Blank Deed in Lieu of Foreclosure Document for Arizona

Misconceptions

The Arizona Deed in Lieu of Foreclosure is a legal tool that can help homeowners facing foreclosure. However, several misconceptions surround this process. Here are seven common misunderstandings:

-

It eliminates all debts associated with the mortgage.

A Deed in Lieu of Foreclosure transfers property ownership to the lender, but it does not automatically erase all debts. Homeowners may still owe money if the property sells for less than the mortgage balance.

-

It is a quick solution to avoid foreclosure.

While it can be faster than a foreclosure process, a Deed in Lieu still requires negotiation with the lender. Approval can take time, and homeowners must meet specific criteria.

-

All lenders accept Deeds in Lieu of Foreclosure.

Not all lenders offer this option. Homeowners should check with their lender to see if it is an available alternative and understand the lender's policies.

-

It has no impact on credit scores.

A Deed in Lieu of Foreclosure can negatively affect credit scores, similar to a foreclosure. It is essential to understand the potential long-term consequences for creditworthiness.

-

Homeowners can stay in the home until the process is complete.

Once the lender accepts the Deed in Lieu, homeowners may need to vacate the property quickly. They should clarify the timeline with their lender to avoid surprises.

-

It is the same as a short sale.

A Deed in Lieu involves transferring ownership to the lender, while a short sale requires selling the property for less than the mortgage balance with the lender's approval. They are distinct processes.

-

Legal representation is not necessary.

While it is possible to navigate the process without a lawyer, having legal representation can help ensure that homeowners understand their rights and obligations, making the process smoother.

Form Properties

| Fact Name | Description |

|---|---|

| Definition | A Deed in Lieu of Foreclosure is a legal document that allows a borrower to transfer ownership of their property to the lender to avoid foreclosure. |

| Governing Law | In Arizona, the deed in lieu of foreclosure is governed by the Arizona Revised Statutes, particularly under Title 33, Chapter 6. |

| Eligibility | Typically, borrowers who are facing financial hardship and are unable to make mortgage payments may qualify for a deed in lieu of foreclosure. |

| Process | The borrower must first negotiate with the lender. If both parties agree, the borrower signs the deed, transferring the property to the lender. |

| Benefits | This option can help borrowers avoid the lengthy and costly foreclosure process, potentially preserving their credit score. |

| Risks | Borrowers may still face tax implications, as the IRS may treat forgiven mortgage debt as taxable income. |

| Title Issues | Before proceeding, the lender typically conducts a title search to ensure there are no liens or other claims against the property. |

| Documentation | Essential documents include the deed itself, a statement of debt, and any agreements regarding the transfer of property. |

| Alternatives | Other options to avoid foreclosure include loan modifications, short sales, and repayment plans, which borrowers may consider based on their situation. |

Key takeaways

Filling out and using the Arizona Deed in Lieu of Foreclosure form can be a straightforward process, but it’s important to understand the key points involved. Here are some essential takeaways to consider:

- Understand the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to transfer property ownership to the lender to avoid foreclosure.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the homeowner is in default and unable to keep up with mortgage payments.

- Consult with Professionals: It's advisable to seek guidance from a real estate attorney or a housing counselor before proceeding.

- Complete the Form Accurately: Fill out the form carefully, ensuring all information is correct to avoid delays or complications.

- Review Your Mortgage Agreement: Check your mortgage documents for any clauses that might affect your ability to use a Deed in Lieu.

- Consider Tax Implications: Transferring property through a Deed in Lieu may have tax consequences, so consulting a tax professional is wise.

- Negotiate with Your Lender: Before signing, discuss any potential issues or concerns with your lender to ensure a smooth process.

Understanding these points can help homeowners navigate the Deed in Lieu of Foreclosure process more effectively.

Dos and Don'ts

When filling out the Arizona Deed in Lieu of Foreclosure form, it is important to approach the task with care. Here are six key points to consider:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and property details.

- Don't rush through the form. Take your time to understand each section before filling it out.

- Do consult with a legal professional if you have questions. Their expertise can help you avoid mistakes.

- Don't leave any sections blank. If a section does not apply, indicate that it is not applicable.

- Do sign and date the form in the appropriate places. An unsigned form may not be valid.

- Don't forget to keep a copy for your records. Documentation is crucial for future reference.

