Blank Tractor Bill of Sale Document for Arizona

Misconceptions

The Arizona Tractor Bill of Sale form is an important document for anyone involved in the sale or purchase of a tractor in the state. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about this form:

- It is not legally required. Many believe that a bill of sale is optional, but in Arizona, it serves as a crucial record of the transaction.

- Only one copy is needed. Some think that a single copy suffices. In reality, both the buyer and seller should retain copies for their records.

- It can be handwritten. While a handwritten bill of sale is acceptable, using a standardized form is often recommended for clarity and completeness.

- All sales are tax-exempt. There is a misconception that tractor sales are exempt from sales tax. In fact, buyers may still be responsible for paying sales tax unless specific exemptions apply.

- It does not need to be notarized. Many assume notarization is unnecessary. However, having the document notarized can add an extra layer of legitimacy and protection.

- It only needs to include the price. Some individuals think listing the sale price is sufficient. However, the form should also include details like the make, model, and VIN of the tractor.

- It is only for private sales. Some people believe the bill of sale is only relevant for private transactions. In fact, it is also important for sales conducted through dealerships.

- Once signed, it cannot be changed. There is a belief that the bill of sale is final once signed. If errors are found, amendments can be made, but both parties must agree to any changes.

- It is not necessary if the tractor is registered. Some think that registration alone negates the need for a bill of sale. However, the bill of sale provides essential proof of ownership transfer.

Understanding these misconceptions is vital for anyone involved in buying or selling a tractor in Arizona. Proper documentation not only protects both parties but also ensures a smooth transaction process.

Form Properties

| Fact Name | Details |

|---|---|

| Purpose | The Arizona Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by Arizona state laws regarding the sale and transfer of personal property. |

| Identification | The form requires identification details for both the buyer and the seller, including names and addresses. |

| Vehicle Information | Details about the tractor must be included, such as make, model, year, and Vehicle Identification Number (VIN). |

| Sale Price | The agreed sale price of the tractor must be clearly stated in the form. |

| Signatures | Both the buyer and seller must sign the document to validate the sale and transfer of ownership. |

| Date of Sale | The date on which the sale occurs should be recorded on the form to establish a timeline. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the transaction. |

| Record Keeping | It is advisable for both parties to keep a copy of the bill of sale for their records. |

| Transfer of Title | The bill of sale is often used in conjunction with the title transfer process to the new owner. |

Key takeaways

When filling out and using the Arizona Tractor Bill of Sale form, it’s important to keep several key points in mind. This document serves as a legal record of the sale and transfer of ownership for a tractor. Here are five essential takeaways:

- Accurate Information: Ensure all details are correct. This includes the names of both the buyer and seller, the tractor's make, model, year, and Vehicle Identification Number (VIN).

- Signatures Required: Both parties must sign the document. This signature confirms that both the buyer and seller agree to the terms of the sale.

- Consider a Notary: While not required, having the bill of sale notarized can add an extra layer of authenticity and may help resolve any disputes in the future.

- Keep Copies: Each party should retain a copy of the signed bill of sale. This serves as proof of the transaction and can be useful for future reference.

- Check Local Regulations: Verify if there are any additional requirements in your county or city. Local regulations may dictate specific forms or additional paperwork needed for tractor sales.

By following these guidelines, you can ensure a smooth transaction and protect your interests in the sale of a tractor in Arizona.

Dos and Don'ts

When filling out the Arizona Tractor Bill of Sale form, it’s important to ensure accuracy and completeness. Here are some dos and don’ts to keep in mind:

- Do provide accurate information about the tractor, including make, model, year, and VIN.

- Do include the sale price clearly to avoid any disputes later.

- Do have both the buyer and seller sign the document to validate the sale.

- Do keep a copy of the completed form for your records.

- Don’t leave any sections blank; fill in all required fields.

- Don’t use white-out or erase any information; if you make a mistake, cross it out and write the correct information.

