Download Adp Pay Stub Template

Misconceptions

Understanding your ADP pay stub is crucial for managing your finances and ensuring you receive the correct compensation. However, several misconceptions can lead to confusion. Here are nine common misunderstandings about the ADP pay stub form:

- Misconception 1: The pay stub is only for employees who are paid hourly.

- Misconception 2: The pay stub shows only gross pay.

- Misconception 3: Deductions on the pay stub are always taxes.

- Misconception 4: The pay stub format is the same for all companies.

- Misconception 5: You cannot access old pay stubs.

- Misconception 6: Pay stubs are not necessary for tax purposes.

- Misconception 7: The pay stub is only useful for tracking pay.

- Misconception 8: You can’t dispute errors on your pay stub.

- Misconception 9: All deductions are mandatory.

This is not true. Both hourly and salaried employees receive pay stubs. Regardless of your pay structure, you should receive a detailed breakdown of your earnings.

Many people believe the pay stub only displays gross pay, but it also includes deductions and net pay. Understanding these figures is essential for financial planning.

While taxes are a significant part of deductions, they are not the only ones. Other deductions may include health insurance, retirement contributions, and other benefits.

Each company may have a different format for their ADP pay stub. While the essential information is typically consistent, the layout can vary.

Many employees think they can only view their most recent pay stubs. However, ADP usually allows access to previous pay stubs through their online portal.

Some individuals believe that pay stubs are irrelevant for taxes. In reality, they provide important information for filing your tax return accurately.

While tracking pay is important, pay stubs also help monitor benefits, deductions, and overall financial health. They can be a valuable resource for budgeting.

This is a common belief, but you absolutely can dispute errors. If you notice discrepancies, it’s important to contact your HR department or payroll administrator.

Not all deductions are mandatory. Some, like contributions to retirement plans or additional insurance, may be optional, depending on your choices and the company’s policies.

Clearing up these misconceptions can empower you to better understand your pay stub and make informed financial decisions. If you have questions or concerns, don't hesitate to reach out to your HR department for assistance.

File Details

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The pay stub typically includes gross pay, net pay, taxes withheld, and other deductions such as health insurance or retirement contributions. |

| Frequency | Pay stubs are issued on a regular basis, usually aligned with the company's payroll schedule, which can be weekly, bi-weekly, or monthly. |

| Access | Employees can access their pay stubs electronically through the ADP portal or receive them in paper form, depending on company policy. |

| State-Specific Requirements | Some states have specific laws regarding the information that must be included on pay stubs. For example, California requires detailed itemization of deductions. |

| Importance | Understanding the pay stub is crucial for employees to verify their earnings, ensure correct tax withholding, and plan their finances effectively. |

Key takeaways

When it comes to filling out and using the ADP Pay Stub form, there are several important points to keep in mind. Here are some key takeaways to help you navigate the process effectively:

- Accuracy is crucial. Ensure that all personal and financial information is entered correctly to avoid any discrepancies.

- Understand the components. Familiarize yourself with the different sections of the pay stub, such as earnings, deductions, and net pay.

- Keep it for your records. Save a copy of your pay stub for future reference, especially when preparing taxes or applying for loans.

- Review regularly. Check your pay stub each pay period to confirm that your hours and deductions are correct.

- Seek help if needed. If you find any errors or have questions, don’t hesitate to reach out to your HR department or payroll administrator.

- Use it as a financial tool. Your pay stub can provide insights into your earnings and spending, helping you budget more effectively.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s important to get it right. Here are some things to keep in mind:

- Do double-check your personal information for accuracy.

- Don’t leave any required fields blank.

- Do review your pay rates and hours worked carefully.

- Don’t use incorrect codes for deductions or contributions.

- Do keep a copy of your completed form for your records.

- Don’t rush through the process; take your time to ensure everything is correct.

- Do reach out to your HR department if you have questions.

Following these guidelines can help you avoid mistakes and ensure your pay stub reflects accurate information.

Common mistakes

-

Incorrect Personal Information: Many individuals mistakenly enter wrong names, addresses, or Social Security numbers. This can lead to issues with tax reporting and payroll processing.

-

Miscalculating Hours Worked: Some employees fail to accurately track their hours. This can result in underpayment or overpayment, affecting both the employee's finances and the employer's records.

-

Neglecting Deductions: It’s common for people to overlook mandatory deductions such as taxes or health insurance premiums. Missing these can lead to unexpected tax liabilities.

-

Choosing Incorrect Pay Period: Selecting the wrong pay period can cause confusion. Employees might receive incorrect pay or miss out on overtime calculations.

-

Failing to Review Pay Stub: Some individuals do not take the time to review their pay stubs carefully. This can result in overlooking errors that need to be corrected promptly.

-

Ignoring State-Specific Requirements: Each state has different tax rules and deductions. Employees often forget to account for these, which can lead to compliance issues.

-

Not Keeping Records: Many people fail to save their pay stubs for future reference. Keeping these documents is essential for tax purposes and financial planning.

What You Should Know About This Form

-

What is an ADP Pay Stub?

