Blank Promissory Note Document for Arizona

Misconceptions

Here are six common misconceptions about the Arizona Promissory Note form, along with explanations for each:

-

All Promissory Notes are the same.

This is not true. Promissory notes can vary in terms of terms, interest rates, and repayment schedules. Each note should be tailored to the specific agreement between the parties involved.

-

A Promissory Note does not need to be in writing.

While verbal agreements can be valid, having a written Promissory Note is essential for clarity and enforceability. A written document helps prevent misunderstandings.

-

Only banks can issue Promissory Notes.

Individuals and businesses can also create and issue Promissory Notes. It's a common way for private lenders to formalize a loan.

-

A Promissory Note guarantees payment.

While a Promissory Note is a promise to pay, it does not guarantee that the borrower will fulfill that promise. If the borrower defaults, the lender may need to take legal action to recover the funds.

-

Once signed, a Promissory Note cannot be changed.

This is a misconception. Both parties can agree to modify the terms of a Promissory Note, but it should be documented in writing and signed by both parties.

-

Promissory Notes are only for large amounts of money.

Promissory Notes can be used for any amount, large or small. They are a flexible tool for personal loans, business transactions, and more.

Form Properties

| Fact Name | Details |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time. |

| Governing Law | The Arizona Promissory Note is governed by Arizona Revised Statutes, Title 47, which covers commercial transactions. |

| Parties Involved | The note typically involves two parties: the borrower (maker) and the lender (payee). |

| Interest Rate | The interest rate can be fixed or variable, and should be clearly stated in the document. |

| Payment Terms | Payment terms, including due dates and installment amounts, must be explicitly outlined in the note. |

| Default Clause | A default clause is often included, detailing the consequences if the borrower fails to make payments. |

| Signatures Required | The document must be signed by the borrower for it to be legally binding. |

Key takeaways

When filling out and using the Arizona Promissory Note form, it is important to consider the following key points:

- The form must include the names of both the borrower and the lender. This establishes who is involved in the agreement.

- Clearly state the loan amount. The total sum being borrowed should be written in both numbers and words for clarity.

- Include the interest rate, if applicable. This specifies how much extra the borrower will pay on top of the principal amount.

- Define the repayment terms. Specify the schedule for payments, including the due dates and frequency (e.g., monthly, quarterly).

- Include any late fees. This informs the borrower of potential additional costs if payments are not made on time.

- State the maturity date. This is the date by which the loan must be fully repaid.

- Consider including a prepayment clause. This allows the borrower to pay off the loan early without penalties.

- Both parties should sign and date the document. This indicates mutual agreement and acceptance of the terms.

- Keep a copy of the signed note for personal records. This provides proof of the loan agreement for both parties.

- Consult with a legal professional if there are any uncertainties. This ensures that the document meets all legal requirements and protects the interests of both parties.

Dos and Don'ts

When filling out the Arizona Promissory Note form, it's important to follow specific guidelines to ensure the document is valid and effective. Here are nine things to keep in mind:

- Do: Clearly state the names of the borrower and lender.

- Do: Specify the loan amount in both numbers and words.

- Do: Include the interest rate, if applicable.

- Do: Outline the repayment schedule, including due dates.

- Do: Sign and date the document in the appropriate places.

- Don't: Leave any sections blank; fill in all required fields.

- Don't: Use vague language; be specific about terms and conditions.

- Don't: Forget to keep a copy for your records.

- Don't: Ignore state laws that may affect the note's enforceability.

Common mistakes

-

Failing to include the correct date. It’s essential to write the date when the note is signed, as this establishes the timeline for repayment.

-

Not clearly identifying the parties involved. Make sure to include full names and addresses for both the borrower and the lender.

-

Omitting the loan amount. Clearly state the principal amount being borrowed to avoid confusion later on.

-

Neglecting to specify the interest rate. If applicable, include the exact interest rate to clarify the cost of borrowing.

-

Not detailing the repayment terms. Specify how and when the borrower will repay the loan, including any installment amounts and due dates.

-

Leaving out late fees or penalties. If there are consequences for late payments, these should be clearly outlined to prevent misunderstandings.

-

Failing to include a default clause. This clause explains what happens if the borrower fails to make payments as agreed.

-

Not signing the document. Both parties must sign the note for it to be legally binding.

-

Ignoring the need for witnesses or notarization. Depending on the situation, having a witness or notary can add an extra layer of validity.

-

Using vague language. Be clear and specific in all terms to avoid ambiguity that could lead to disputes later on.

What You Should Know About This Form

-

What is a Promissory Note in Arizona?

A Promissory Note is a legal document that outlines a borrower's promise to repay a specified amount of money to a lender at a designated time. In Arizona, this document is crucial for both personal and business transactions. It serves as a written record of the loan agreement and includes details such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. Having a clear Promissory Note helps protect both parties by establishing the terms of the loan.

-

What are the key components of an Arizona Promissory Note?

When creating a Promissory Note in Arizona, several essential components must be included:

- Loan Amount: Clearly state the total amount being borrowed.

- Interest Rate: Specify the interest rate, whether it’s fixed or variable.

- Repayment Schedule: Outline how and when payments will be made, including due dates.

- Default Terms: Describe what happens if the borrower fails to make payments.

- Signatures: Both parties must sign the document to make it legally binding.

Including these components ensures that both the borrower and lender have a clear understanding of their obligations.

-

Do I need a lawyer to create a Promissory Note in Arizona?

While it is not legally required to have a lawyer draft a Promissory Note, it is highly advisable. Legal professionals can help ensure that the document complies with Arizona laws and meets the specific needs of both parties. A well-drafted Promissory Note can prevent misunderstandings and disputes in the future. If you choose to create one on your own, make sure to research and follow all legal requirements to avoid potential issues.