Common mistakes

-

Incomplete Information: Many individuals fail to provide all required details. This can include missing names, addresses, or property descriptions. Ensure every section is filled out completely to avoid delays.

-

Not Signing the Document: Some forget to sign the deed. A signature is essential for the document to be valid. Double-check that all necessary parties have signed.

-

Incorrect Notarization: Failing to have the document properly notarized is a common error. A notary public must witness the signing to validate the deed. Ensure you follow the notarization requirements.

-

Ignoring Lender Requirements: Each lender may have specific instructions for submitting a deed in lieu. Neglecting to follow these can lead to rejection. Always review your lender's guidelines carefully.

-

Not Consulting Legal Advice: Many people attempt to fill out the form without seeking legal advice. This can lead to misunderstandings of the implications. It’s wise to consult with a legal professional to ensure you understand the process.

What You Should Know About This Form

-

What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal process where a homeowner voluntarily transfers the ownership of their property to the lender to avoid foreclosure. This option allows the homeowner to relinquish their property and, in return, may help them avoid the lengthy and often stressful foreclosure process.

-

Who is eligible for a Deed in Lieu of Foreclosure in Arizona?

Eligibility typically depends on several factors, including the homeowner's financial situation and the lender's policies. Generally, homeowners facing financial hardship, such as job loss or medical expenses, may qualify. However, the property must also be free of any other liens, or the lender must agree to accept the property with those liens.

-

What are the benefits of choosing a Deed in Lieu of Foreclosure?

Opting for a Deed in Lieu can provide several advantages. First, it often results in a less damaging impact on the homeowner's credit score compared to a foreclosure. Second, it can expedite the process of resolving a mortgage default, allowing homeowners to move on more quickly. Finally, some lenders may offer a cash incentive to homeowners who choose this option, which can help with relocation costs.

-

What are the potential drawbacks of a Deed in Lieu of Foreclosure?

While there are benefits, there are also potential downsides. Homeowners may still face tax implications, as the forgiven debt might be considered taxable income. Additionally, not all lenders accept Deeds in Lieu, and some may require homeowners to explore other options first. Lastly, homeowners will lose their property and any equity they may have built up.

-

How does the process work?

The process typically begins with the homeowner contacting their lender to express interest in a Deed in Lieu. The lender will then review the homeowner's financial situation and the property's status. If approved, both parties will sign the necessary documents to transfer ownership. It is essential for homeowners to ensure they understand all terms and implications before proceeding.

-

Can I still negotiate with my lender after initiating a Deed in Lieu?

Yes, homeowners can negotiate terms even after expressing interest in a Deed in Lieu. Communication with the lender is crucial. Homeowners may discuss alternatives, such as loan modifications or repayment plans, if they believe they can resolve their financial issues without losing their home.

-

Should I seek legal advice before proceeding with a Deed in Lieu of Foreclosure?

It is highly advisable to seek legal counsel before proceeding. An attorney can help homeowners understand their rights and obligations, review the terms of the Deed in Lieu, and ensure that all necessary steps are taken to protect their interests. This guidance can be invaluable in navigating the complexities of real estate law.