An ADP Pay Stub is a document provided by ADP, a payroll processing company, that outlines an employee's earnings for a specific pay period. It details the gross pay, deductions, and net pay, allowing employees to understand how their pay is calculated.

-

How can I access my ADP Pay Stub?

You can access your ADP Pay Stub online through the ADP portal. Employees typically receive a login ID and password from their employer. Once logged in, navigate to the pay section to view and download your pay stubs.

-

What information is included on an ADP Pay Stub?

An ADP Pay Stub usually includes the following information:

- Employee name and ID

- Pay period dates

- Gross earnings

- Deductions (such as taxes, health insurance, and retirement contributions)

- Net pay (the amount you take home)

- Year-to-date totals for earnings and deductions

-

Why is it important to review my pay stub?

Reviewing your pay stub is essential to ensure that you are being paid correctly. It helps you verify that your hours worked, deductions, and other entries are accurate. If you find any discrepancies, addressing them promptly with your employer can prevent larger issues down the line.

-

What should I do if I cannot find my ADP Pay Stub?

If you cannot find your pay stub, first check the ADP online portal. If you still cannot locate it, contact your HR department or payroll administrator. They can assist you in retrieving your pay stub or resolving any access issues.

-

Can I receive my pay stub in a paper format?

Many employers offer the option to receive pay stubs in paper format. If you prefer a physical copy, check with your HR department to see if this option is available and how to request it.

-

How long should I keep my pay stubs?

It is generally advisable to keep your pay stubs for at least one year. This can help with tax preparation and serve as proof of income for loan applications or other financial matters. Some people choose to keep them for several years in case they need to reference them in the future.

-

What if I notice an error on my pay stub?

If you notice an error, such as incorrect hours or deductions, contact your employer's HR or payroll department immediately. They will guide you through the process of correcting the error and ensuring that your pay is adjusted accordingly.

-

Is my personal information on the pay stub secure?

ADP takes data security seriously. Pay stubs accessed through their portal are protected by encryption and other security measures. However, it’s always wise to keep your login information confidential and to avoid sharing your pay stub with unauthorized individuals.

