be designated as beneficiaries on a TODD. In fact, anyone can be named as a beneficiary, including friends or charitable organizations.

- It is only for married couples. Many believe that TODDs are only beneficial for married couples. However, single individuals, divorced persons, and widows or widowers can also utilize this deed to ensure their property is transferred according to their wishes.

By addressing these misconceptions, individuals can better navigate their estate planning options and make choices that align with their goals.

Form Properties

| Fact Name | Details |

|---|---|

| What is a Transfer-on-Death Deed? | A Transfer-on-Death (TOD) Deed allows property owners in Arizona to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed is governed by Arizona Revised Statutes, specifically Title 33, Chapter 4, Article 1.5. |

| Beneficiary Designation | Property owners can designate one or more beneficiaries. This can include individuals or entities such as trusts. |

| Revocation | A TOD Deed can be revoked or changed at any time by the property owner, as long as they are alive and competent. |

| Filing Requirements | The TOD Deed must be recorded with the county recorder's office in the county where the property is located to be effective. |

| Tax Implications | Transfer-on-Death Deeds do not affect property taxes until the property is transferred to the beneficiary. |

| Limitations | Not all types of property can be transferred via a TOD Deed. For instance, certain types of jointly owned properties may have restrictions. |

| Effectiveness | The deed becomes effective upon the death of the property owner, ensuring a smooth transition of ownership to the designated beneficiaries. |

Key takeaways

Filling out and using the Arizona Transfer-on-Death Deed form can simplify the transfer of property upon death. Here are some key takeaways to consider:

- The Transfer-on-Death Deed allows property owners to transfer their real estate directly to beneficiaries without going through probate.

- To create a valid deed, the property owner must be of sound mind and at least 18 years old.

- It is essential to include the legal description of the property accurately to avoid any issues later.

- Beneficiaries can be individuals or entities, such as trusts or charities.

- The deed must be signed by the property owner in the presence of a notary public.

- After signing, the deed must be recorded with the county recorder’s office where the property is located.

- Filing the deed is a one-time process; no ongoing maintenance is required.

- Property owners can revoke or change the deed at any time before their death by filing a new deed.

- Tax implications may arise upon the transfer of property, so consulting a tax professional is advisable.

- Once the property owner passes away, the transfer occurs automatically, and the beneficiaries receive full ownership without delay.

Dos and Don'ts

When filling out the Arizona Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure that the process goes smoothly. Here are ten key do's and don'ts:

- Do provide accurate information about the property.

- Do include the names of all intended beneficiaries.

- Do sign the form in the presence of a notary.

- Do keep a copy of the completed form for your records.

- Do check for any local requirements that may apply.

- Don't leave any fields blank unless instructed.

- Don't forget to date the form when signing.

- Don't use white-out or make alterations to the form.

- Don't submit the form without proper notarization.

- Don't assume the form is valid without confirming local laws.

Common mistakes

-

Incomplete Information: One common mistake is failing to provide all necessary details. This includes not listing the full names of the property owners or the beneficiaries. Ensure that all parties are correctly identified.

-

Incorrect Legal Descriptions: Using inaccurate or vague legal descriptions of the property can lead to confusion. It’s important to use the exact language found in the property deed to avoid issues during transfer.

-

Not Signing the Document: A Transfer-on-Death Deed must be signed by the property owner. Neglecting to sign can render the deed invalid. Ensure that all required signatures are present before submission.

-

Failure to Notarize: In Arizona, the deed must be notarized to be legally binding. Skipping this step can prevent the deed from being recognized by the court.

-

Improper Recording: After completing the deed, it must be recorded with the county recorder's office. Failing to do so means that the deed may not be enforceable, and the intended transfer may not occur.

-

Not Updating the Deed: Life changes, such as marriage or divorce, can affect the validity of the deed. Regularly reviewing and updating the deed ensures that it reflects current intentions and circumstances.

What You Should Know About This Form

-

What is a Transfer-on-Death Deed in Arizona?

A Transfer-on-Death Deed (TODD) is a legal document that allows property owners in Arizona to designate a beneficiary who will receive their property upon their death. This deed enables the transfer of real estate without going through probate, simplifying the process for heirs.

-

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Arizona can use a Transfer-on-Death Deed. This includes homeowners and property owners, regardless of whether they are single or married. However, it is important to note that the property must be solely owned by the individual creating the deed.

-

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, the property owner must fill out the appropriate form, which includes details about the property and the designated beneficiary. The deed must then be signed in front of a notary public and recorded with the county recorder's office where the property is located. It is advisable to keep a copy for personal records.

-

Can I change or revoke a Transfer-on-Death Deed after it is created?

Yes, a Transfer-on-Death Deed can be changed or revoked at any time before the property owner's death. To do this, the owner must create a new deed that explicitly revokes the previous one or record a revocation document with the county recorder's office. It is crucial to ensure that the new deed is properly executed and recorded to avoid confusion.

-

What happens if the beneficiary dies before the property owner?

If the designated beneficiary dies before the property owner, the Transfer-on-Death Deed will not automatically transfer the property to that beneficiary's heirs. The property owner may choose to designate a new beneficiary or allow the property to pass through probate according to state laws.

-

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, the transfer of property through a Transfer-on-Death Deed does not trigger immediate tax consequences. However, the beneficiary may be responsible for property taxes and other obligations once the property is transferred. It is advisable for beneficiaries to consult a tax professional to understand any potential tax liabilities.

-

Is legal assistance necessary to complete a Transfer-on-Death Deed?

While it is possible to complete a Transfer-on-Death Deed without legal assistance, consulting an attorney is recommended. An attorney can provide guidance on the implications of the deed, ensure that it is filled out correctly, and help avoid potential pitfalls that could affect the transfer of property.