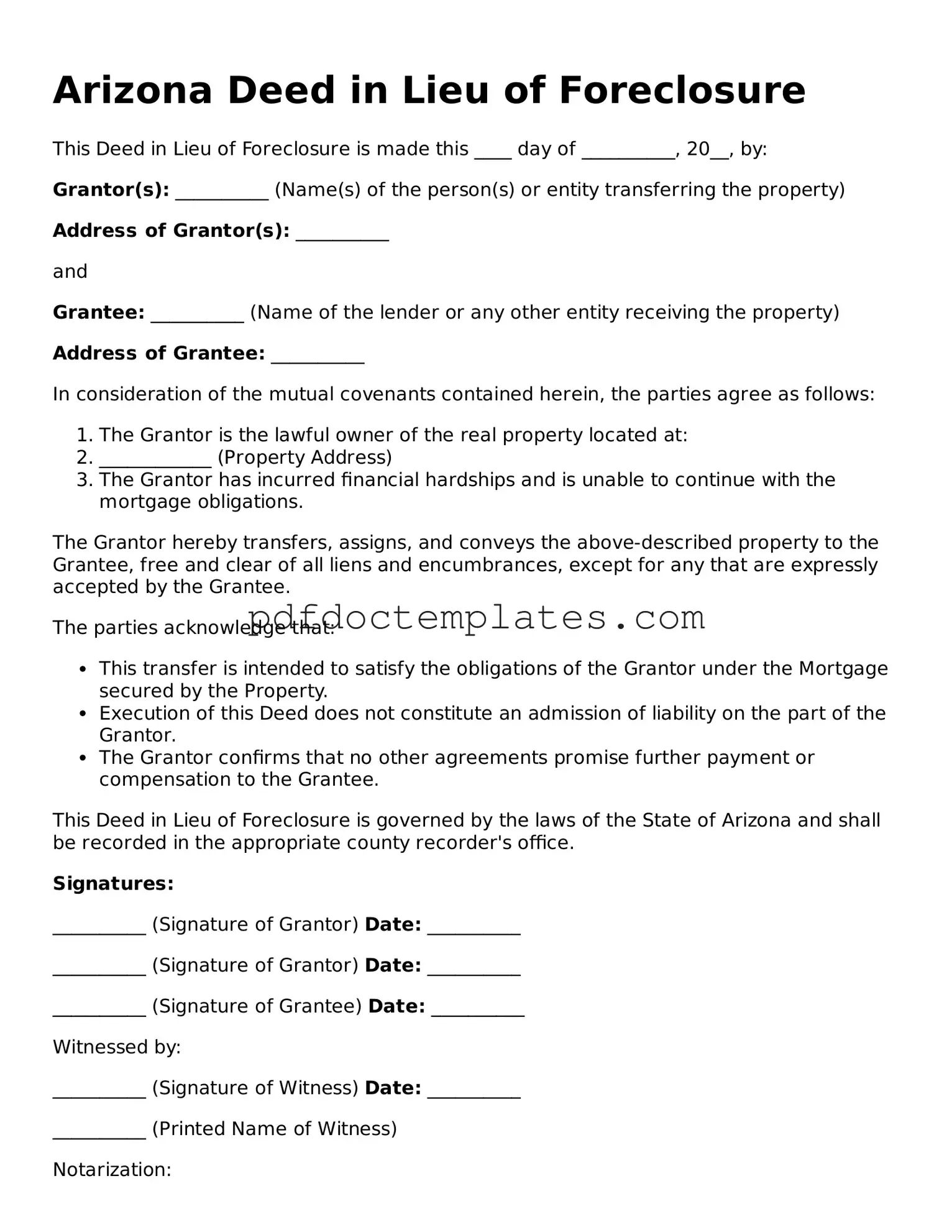

Arizona Deed in Lieu of Foreclosure Example

Arizona Deed in Lieu of Foreclosure

This Deed in Lieu of Foreclosure is made this ____ day of __________, 20__, by:

Grantor(s): __________ (Name(s) of the person(s) or entity transferring the property)

Address of Grantor(s): __________

and

Grantee: __________ (Name of the lender or any other entity receiving the property)

Address of Grantee: __________

In consideration of the mutual covenants contained herein, the parties agree as follows:

- The Grantor is the lawful owner of the real property located at:

- ____________ (Property Address)

- The Grantor has incurred financial hardships and is unable to continue with the mortgage obligations.

The Grantor hereby transfers, assigns, and conveys the above-described property to the Grantee, free and clear of all liens and encumbrances, except for any that are expressly accepted by the Grantee.

The parties acknowledge that:

- This transfer is intended to satisfy the obligations of the Grantor under the Mortgage secured by the Property.

- Execution of this Deed does not constitute an admission of liability on the part of the Grantor.

- The Grantor confirms that no other agreements promise further payment or compensation to the Grantee.

This Deed in Lieu of Foreclosure is governed by the laws of the State of Arizona and shall be recorded in the appropriate county recorder's office.

Signatures:

__________ (Signature of Grantor) Date: __________

__________ (Signature of Grantor) Date: __________

__________ (Signature of Grantee) Date: __________

Witnessed by:

__________ (Signature of Witness) Date: __________

__________ (Printed Name of Witness)

Notarization:

State of Arizona, County of __________:

Subscribed and sworn to before me this ____ day of __________, 20__.

__________ (Notary Public Signature)

My commission expires: __________