Blank Durable Power of Attorney Document for Arizona

Misconceptions

When it comes to the Arizona Durable Power of Attorney (DPOA), there are several misconceptions that can lead to confusion. Understanding these can help ensure that you and your loved ones make informed decisions. Here’s a list of common misunderstandings:

- A Durable Power of Attorney is the same as a regular Power of Attorney. While both documents allow someone to act on your behalf, a Durable Power of Attorney remains effective even if you become incapacitated, whereas a regular Power of Attorney does not.

- You must be incapacitated for a Durable Power of Attorney to take effect. This is not true. You can choose to have your DPOA take effect immediately, or you can specify that it only becomes active when you are unable to make decisions for yourself.

- Once a Durable Power of Attorney is signed, it cannot be changed. This is a misconception. You can revoke or modify your DPOA at any time, as long as you are mentally competent to do so.

- All Durable Power of Attorney forms are the same. Not all DPOA forms are created equal. Each state has specific requirements, and it’s crucial to use the Arizona-specific form to ensure it complies with local laws.

- A Durable Power of Attorney can make medical decisions. This is misleading. A DPOA typically covers financial and legal matters. For medical decisions, you would need a separate document, such as a Healthcare Power of Attorney.

- Once a Durable Power of Attorney is in place, the agent has unlimited power. While your agent does have significant authority, their powers can be limited by the terms you set in the DPOA document.

- You cannot use a Durable Power of Attorney if you are already incapacitated. This is incorrect. If you have already designated someone as your agent while you were competent, they can act on your behalf once you become incapacitated.

- A Durable Power of Attorney is only for the elderly. This is a common misconception. Anyone, regardless of age, can benefit from having a DPOA in place to prepare for unforeseen circumstances.

By clarifying these misconceptions, you can better navigate the process of creating a Durable Power of Attorney in Arizona, ensuring that your wishes are respected and your affairs are managed according to your preferences.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | An Arizona Durable Power of Attorney is a legal document that allows an individual (the principal) to appoint someone else (the agent) to make decisions on their behalf, even if the principal becomes incapacitated. |

| Governing Law | The Arizona Durable Power of Attorney is governed by Arizona Revised Statutes, Title 14, Chapter 5. |

| Durability | This document remains effective even if the principal becomes mentally or physically incapacitated. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's wishes outlined in the document. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent. |

| Execution Requirements | The form must be signed by the principal in the presence of a notary public or two witnesses to be valid. |

| Importance | Having a Durable Power of Attorney in place can provide peace of mind, ensuring that personal and financial matters are handled according to the principal's wishes in times of need. |

Key takeaways

When considering a Durable Power of Attorney in Arizona, it's essential to understand the key aspects involved in filling out and using the form. Here are six important takeaways:

- Purpose: A Durable Power of Attorney allows you to designate someone to make financial and legal decisions on your behalf if you become incapacitated.

- Selection of Agent: Choose a trusted individual as your agent. This person will have significant authority over your affairs.

- Durability: The term "durable" means the power of attorney remains effective even if you become mentally incapacitated.

- Specific Powers: Clearly outline the powers you grant to your agent. This can include managing bank accounts, paying bills, or handling real estate transactions.

- Revocation: You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent to do so.

- Legal Requirements: Ensure the form is properly signed and notarized to comply with Arizona state laws.

Understanding these points can help you navigate the process more effectively and ensure your wishes are honored. Always consider consulting a legal professional for personalized advice.

Dos and Don'ts

When filling out the Arizona Durable Power of Attorney form, it's important to approach the process with care. Here are some key dos and don'ts to consider:

- Do ensure you understand the powers you are granting. Familiarize yourself with what a Durable Power of Attorney entails.

- Do select a trusted individual as your agent. This person will make decisions on your behalf, so choose someone you trust completely.

- Do sign the form in the presence of a notary public. This adds a layer of validity to the document.

- Do keep copies of the completed form. Distribute them to your agent and any relevant parties, like your bank or healthcare providers.

- Don't rush through the form. Take your time to read each section carefully and ensure everything is filled out correctly.

- Don't assume all Durable Power of Attorney forms are the same. Make sure you are using the correct form for Arizona, as laws can vary by state.

Common mistakes

-

Not specifying the powers granted: One common mistake is failing to clearly outline the specific powers the agent will have. This can lead to confusion and potential disputes later on.

-

Choosing the wrong agent: Selecting someone who may not act in your best interest can be detrimental. It's essential to choose a trustworthy and responsible individual.

-

Not signing the document: A Durable Power of Attorney is not valid unless it is signed by the principal. Forgetting this step can invalidate the entire document.