Common mistakes

-

Incomplete Information: One of the most common mistakes is failing to fill out all required fields. This includes not providing the full names and addresses of both the buyer and the seller. Each piece of information is crucial for establishing a clear record of the transaction.

-

Incorrect Vehicle Identification Number (VIN): The VIN is like a fingerprint for the tractor. If it’s entered incorrectly, it can create confusion or legal issues later on. Always double-check the VIN on the tractor against what is written on the form.

-

Not Including the Sale Price: Some people forget to specify the sale price of the tractor. This detail is important not only for the buyer and seller but also for tax purposes. Ensure the price is clear and accurate.

-

Neglecting to Sign the Document: A signature is a must! Without it, the bill of sale is not legally binding. Both parties should sign the document to confirm their agreement and understanding of the sale.

-

Failure to Keep Copies: After completing the bill of sale, it’s essential to make copies for both the buyer and seller. This serves as proof of the transaction and can be useful for future reference, especially if any disputes arise.

What You Should Know About This Form

-

What is the Arizona Tractor Bill of Sale form?

The Arizona Tractor Bill of Sale form is a document used to record the sale of a tractor between a buyer and a seller in the state of Arizona. This form serves as proof of the transaction and includes important details about the tractor, the parties involved, and the terms of the sale.

-

What information is required on the form?

The form typically requires the following information:

- The names and addresses of both the buyer and the seller.

- The make, model, year, and Vehicle Identification Number (VIN) of the tractor.

- The sale price of the tractor.

- The date of the sale.

- Any warranties or conditions related to the sale.

-

Is the Tractor Bill of Sale form required by law?

While it is not legally required to use a Bill of Sale for every tractor transaction in Arizona, it is highly recommended. This document provides a clear record of the sale and can help prevent disputes between the buyer and seller in the future.

-

How does the buyer use the form after the sale?

After the sale, the buyer should keep a copy of the Bill of Sale for their records. This document may be needed for vehicle registration, insurance purposes, or if any issues arise regarding ownership or condition of the tractor.

-

Can the form be used for other types of equipment?

While the Arizona Tractor Bill of Sale form is specifically designed for tractors, similar forms can be used for other types of agricultural or heavy equipment. It is important to ensure that the form used includes all necessary details relevant to the specific equipment being sold.

-

Where can I obtain the Arizona Tractor Bill of Sale form?

The form can often be found online through various legal document websites or state resources. Additionally, local county assessor offices may provide copies or templates for the Bill of Sale.