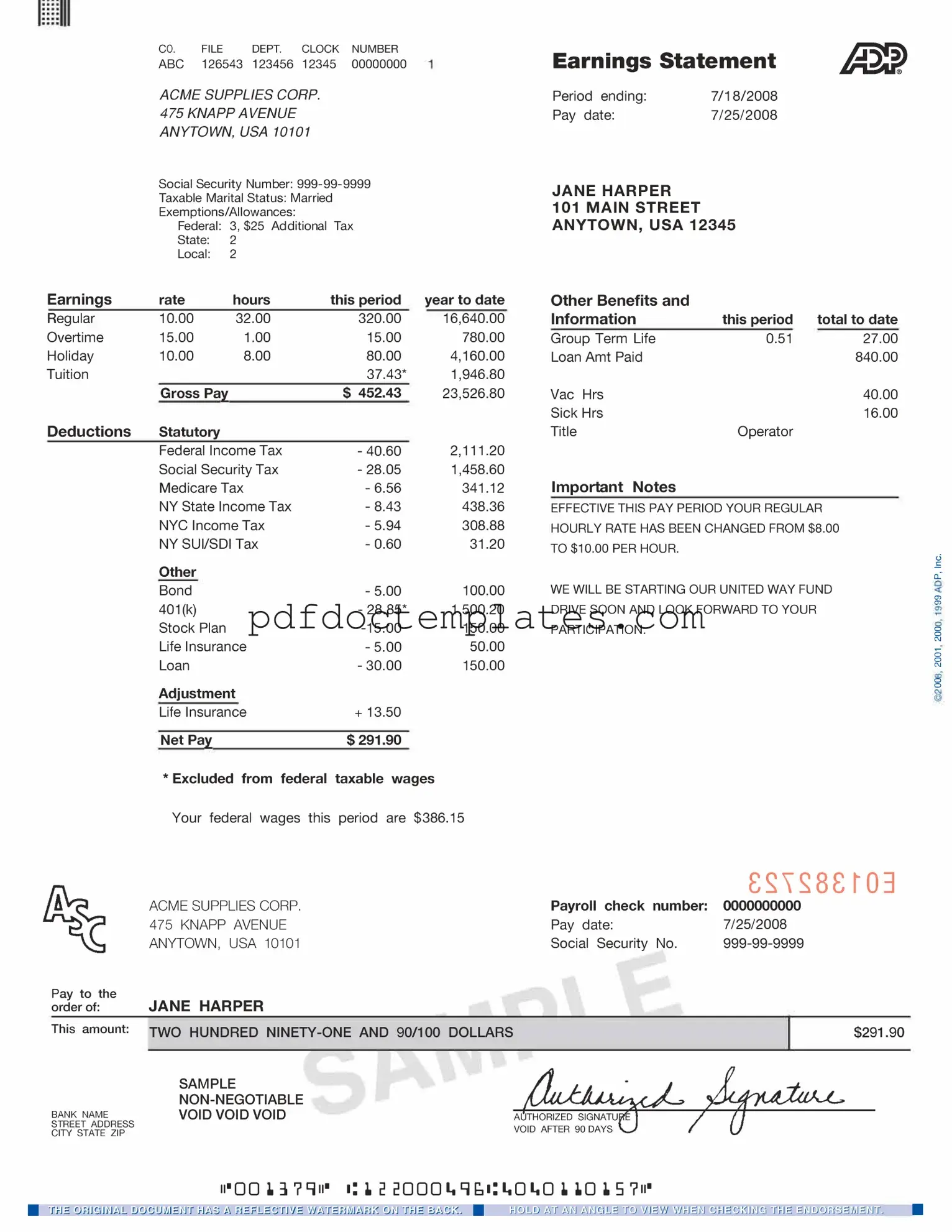

Adp Pay Stub Example

|

CO. |

FILE |

DEPT. |

CLOCK |

NUMBER |

|

|

ABC |

126543 123456 |

12345 |

00000000 |

|

|

|

ACME SUPPLIES CORP. |

|

|

|||

|

475 KNAPP AVENUE |

|

|

|

||

|

ANYTOWN, USA 10101 |

|

|

|||

|

Social Security Number: |

|

||||

|

Taxable Marital Status: Married |

|

|

|||

|

Exemptions/Allowances: |

|

|

|

||

|

Federal: 3, $25 Additional Tax |

|

||||

|

State: |

2 |

|

|

|

|

|

Local: |

2 |

|

|

|

|

Earnings |

rate |

|

hours |

this period |

year to date |

|

Regular |

10.00 |

|

32.00 |

|

320.00 |

16,640.00 |

Overtime |

15.00 |

|

1.00 |

|

15.00 |

780.00 |

Holiday |

10.00 |

|

8.00 |

|

80.00 |

4,160.00 |

Tuition |

|

|

|

|

37.43* |

1,946.80 |

|

Gross Pa� |

|

|

$ 452.43 |

23,526.80 |

|

Deductions |

Statutory |

|

|

|

2,111.20 |

|

|

Federal Income Tax |

|

- 40.60 |

|||

|

Social Security Tax |

|

- 28.05 |

1,458.60 |

||

|

Medicare Tax |

|

- 6.56 |

341.12 |

||

|

NY State Income Tax |

|

- 8.43 |

438.36 |

||

|

NYC Income Tax |

|

- 5.94 |

308.88 |

||

|

NY SUI/SDI Tax |

|

- 0.60 |

31.20 |

||

|

Other |

|

|

|

|

|

|

Bond |

|

|

|

- 5.00 |

100.00 |

|

401(k) |

|

|

|

- 28.85* |

1,500.20 |

|

Stock Plan |

|

|

150.00 |

||

|

Life Insurance |

|

- 5.00 |

50.00 |

||

|

Loan |

|

|

|

- 30.00 |

150.00 |

|

Adjustment |

|

|

|

||

|

Life Insurance |

|

+ 13.50 |

|

||

|

Net Pa� |

|

|

$291.90 |

|

|

*Excluded from federal taxable wages Your federal wages this period are $386.15

ACME SUPPLIES CORP. 475 KNAPP AVENUE ANYTOWN, USA 10101

Pay to the

order of: JANE HARPER

This amount: TWO HUNDRED

SAMPLE

BANK NAMEVOID VOID VOID

STREET ADDRESS

CITY STATE ZIP

Earnings Statement

Period ending: |

7/18/2008 |

Pay date: |

7/25/2008 |

JANE HARPER

101MAIN STREET

ANYTOWN, USA 12345

Other Benefits and

Information |

this period |

total to date |

|

|

Group Term Life |

0.51 |

27.00 |

|

|

Loan Amt Paid |

|

840.00 |

|

|

Vac Hrs |

|

40.00 |

|

|

Sick Hrs |

|

16.00 |

|

|

Title |

Operator |

|

|

|

Important Notes |

|

|

|

|

EFFECTIVE THIS PAY PERIOD YOUR REGULAR |

|

|||

HOURLY RATE HAS BEEN CHANGED FROM $8.00 |

|

|||

TO $10.00 PER HOUR. |

|

|

0 |

|

|

|

|

||

|

|

|

.!: |

|

WE WILL BE STARTING OUR UNITED WAY FUND |

0: |

|||

"' |

||||

DRIVE SOON AND LOOK FORWARD TO YOUR |

|

|||

|

|

|||

PARTICIPATION. |

|

|

0 |

|

|

|

|

0 |

|

C\J

0

0

C\J

0

0

|

£�,�8£�03 |

Payroll check number: |

0000000000 |

Pay date: |

7/25/2008 |

Social Security No. |

$291.90

Consider More Forms

Doctors Return to Work Note - Review and complete this form to initiate your work release request.

For those looking to understand the intricacies of the transaction process, our guide on the crucial California Dog Bill of Sale is a must-read: important aspects of the Dog Bill of Sale form.

Who Can Write Esa Letters - Receive personalized documentation tailored to your specific emotional support needs.