-

Failing to date the form: Not including a date can create ambiguity regarding when the powers take effect. Always include the date to ensure clarity.

-

Ignoring witness and notarization requirements: Arizona law requires certain signatures to be witnessed or notarized. Skipping this step can render the document ineffective.

-

Not reviewing the document regularly: Life circumstances change, and so should your Durable Power of Attorney. Failing to review and update the document can lead to outdated provisions.

-

Overlooking alternate agents: It’s wise to designate an alternate agent in case the primary agent is unable or unwilling to serve. Not doing so can leave you without representation.

-

Assuming all agents have the same authority: Each agent can have different powers. Clearly delineate what each agent can and cannot do to avoid misunderstandings.

-

Not considering state-specific laws: Each state has its own requirements for a Durable Power of Attorney. Failing to comply with Arizona’s specific laws can lead to complications.

-

Neglecting to inform the agent: It is crucial to discuss your wishes and the responsibilities with the agent. Leaving them uninformed can lead to decisions that do not align with your intentions.

What You Should Know About This Form

-

What is a Durable Power of Attorney in Arizona?

A Durable Power of Attorney (DPOA) is a legal document that allows you to appoint someone to make decisions on your behalf if you become unable to do so. Unlike a regular power of attorney, a DPOA remains effective even if you become incapacitated. This can be crucial for managing your finances and healthcare decisions.

-

Who can be appointed as an agent?

You can appoint any competent adult as your agent. This could be a family member, friend, or trusted advisor. It’s important to choose someone who understands your values and will act in your best interests.

-

What powers can be granted through a Durable Power of Attorney?

You can grant a wide range of powers, including the ability to manage your financial affairs, pay bills, make investments, and handle real estate transactions. Additionally, you can specify health care decisions, such as medical treatment options, if you become incapacitated.

-

How do I create a Durable Power of Attorney in Arizona?

To create a DPOA, you must complete a form that complies with Arizona law. The form should clearly state your intentions and the powers you are granting. After filling out the form, you must sign it in front of a notary public. It's recommended to discuss your decisions with an attorney to ensure everything is in order.

-

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a DPOA at any time, as long as you are still mentally competent. To revoke, you must create a written document stating your intention to revoke the DPOA and notify your agent and any institutions that may have relied on the DPOA.

-

What happens if I do not have a Durable Power of Attorney?

If you do not have a DPOA and become incapacitated, the court may appoint a guardian or conservator to manage your affairs. This process can be time-consuming and may not align with your wishes. Having a DPOA allows you to choose someone you trust to make decisions on your behalf.

-

Is a Durable Power of Attorney the same as a Living Will?

No, a Durable Power of Attorney and a Living Will serve different purposes. A DPOA allows someone to make decisions on your behalf, while a Living Will outlines your wishes regarding medical treatment and end-of-life care. Both documents are important for comprehensive planning.

-

Can I use a Durable Power of Attorney from another state in Arizona?

Generally, Arizona will recognize a DPOA created in another state, as long as it complies with the laws of that state. However, it’s advisable to consult with a legal professional in Arizona to ensure that the document meets local requirements and is enforceable.

-

Are there any limitations to the powers granted in a Durable Power of Attorney?

Yes, there can be limitations. You can specify which powers your agent does or does not have. For example, you might restrict your agent from selling your property or making certain financial decisions. Clearly outlining these limitations in the DPOA can help prevent misunderstandings later.