Arizona Transfer-on-Death Deed Example

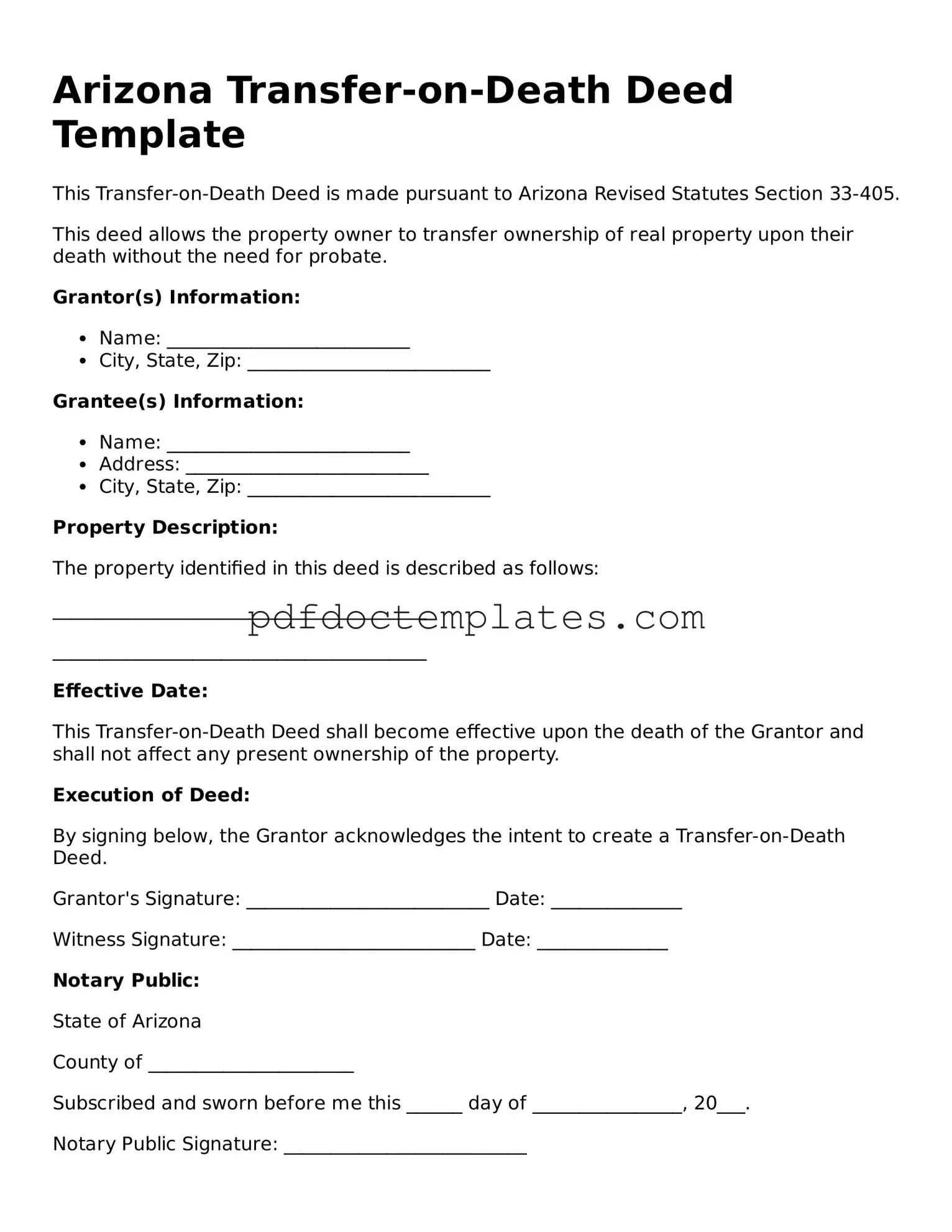

Arizona Transfer-on-Death Deed Template

This Transfer-on-Death Deed is made pursuant to Arizona Revised Statutes Section 33-405.

This deed allows the property owner to transfer ownership of real property upon their death without the need for probate.

Grantor(s) Information:

- Name: __________________________

- City, State, Zip: __________________________

Grantee(s) Information:

- Name: __________________________

- Address: __________________________

- City, State, Zip: __________________________

Property Description:

The property identified in this deed is described as follows:

________________________________________

________________________________________

Effective Date:

This Transfer-on-Death Deed shall become effective upon the death of the Grantor and shall not affect any present ownership of the property.

Execution of Deed:

By signing below, the Grantor acknowledges the intent to create a Transfer-on-Death Deed.

Grantor's Signature: __________________________ Date: ______________

Witness Signature: __________________________ Date: ______________

Notary Public:

State of Arizona

County of ______________________

Subscribed and sworn before me this ______ day of ________________, 20___.

Notary Public Signature: __________________________

My commission expires: ____________

Check out Other Common Transfer-on-Death Deed Templates for US States

Transfer on Death Deed Tennessee Form - Sharing information about the deed with beneficiaries can be helpful.

A Power of Attorney form in New York is a legal document that allows an individual to appoint another person to make important decisions on their behalf. These decisions can span from financial matters to medical care, ensuring that someone is available to manage affairs when the individual cannot do so themselves. For a comprehensive understanding and to avoid any ambiguities, it is advisable to refer to resources such as All New York Forms, which provide essential templates and guidance for securing one’s future decisions and welfare.

Transfer on Death Deed Washington State - Ensure to check state laws, as various states have different rules for Transfer-on-Death Deeds.

Transfer on Death Deed California - Timely execution and filing of the deed are crucial to ensure a smooth property transfer process when the time comes.

How to Transfer Land Ownership - A Transfer-on-Death Deed helps avoid potential conflicts among heirs by clearly designating property ownership in advance.