Arizona Tractor Bill of Sale Example

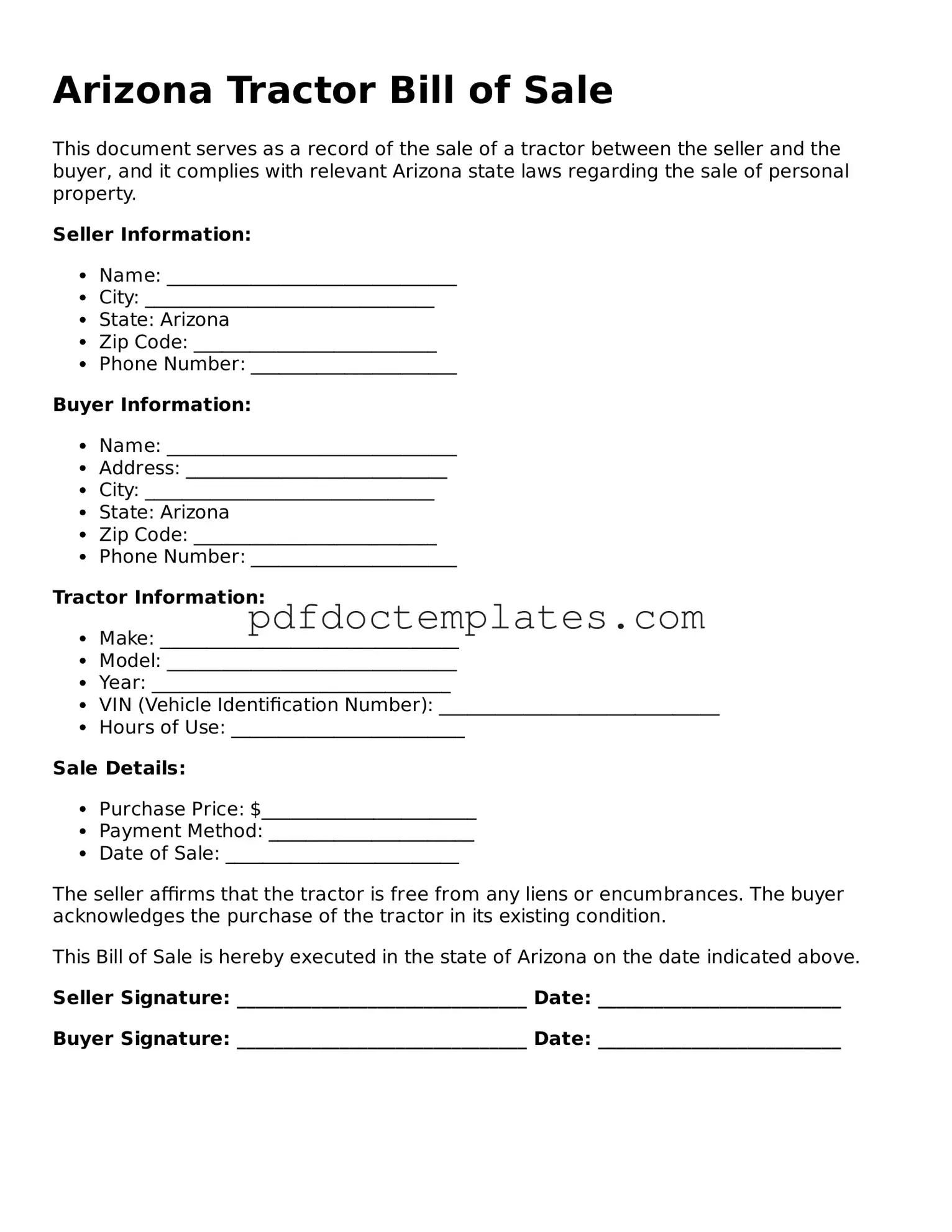

Arizona Tractor Bill of Sale

This document serves as a record of the sale of a tractor between the seller and the buyer, and it complies with relevant Arizona state laws regarding the sale of personal property.

Seller Information:

- Name: _______________________________

- City: _______________________________

- State: Arizona

- Zip Code: __________________________

- Phone Number: ______________________

Buyer Information:

- Name: _______________________________

- Address: ____________________________

- City: _______________________________

- State: Arizona

- Zip Code: __________________________

- Phone Number: ______________________

Tractor Information:

- Make: ________________________________

- Model: _______________________________

- Year: ________________________________

- VIN (Vehicle Identification Number): ______________________________

- Hours of Use: _________________________

Sale Details:

- Purchase Price: $_______________________

- Payment Method: ______________________

- Date of Sale: _________________________

The seller affirms that the tractor is free from any liens or encumbrances. The buyer acknowledges the purchase of the tractor in its existing condition.

This Bill of Sale is hereby executed in the state of Arizona on the date indicated above.

Seller Signature: _______________________________ Date: __________________________

Buyer Signature: _______________________________ Date: __________________________

Check out Other Common Tractor Bill of Sale Templates for US States

Farm Tractor Bill of Sale - The Tractor Bill of Sale includes essential details about the tractor, including make, model, and year.

When creating a Florida Power of Attorney form, it is essential to understand its significance in managing both financial and healthcare decisions. By executing this document, individuals can ensure that their interests are protected and effectively represented, especially during times when they may not be able to communicate their wishes. For more information on obtaining this crucial document, visit All Florida Forms.

Bill of Sale Truck - Provides legal backing during disputes regarding the transaction.