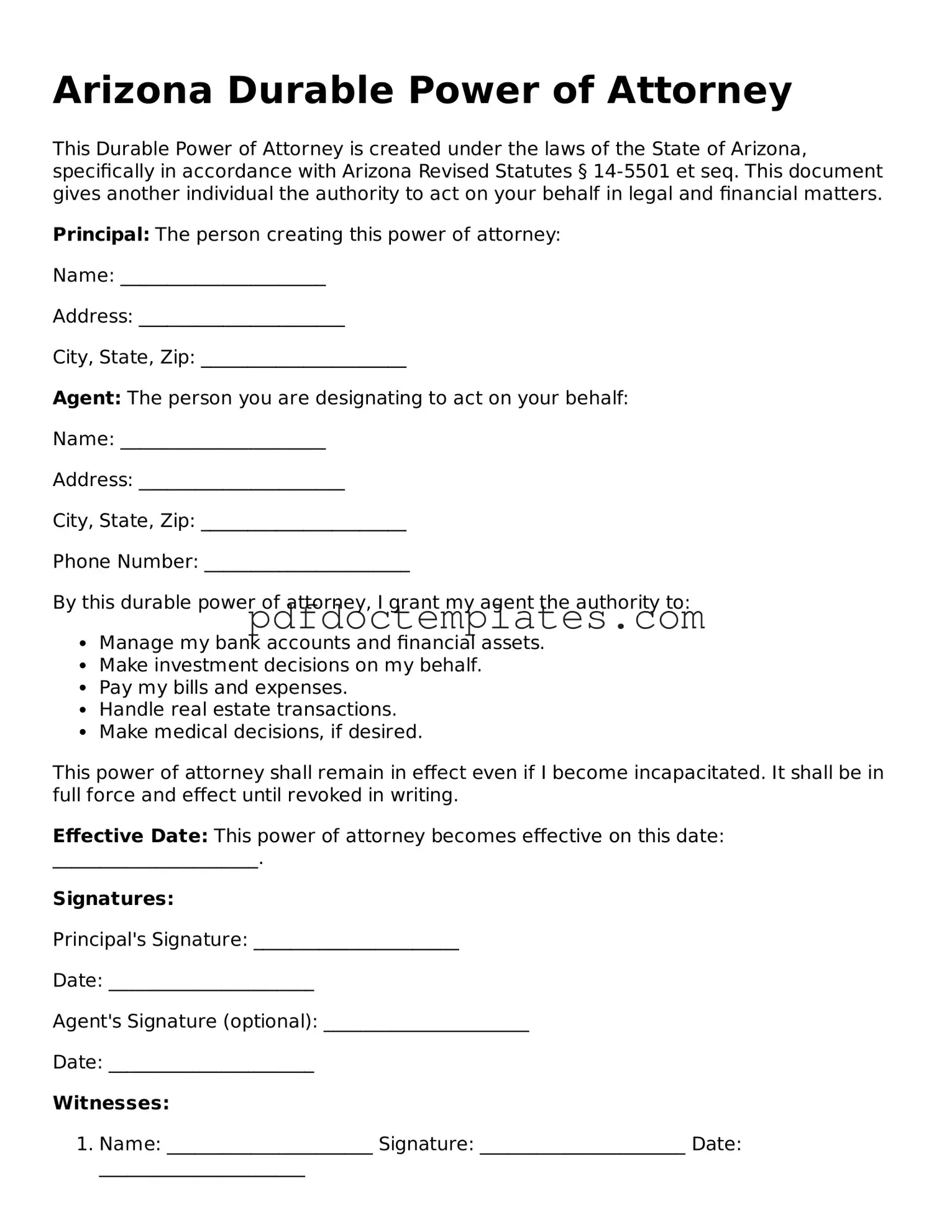

Arizona Durable Power of Attorney Example

Arizona Durable Power of Attorney

This Durable Power of Attorney is created under the laws of the State of Arizona, specifically in accordance with Arizona Revised Statutes § 14-5501 et seq. This document gives another individual the authority to act on your behalf in legal and financial matters.

Principal: The person creating this power of attorney:

Name: ______________________

Address: ______________________

City, State, Zip: ______________________

Agent: The person you are designating to act on your behalf:

Name: ______________________

Address: ______________________

City, State, Zip: ______________________

Phone Number: ______________________

By this durable power of attorney, I grant my agent the authority to:

- Manage my bank accounts and financial assets.

- Make investment decisions on my behalf.

- Pay my bills and expenses.

- Handle real estate transactions.

- Make medical decisions, if desired.

This power of attorney shall remain in effect even if I become incapacitated. It shall be in full force and effect until revoked in writing.

Effective Date: This power of attorney becomes effective on this date: ______________________.

Signatures:

Principal's Signature: ______________________

Date: ______________________

Agent's Signature (optional): ______________________

Date: ______________________

Witnesses:

- Name: ______________________ Signature: ______________________ Date: ______________________

- Name: ______________________ Signature: ______________________ Date: ______________________

This document must be signed by the Principal and can be witnessed or notarized as per the laws of Arizona to ensure its validity.

Always consult with a qualified attorney when creating or implementing a Durable Power of Attorney to understand its implications fully.

Check out Other Common Durable Power of Attorney Templates for US States

Power of Attorney in New Jersey - It helps provide clarity and structure to your personal affairs in challenging situations.

In addition to the essential elements outlined in the New York Operating Agreement, it is important for LLC members to consider utilizing resources that can aid in the creation and understanding of this document. For instance, accessing All New York Forms can provide helpful templates and guidance that ensure compliance with state regulations and best practices.

Power of Attorney Form Tn Pdf - Make sure to discuss the implications of this document with your family to ensure everyone understands its importance.