-

What happens if a borrower defaults on a Promissory Note?

If a borrower defaults, meaning they fail to make payments as agreed, the lender has several options. First, the lender can attempt to work with the borrower to create a new payment plan or offer a grace period. If that doesn’t work, the lender may pursue legal action to recover the owed amount. This could involve filing a lawsuit or seeking a judgment against the borrower. The terms outlined in the Promissory Note will dictate the specific actions that can be taken. It’s crucial for both parties to understand these terms before signing.

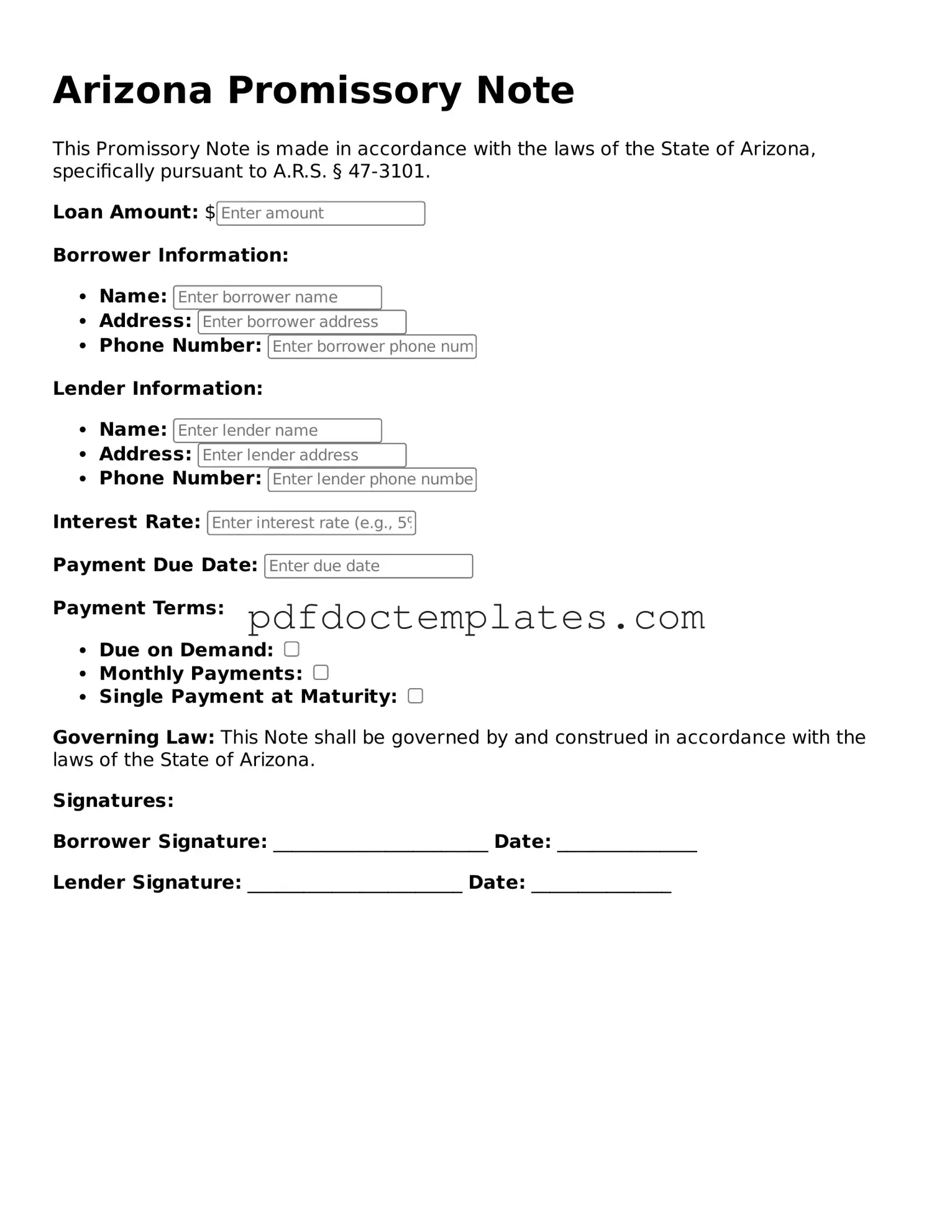

Arizona Promissory Note Example

Arizona Promissory Note

This Promissory Note is made in accordance with the laws of the State of Arizona, specifically pursuant to A.R.S. § 47-3101.

Loan Amount: $

Borrower Information:

- Name:

- Address:

- Phone Number:

Lender Information:

- Name:

- Address:

- Phone Number:

Interest Rate:

Payment Due Date:

Payment Terms:

- Due on Demand:

- Monthly Payments:

- Single Payment at Maturity:

Governing Law: This Note shall be governed by and construed in accordance with the laws of the State of Arizona.

Signatures:

Borrower Signature: _______________________ Date: _______________

Lender Signature: _______________________ Date: _______________

Check out Other Common Promissory Note Templates for US States

Tennessee Promissory Note - Parties are encouraged to review the note with legal counsel if unsure about any terms.

Michigan Promissory Note - Cross-collateralization may be included in some promissory notes to secure the debt with multiple assets.

Promissory Note Virginia - The note typically indicates whether payments will be made in cash, check, or electronically.

The Florida Power of Attorney for a Child form is a crucial legal document for parents, providing a structured way to ensure that their child(ren) are cared for in their absence. By allowing another adult to make decisions and look after the child’s needs, this form helps maintain continuity and security during times when parents may be unavailable, such as during travel, illness, or military deployment. For comprehensive resources, including obtaining the necessary documentation, parents can visit All Florida Forms, which offers a variety of templates and guidance tailored to their needs.

Promissory Note Notarized - The duration of the loan should be clearly outlined in the document.